A N N U A L R E P O R T G R U P O S E C U R I T Y ... - Banco Security

A N N U A L R E P O R T G R U P O S E C U R I T Y ... - Banco Security

A N N U A L R E P O R T G R U P O S E C U R I T Y ... - Banco Security

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

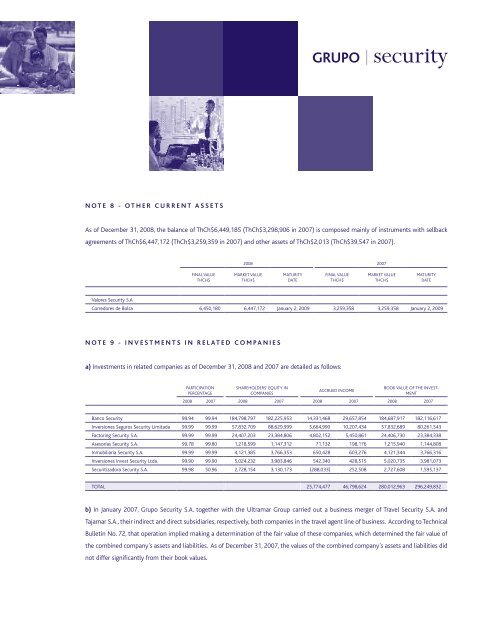

Note 8 - Other Current Assets<br />

As of December 31, 2008, the balance of ThCh$6,449,185 (ThCh$3,298,906 in 2007) is composed mainly of instruments with sellback<br />

agreements of ThCh$6,447,172 (ThCh$3,259,359 in 2007) and other assets of ThCh$2,013 (ThCh$39,547 in 2007).<br />

2008 2007<br />

Final value<br />

ThCh$<br />

Market value<br />

ThCh$<br />

Maturity<br />

date<br />

Final value<br />

ThCh$<br />

Market value<br />

ThCh$<br />

Maturity<br />

date<br />

Valores <strong>Security</strong> S.A<br />

Corredores de Bolsa 6,450,180 6,447,172 January 2, 2009 3,259,358 3,259,358 January 2, 2009<br />

Note 9 - Investments in Related Companies<br />

a) Investments in related companies as of December 31, 2008 and 2007 are detailed as follows:<br />

Participation<br />

percentage<br />

Shareholders’ equity in<br />

companies<br />

Accrued income<br />

Book value of the investment<br />

2008 2007 2008 2007 2008 2007 2008 2007<br />

<strong>Banco</strong> <strong>Security</strong> 99.94 99.94 184,798,797 182,225,953 14,331,468 29,657,854 184,687,917 182,116,617<br />

Inversiones Seguros <strong>Security</strong> Limitada 99.99 99.99 57,832,709 88,629,999 5,664,990 10,207,434 57,832,689 80,261,543<br />

Factoring <strong>Security</strong> S.A. 99.99 99.99 24,407,203 23,384,806 4,802,152 5,450,861 24,406,730 23,384,338<br />

Asesorías <strong>Security</strong> S.A. 99.78 99.80 1,218,599 1,147,312 71,132 198,176 1,215,940 1,144,808<br />

Inmobiliaria <strong>Security</strong> S.A. 99.99 99.99 4,121,385 3,766,353 650,428 603,276 4,121,344 3,766,316<br />

Inversiones Invest <strong>Security</strong> Ltda. 99.90 99.90 5,024,232 3,983,846 542,340 428,515 5,020,735 3,981,073<br />

Securitizadora <strong>Security</strong> S.A. 99.98 50.96 2,728,154 3,130,173 (288,033) 252,508 2,727,608 1,595,137<br />

Total 25,774,477 46,798,624 280,012,963 296,249,832<br />

b) In January 2007, Grupo <strong>Security</strong> S.A. together with the Ultramar Group carried out a business merger of Travel <strong>Security</strong> S.A. and<br />

Tajamar S.A., their indirect and direct subsidiaries, respectively, both companies in the travel agent line of business. According to Technical<br />

Bulletin No. 72, that operation implied making a determination of the fair value of these companies, which determined the fair value of<br />

the combined company’s assets and liabilities. As of December 31, 2007, the values of the combined company’s assets and liabilities did<br />

not differ significantly from their book values.