Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger

Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger

Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

28<br />

RISK MANAGEMENT – MANAGING RISK COST WITH FAST PROCESSES<br />

Micro risk management must be<br />

enhanced as both loan volumes and<br />

NPL ratios are higher <strong>in</strong> micros than<br />

<strong>in</strong> PI<br />

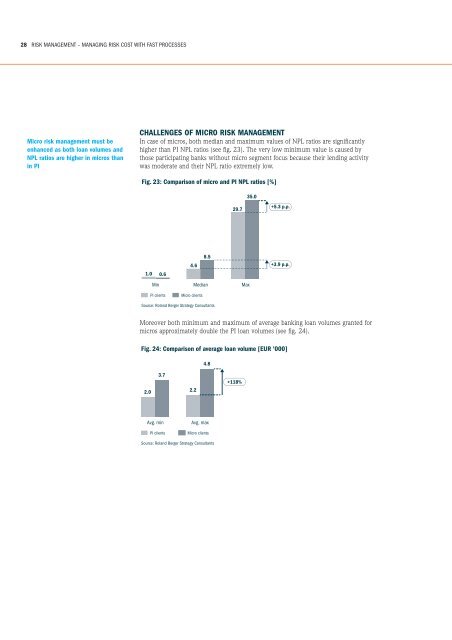

CHALLENGES OF MICRO RISK MANAGEMENT<br />

In case <strong>of</strong> micros, both median and maximum values <strong>of</strong> NPL ratios are significantly<br />

higher than PI NPL ratios (see fig. 23). The very low m<strong>in</strong>imum value is caused by<br />

those participat<strong>in</strong>g banks without micro segment focus because <strong>the</strong>ir lend<strong>in</strong>g activity<br />

was moderate and <strong>the</strong>ir NPL ratio extremely low.<br />

Moreover both m<strong>in</strong>imum and maximum <strong>of</strong> average bank<strong>in</strong>g loan volumes granted for<br />

micros approximately double <strong>the</strong> PI loan volumes (see fig. 24).