Download PDF - Kumba Iron Ore

Download PDF - Kumba Iron Ore

Download PDF - Kumba Iron Ore

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

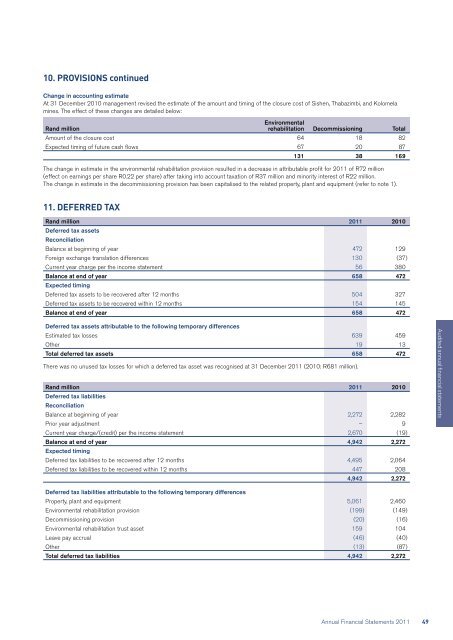

10. PROVISIONS continued<br />

Change in accounting estimate<br />

<br />

mines. The effect of these changes are detailed below:<br />

Rand million<br />

Environmental<br />

rehabilitation Decommissioning Total<br />

Amount of the closure cost 64 18 82<br />

Expected timing of future cash flows 67 20 87<br />

131 38 169<br />

The change in estimate in the environmental rehabilitation provision resulted in a decrease in attributable profit for 2011 of R72 million<br />

(effect on earnings per share R0.22 per share) after taking into account taxation of R37 million and minority interest of R22 million.<br />

The change in estimate in the decommissioning provision has been capitalised to the related property, plant and equipment (refer to note 1).<br />

11. DEFERRED TAX<br />

Rand million 2011 2010<br />

Deferred tax assets<br />

Reconciliation<br />

Balance at beginning of year 472 129<br />

Foreign exchange translation differences 130 (37)<br />

Current year charge per the income statement 56 380<br />

Balance at end of year 658 472<br />

Expected timing<br />

Deferred tax assets to be recovered after 12 months 504 327<br />

Deferred tax assets to be recovered within 12 months 154 145<br />

Balance at end of year 658 472<br />

Deferred tax assets attributable to the following temporary differences<br />

Estimated tax losses 639 459<br />

Other 19 13<br />

Total deferred tax assets 658 472<br />

There was no unused tax losses for which a deferred tax asset was recognised at 31 December 2011 (2010: R681 million).<br />

Rand million 2011 2010<br />

Deferred tax liabilities<br />

Reconciliation<br />

Balance at beginning of year 2,272 2,282<br />

Prior year adjustment – 9<br />

Current year charge/(credit) per the income statement 2,670 (19)<br />

Balance at end of year 4,942 2,272<br />

Expected timing<br />

Deferred tax liabilities to be recovered after 12 months 4,495 2,064<br />

Deferred tax liabilities to be recovered within 12 months 447 208<br />

4,942 2,272<br />

Audited annual financial statements<br />

Deferred tax liabilities attributable to the following temporary differences<br />

Property, plant and equipment 5,061 2,460<br />

Environmental rehabilitation provision (199) (149)<br />

Decommissioning provision (20) (16)<br />

Environmental rehabilitation trust asset 159 104<br />

Leave pay accrual (46) (40)<br />

Other (13) (87)<br />

Total deferred tax liabilities 4,942 2,272<br />

Annual Financial Statements 2011<br />

49

![English PDF [ 189KB ] - Anglo American](https://img.yumpu.com/50470814/1/184x260/english-pdf-189kb-anglo-american.jpg?quality=85)

![pdf [ 595KB ] - Anglo American](https://img.yumpu.com/49420483/1/184x260/pdf-595kb-anglo-american.jpg?quality=85)

![pdf [ 1.1MB ] - Anglo American](https://img.yumpu.com/49057963/1/190x240/pdf-11mb-anglo-american.jpg?quality=85)