Economic Impacts of the Green Industry in the - Urban Forest ...

Economic Impacts of the Green Industry in the - Urban Forest ...

Economic Impacts of the Green Industry in the - Urban Forest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>in</strong>creased at a compound annual growth rate <strong>of</strong> 5 percent, from $30.2 billion <strong>in</strong> 1998 to $38.4 billion <strong>in</strong><br />

2003.<br />

• The most important consumers <strong>of</strong> lawn and garden products last year were men; people age 45 and older;<br />

college graduates; households with no children at home; households <strong>in</strong> <strong>the</strong> Nor<strong>the</strong>ast, South, and West;<br />

married households; 2-person households; and households with annual <strong>in</strong>comes over $75,000.<br />

Current <strong>Green</strong> <strong>Industry</strong> Situation<br />

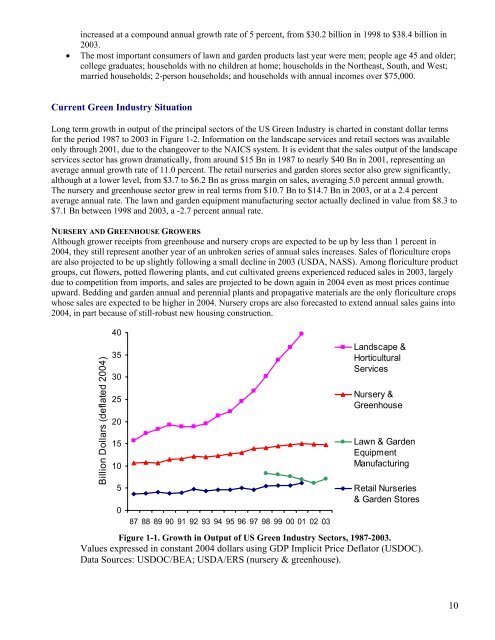

Long term growth <strong>in</strong> output <strong>of</strong> <strong>the</strong> pr<strong>in</strong>cipal sectors <strong>of</strong> <strong>the</strong> US <strong>Green</strong> <strong>Industry</strong> is charted <strong>in</strong> constant dollar terms<br />

for <strong>the</strong> period 1987 to 2003 <strong>in</strong> Figure 1-2. Information on <strong>the</strong> landscape services and retail sectors was available<br />

only through 2001, due to <strong>the</strong> changeover to <strong>the</strong> NAICS system. It is evident that <strong>the</strong> sales output <strong>of</strong> <strong>the</strong> landscape<br />

services sector has grown dramatically, from around $15 Bn <strong>in</strong> 1987 to nearly $40 Bn <strong>in</strong> 2001, represent<strong>in</strong>g an<br />

average annual growth rate <strong>of</strong> 11.0 percent. The retail nurseries and garden stores sector also grew significantly,<br />

although at a lower level, from $3.7 to $6.2 Bn as gross marg<strong>in</strong> on sales, averag<strong>in</strong>g 5.0 percent annual growth.<br />

The nursery and greenhouse sector grew <strong>in</strong> real terms from $10.7 Bn to $14.7 Bn <strong>in</strong> 2003, or at a 2.4 percent<br />

average annual rate. The lawn and garden equipment manufactur<strong>in</strong>g sector actually decl<strong>in</strong>ed <strong>in</strong> value from $8.3 to<br />

$7.1 Bn between 1998 and 2003, a -2.7 percent annual rate.<br />

NURSERY AND GREENHOUSE GROWERS<br />

Although grower receipts from greenhouse and nursery crops are expected to be up by less than 1 percent <strong>in</strong><br />

2004, <strong>the</strong>y still represent ano<strong>the</strong>r year <strong>of</strong> an unbroken series <strong>of</strong> annual sales <strong>in</strong>creases. Sales <strong>of</strong> floriculture crops<br />

are also projected to be up slightly follow<strong>in</strong>g a small decl<strong>in</strong>e <strong>in</strong> 2003 (USDA, NASS). Among floriculture product<br />

groups, cut flowers, potted flower<strong>in</strong>g plants, and cut cultivated greens experienced reduced sales <strong>in</strong> 2003, largely<br />

due to competition from imports, and sales are projected to be down aga<strong>in</strong> <strong>in</strong> 2004 even as most prices cont<strong>in</strong>ue<br />

upward. Bedd<strong>in</strong>g and garden annual and perennial plants and propagative materials are <strong>the</strong> only floriculture crops<br />

whose sales are expected to be higher <strong>in</strong> 2004. Nursery crops are also forecasted to extend annual sales ga<strong>in</strong>s <strong>in</strong>to<br />

2004, <strong>in</strong> part because <strong>of</strong> still-robust new hous<strong>in</strong>g construction.<br />

Billion Dollars (deflated 2004)<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03<br />

Landscape &<br />

Horticultural<br />

Services<br />

Nursery &<br />

<strong>Green</strong>house<br />

Lawn & Garden<br />

Equipment<br />

Manufactur<strong>in</strong>g<br />

Retail Nurseries<br />

& Garden Stores<br />

Figure 1-1. Growth <strong>in</strong> Output <strong>of</strong> US <strong>Green</strong> <strong>Industry</strong> Sectors, 1987-2003.<br />

Values expressed <strong>in</strong> constant 2004 dollars us<strong>in</strong>g GDP Implicit Price Deflator (USDOC).<br />

Data Sources: USDOC/BEA; USDA/ERS (nursery & greenhouse).<br />

10