A N N U A L R E P O R T G R U P O S E C U R I T Y ... - Banco Security

A N N U A L R E P O R T G R U P O S E C U R I T Y ... - Banco Security

A N N U A L R E P O R T G R U P O S E C U R I T Y ... - Banco Security

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

página<br />

172<br />

4.5 Insurance Industry<br />

The insurance industry in Chile is made up of two main branches, life and general, which are differentiated by the regulations covering<br />

the players and the types of product they sell. At September 2008, there were 28 life insurance companies and 17 general insurance<br />

companies (excluding credit companies). In recent years, the number of participants in life insurance has increased considerably, but<br />

with a high degree of concentration; this is not only in life insurance but also in the general insurance segment.<br />

The direct premium income of life and general insurance companies was Ch$ 1,812 billion and Ch$ 896 billion respectively at September<br />

2008. The industry’s results were a loss of Ch$ 60,167 million and a profit of Ch$ 10,631 million for life and general insurance<br />

companies respectively, at September 2008.<br />

5. Consolidated Statement of Cash Flows of Grupo <strong>Security</strong> S.A.<br />

Descripción y análisis de los principales componentes de los flujos netos:<br />

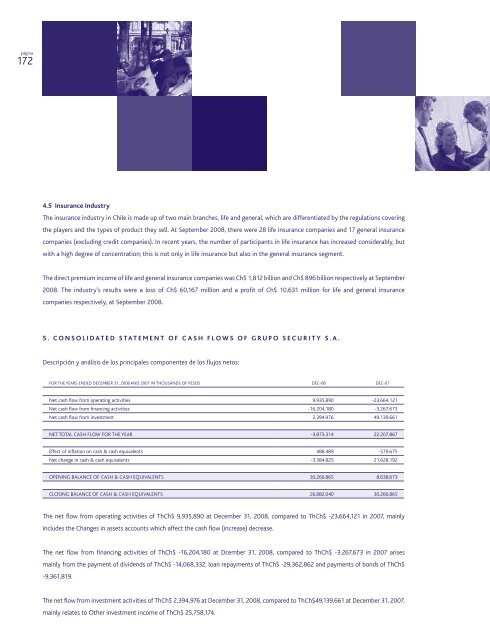

For the years ended December 31, 2008 and 2007 in thousands of pesos Dec-08 Dec-07<br />

Net cash flow from operating activities 9.935.890 -23.664.121<br />

Net cash flow from financing activities -16.204.180 -3.267.673<br />

Net cash flow from investment 2.394.976 49.139.661<br />

Net Total Cash Flow for the Year -3.873.314 22.207.867<br />

Effect of inflation on cash & cash equivalents 488.489 -579.675<br />

Net change in cash & cash equivalents -3.384.825 21.628.192<br />

Opening balance of cash & cash equivalents 30.266.865 8.638.673<br />

Closing balance of cash & cash equivalents 26.882.040 30.266.865<br />

The net flow from operating activities of ThCh$ 9,935,890 at December 31, 2008, compared to ThCh$ -23,664,121 in 2007, mainly<br />

includes the Changes in assets accounts which affect the cash flow (increase) decrease.<br />

The net flow from financing activities of ThCh$ -16,204,180 at Dcember 31, 2008, compared to ThCh$ -3,267,673 in 2007 arises<br />

mainly from the payment of dividends of ThCh$ -14,068,332, loan repayments of ThCh$ -29,362,862 and payments of bonds of ThCh$<br />

-9,361,819.<br />

The net flow from investment activities of ThCh$ 2,394,976 at December 31, 2008, compared to ThCh$49,139,661 at December 31, 2007,<br />

mainly relates to Other investment income of ThCh$ 25,758,174.