Taxability of Real Estate transactions

Taxability of Real Estate transactions

Taxability of Real Estate transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

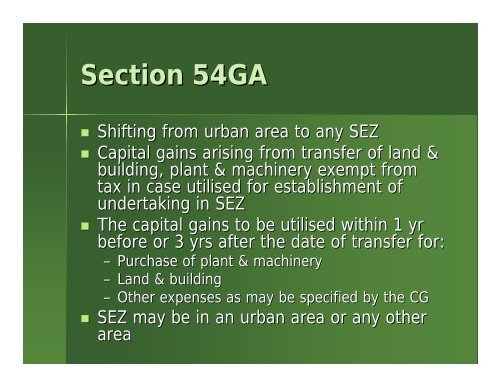

Section 54GA<br />

• Shifting from urban area to any SEZ<br />

• Capital gains arising from transfer <strong>of</strong> land &<br />

building, plant & machinery exempt from<br />

tax in case utilised for establishment <strong>of</strong><br />

undertaking in SEZ<br />

• The capital gains to be utilised within 1 yr<br />

before or 3 yrs after the date <strong>of</strong> transfer for:<br />

– Purchase <strong>of</strong> plant & machinery<br />

– Land & building<br />

– Other expenses as may be specified by the CG<br />

• SEZ may be in an urban area or any other<br />

area