Taxability of Real Estate transactions

Taxability of Real Estate transactions

Taxability of Real Estate transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

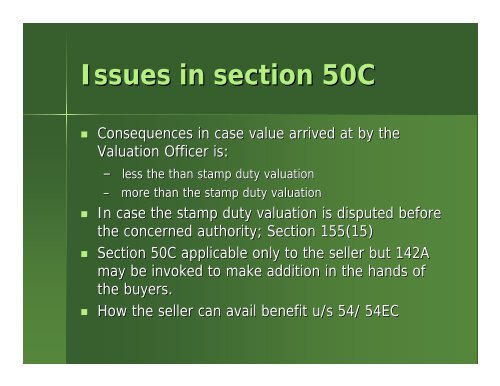

Issues in section 50C<br />

• Consequences in case value arrived at by the<br />

Valuation Officer is:<br />

– less the than stamp duty valuation<br />

– more than the stamp duty valuation<br />

• In case the stamp duty valuation is disputed before<br />

the concerned authority; Section 155(15)<br />

• Section 50C applicable only to the seller but 142A<br />

may be invoked to make addition in the hands <strong>of</strong><br />

the buyers.<br />

• How the seller can avail benefit u/s 54/ 54EC