Taxability of Real Estate transactions

Taxability of Real Estate transactions

Taxability of Real Estate transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

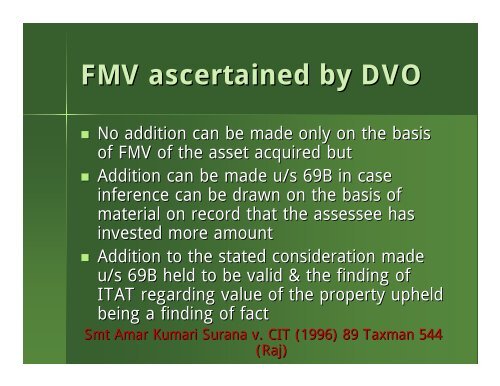

FMV ascertained by DVO<br />

• No addition can be made only on the basis<br />

<strong>of</strong> FMV <strong>of</strong> the asset acquired but<br />

• Addition can be made u/s 69B in case<br />

inference can be drawn on the basis <strong>of</strong><br />

material on record that the assessee has<br />

invested more amount<br />

• Addition to the stated consideration made<br />

u/s 69B held to be valid & the finding <strong>of</strong><br />

ITAT regarding value <strong>of</strong> the property upheld<br />

being a finding <strong>of</strong> fact<br />

Smt Amar Kumari Surana v. CIT (1996) 89 Taxman 544<br />

(Raj)