Dynamic Hedging with Stochastic Differential Utility

Dynamic Hedging with Stochastic Differential Utility

Dynamic Hedging with Stochastic Differential Utility

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The practical advantage is to produce neat formulas for our problem. In<br />

theoretical grounds we are assuming that we can add the certainty equivalent<br />

in the HJB equation when we are maximizing the utility of the final wealth.<br />

Our procedure lies in the remarkable consequence of the forward-looking<br />

nature of the Bellman equation under SDU, dispensing <strong>with</strong> state variables<br />

reflecting past decisions (see Duffie and Epstein, p. 373, 1992).<br />

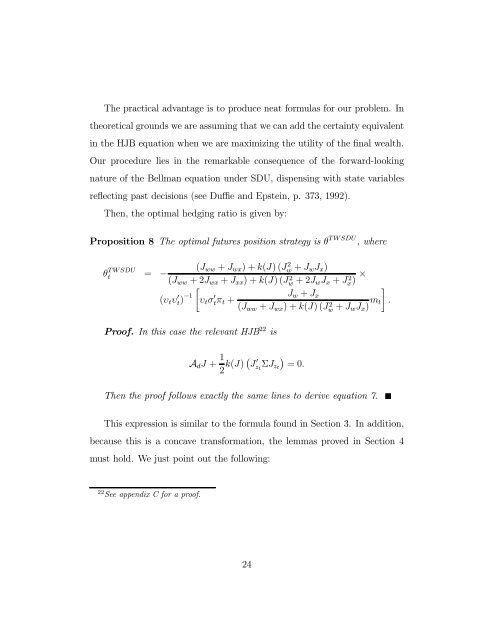

Then, the optimal hedging ratio is given by:<br />

Proposition 8 The optimal futures position strategy is θ TWSDU , where<br />

(J ww + J wx )+k(J)(Jw 2 + J w J x )<br />

t = −<br />

(J ww +2J wx + J xx )+k(J)(Jw 2 +2J w J x + Jx) × 2<br />

θ TWSDU<br />

(υ t υ 0 t) −1 ·υ t σ 0 tπ t +<br />

J w + J x<br />

(J ww + J wx )+k(J)(J 2 w + J w J x ) m t<br />

¸<br />

.<br />

Proof. In this case the relevant HJB 22 is<br />

A d J + 1 2 k(J) ¡ J 0 z t<br />

ΣJ zt<br />

¢<br />

=0.<br />

Then the proof follows exactly the same lines to derive equation 7.<br />

This expression is similar to the formula found in Section 3. In addition,<br />

because this is a concave transformation,thelemmasprovedinSection4<br />

must hold. We just point out the following:<br />

22 See appendix C for a proof.<br />

24