Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

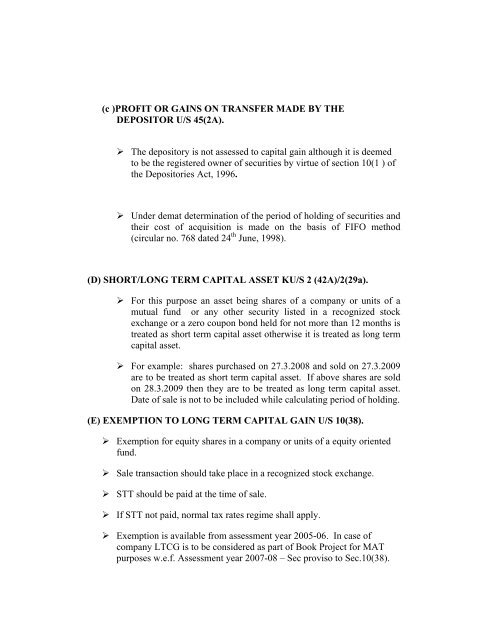

(c )PROFIT OR GAINS ON TRANSFER MADE BY THE<br />

DEPOSITOR U/S 45(2A).<br />

‣ The deposi<strong>to</strong>ry is not assessed <strong>to</strong> capital gain although it is deemed<br />

<strong>to</strong> be the registered owner of securities by virtue of section 10(1 ) of<br />

the Deposi<strong>to</strong>ries Act, 1996.<br />

‣ Under demat determination of the period of holding of securities and<br />

their cost of acquisition is made on the basis of FIFO method<br />

(circular no. 768 dated 24 th June, 1998).<br />

(D) SHORT/LONG TERM CAPITAL ASSET KU/S 2 (42A)/2(29a).<br />

‣ For this purpose an asset being shares of a company or units of a<br />

mutual fund or any other security listed in a recognized s<strong>to</strong>ck<br />

exchange or a zero coupon bond held for not more than 12 months is<br />

treated as short term capital asset otherwise it is treated as long term<br />

capital asset.<br />

‣ For example: shares purchased on 27.3.2008 and sold on 27.3.2009<br />

are <strong>to</strong> be treated as short term capital asset. If above shares are sold<br />

on 28.3.2009 then they are <strong>to</strong> be treated as long term capital asset.<br />

Date of sale is not <strong>to</strong> be included while calculating period of holding.<br />

(E) EXEMPTION TO LONG TERM CAPITAL GAIN U/S 10(38).<br />

‣ Exemption for equity shares in a company or units of a equity oriented<br />

fund.<br />

‣ Sale transaction should take place in a recognized s<strong>to</strong>ck exchange.<br />

‣ STT should be paid at the time of sale.<br />

‣ If STT not paid, normal tax rates regime shall apply.<br />

‣ Exemption is available from assessment year 2005-06. In case of<br />

company LTCG is <strong>to</strong> be considered as part of Book Project for MAT<br />

purposes w.e.f. Assessment year 2007-08 – Sec proviso <strong>to</strong> Sec.10(38).