Taxability of Real Estate transactions

Taxability of Real Estate transactions

Taxability of Real Estate transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

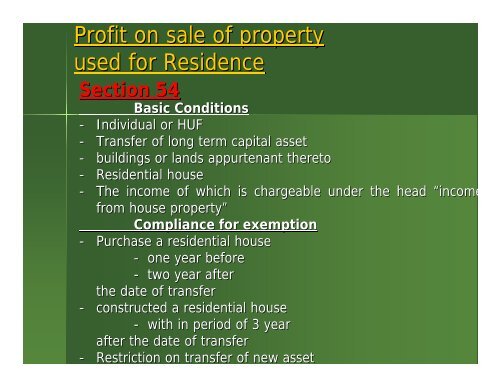

Pr<strong>of</strong>it on sale <strong>of</strong> property<br />

used for Residence<br />

Section 54<br />

Basic Conditions<br />

- Individual or HUF<br />

- Transfer <strong>of</strong> long term capital asset<br />

- buildings or lands appurtenant thereto<br />

- Residential house<br />

- The income <strong>of</strong> which is chargeable under the head “income<br />

from house property”<br />

Compliance for exemption<br />

- Purchase a residential house<br />

- one year before<br />

- two year after<br />

the date <strong>of</strong> transfer<br />

- constructed a residential house<br />

- with in period <strong>of</strong> 3 year<br />

after the date <strong>of</strong> transfer<br />

- Restriction on transfer <strong>of</strong> new asset