Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Accounting & Taxation Issues relating to Capital Market Transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

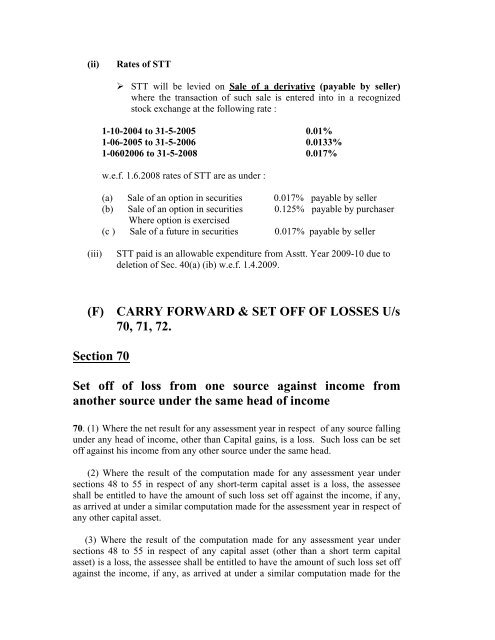

(ii)<br />

Rates of STT<br />

‣ STT will be levied on Sale of a derivative (payable by seller)<br />

where the transaction of such sale is entered in<strong>to</strong> in a recognized<br />

s<strong>to</strong>ck exchange at the following rate :<br />

1-10-2004 <strong>to</strong> 31-5-2005 0.01%<br />

1-06-2005 <strong>to</strong> 31-5-2006 0.0133%<br />

1-0602006 <strong>to</strong> 31-5-2008 0.017%<br />

w.e.f. 1.6.2008 rates of STT are as under :<br />

(a) Sale of an option in securities 0.017% payable by seller<br />

(b) Sale of an option in securities 0.125% payable by purchaser<br />

Where option is exercised<br />

(c ) Sale of a future in securities 0.017% payable by seller<br />

(iii)<br />

STT paid is an allowable expenditure from Asstt. Year 2009-10 due <strong>to</strong><br />

deletion of Sec. 40(a) (ib) w.e.f. 1.4.2009.<br />

(F) CARRY FORWARD & SET OFF OF LOSSES U/s<br />

70, 71, 72.<br />

Section 70<br />

Set off of loss from one source against income from<br />

another source under the same head of income<br />

70. (1) Where the net result for any assessment year in respect of any source falling<br />

under any head of income, other than <strong>Capital</strong> gains, is a loss. Such loss can be set<br />

off against his income from any other source under the same head.<br />

(2) Where the result of the computation made for any assessment year under<br />

sections 48 <strong>to</strong> 55 in respect of any short-term capital asset is a loss, the assessee<br />

shall be entitled <strong>to</strong> have the amount of such loss set off against the income, if any,<br />

as arrived at under a similar computation made for the assessment year in respect of<br />

any other capital asset.<br />

(3) Where the result of the computation made for any assessment year under<br />

sections 48 <strong>to</strong> 55 in respect of any capital asset (other than a short term capital<br />

asset) is a loss, the assessee shall be entitled <strong>to</strong> have the amount of such loss set off<br />

against the income, if any, as arrived at under a similar computation made for the