Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger

Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger

Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SUMMARY – RECOMMENDATIONS FOR "MICRO COMMITTED" BANKS 41<br />

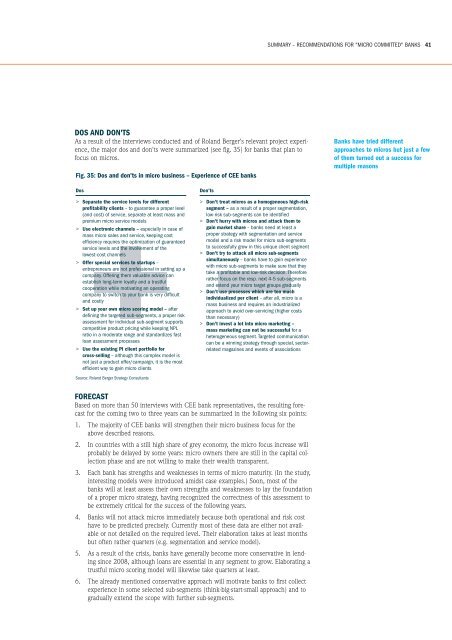

DOS AND DON'TS<br />

As a result <strong>of</strong> <strong>the</strong> <strong>in</strong>terviews conducted and <strong>of</strong> <strong>Roland</strong> <strong>Berger</strong>'s relevant project experience,<br />

<strong>the</strong> major dos and don'ts were summarized (see fig. 35) for banks that plan to<br />

focus on micros.<br />

Banks have tried different<br />

approaches to micros but just a few<br />

<strong>of</strong> <strong>the</strong>m turned out a success for<br />

multiple reasons<br />

FORECAST<br />

Based on more than 50 <strong>in</strong>terviews with <strong>CEE</strong> bank representatives, <strong>the</strong> result<strong>in</strong>g forecast<br />

for <strong>the</strong> com<strong>in</strong>g two to three years can be summarized <strong>in</strong> <strong>the</strong> follow<strong>in</strong>g six po<strong>in</strong>ts:<br />

1. The majority <strong>of</strong> <strong>CEE</strong> banks will streng<strong>the</strong>n <strong>the</strong>ir micro bus<strong>in</strong>ess focus for <strong>the</strong><br />

above described reasons.<br />

2. In countries with a still high share <strong>of</strong> grey economy, <strong>the</strong> micro focus <strong>in</strong>crease will<br />

probably be delayed by some years: micro owners <strong>the</strong>re are still <strong>in</strong> <strong>the</strong> capital collection<br />

phase and are not will<strong>in</strong>g to make <strong>the</strong>ir wealth transparent.<br />

3. Each bank has strengths and weaknesses <strong>in</strong> terms <strong>of</strong> micro maturity. (In <strong>the</strong> study,<br />

<strong>in</strong>terest<strong>in</strong>g models were <strong>in</strong>troduced amidst case examples.) Soon, most <strong>of</strong> <strong>the</strong><br />

banks will at least assess <strong>the</strong>ir own strengths and weaknesses to lay <strong>the</strong> foundation<br />

<strong>of</strong> a proper micro strategy, hav<strong>in</strong>g recognized <strong>the</strong> correctness <strong>of</strong> this assessment to<br />

be extremely critical for <strong>the</strong> success <strong>of</strong> <strong>the</strong> follow<strong>in</strong>g years.<br />

4. Banks will not attack micros immediately because both operational and risk cost<br />

have to be predicted precisely. Currently most <strong>of</strong> <strong>the</strong>se data are ei<strong>the</strong>r not available<br />

or not detailed on <strong>the</strong> required level. Their elaboration takes at least months<br />

but <strong>of</strong>ten ra<strong>the</strong>r quarters (e.g. segmentation and service model).<br />

5. As a result <strong>of</strong> <strong>the</strong> crisis, banks have generally become more conservative <strong>in</strong> lend<strong>in</strong>g<br />

s<strong>in</strong>ce 2008, although loans are essential <strong>in</strong> any segment to grow. Elaborat<strong>in</strong>g a<br />

trustful micro scor<strong>in</strong>g model will likewise take quarters at least.<br />

6. The already mentioned conservative approach will motivate banks to first collect<br />

experience <strong>in</strong> some selected sub-segments (th<strong>in</strong>k-big-start-small approach) and to<br />

gradually extend <strong>the</strong> scope with fur<strong>the</strong>r sub-segments.