Taxability of Real Estate transactions

Taxability of Real Estate transactions

Taxability of Real Estate transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

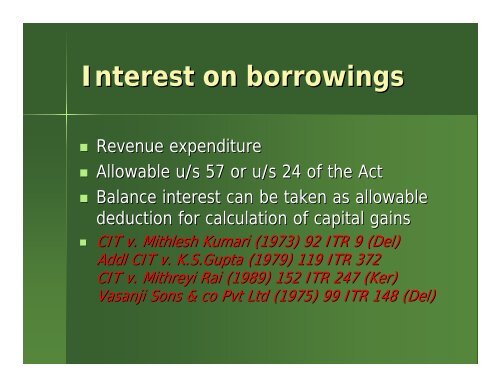

Interest on borrowings<br />

• Revenue expenditure<br />

• Allowable u/s 57 or u/s 24 <strong>of</strong> the Act<br />

• Balance interest can be taken as allowable<br />

deduction for calculation <strong>of</strong> capital gains<br />

• CIT v. Mithlesh Kumari (1973) 92 ITR 9 (Del)<br />

Addl CIT v. K.S.Gupta (1979) 119 ITR 372<br />

CIT v. Mithreyi Rai (1989) 152 ITR 247 (Ker(<br />

Ker)<br />

Vasanji Sons & co Pvt Ltd (1975) 99 ITR 148 (Del)