KI Traveller's Levy Economic Impact Assessment - Kangaroo Island ...

KI Traveller's Levy Economic Impact Assessment - Kangaroo Island ...

KI Traveller's Levy Economic Impact Assessment - Kangaroo Island ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Commercial-in-Confidence<br />

<strong>KI</strong> Traveller’s <strong>Levy</strong><br />

<strong>Impact</strong> <strong>Assessment</strong><br />

nights results in an effective per-visitor levy of $8.07. However domestic overnight visitors,<br />

with an average length of stay of 4.1 nights, bare a significantly greater share of the burden.<br />

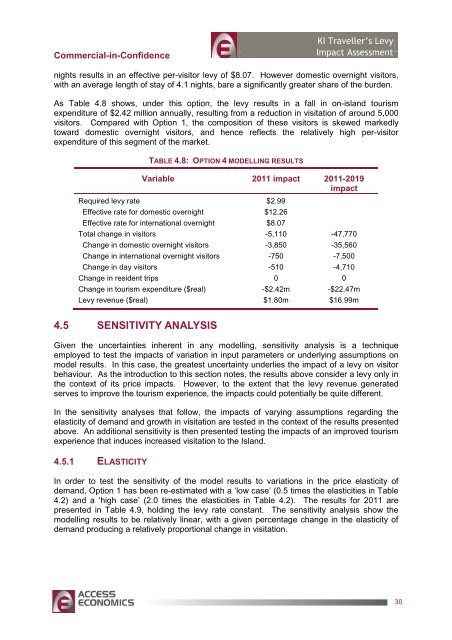

As Table 4.8 shows, under this option, the levy results in a fall in on-island tourism<br />

expenditure of $2.42 million annually, resulting from a reduction in visitation of around 5,000<br />

visitors. Compared with Option 1, the composition of these visitors is skewed markedly<br />

toward domestic overnight visitors, and hence reflects the relatively high per-visitor<br />

expenditure of this segment of the market.<br />

TABLE 4.8: OPTION 4 MODELLING RESULTS<br />

Variable 2011 impact 2011-2019<br />

impact<br />

Required levy rate $2.99<br />

Effective rate for domestic overnight $12.26<br />

Effective rate for international overnight $8.07<br />

Total change in visitors -5,110 -47,770<br />

Change in domestic overnight visitors -3,850 -35,560<br />

Change in international overnight visitors -750 -7,500<br />

Change in day visitors -510 -4,710<br />

Change in resident trips 0 0<br />

Change in tourism expenditure ($real) -$2.42m -$22.47m<br />

<strong>Levy</strong> revenue ($real) $1.80m $16.99m<br />

4.5 SENSITIVITY ANALYSIS<br />

Given the uncertainties inherent in any modelling, sensitivity analysis is a technique<br />

employed to test the impacts of variation in input parameters or underlying assumptions on<br />

model results. In this case, the greatest uncertainty underlies the impact of a levy on visitor<br />

behaviour. As the introduction to this section notes, the results above consider a levy only in<br />

the context of its price impacts. However, to the extent that the levy revenue generated<br />

serves to improve the tourism experience, the impacts could potentially be quite different.<br />

In the sensitivity analyses that follow, the impacts of varying assumptions regarding the<br />

elasticity of demand and growth in visitation are tested in the context of the results presented<br />

above. An additional sensitivity is then presented testing the impacts of an improved tourism<br />

experience that induces increased visitation to the <strong>Island</strong>.<br />

4.5.1 ELASTICITY<br />

In order to test the sensitivity of the model results to variations in the price elasticity of<br />

demand, Option 1 has been re-estimated with a ‘low case’ (0.5 times the elasticities in Table<br />

4.2) and a ‘high case’ (2.0 times the elasticities in Table 4.2). The results for 2011 are<br />

presented in Table 4.9, holding the levy rate constant. The sensitivity analysis show the<br />

modelling results to be relatively linear, with a given percentage change in the elasticity of<br />

demand producing a relatively proportional change in visitation.<br />

30