Taxability of Real Estate transactions

Taxability of Real Estate transactions

Taxability of Real Estate transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

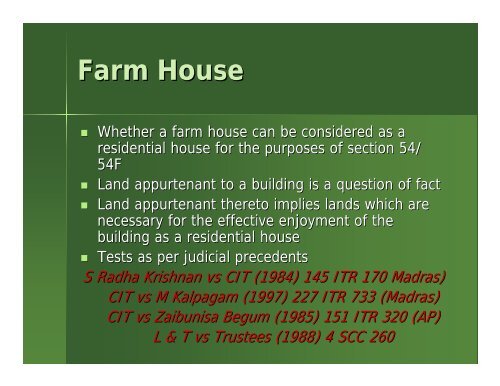

Farm House<br />

• Whether a farm house can be considered as a<br />

residential house for the purposes <strong>of</strong> section 54/<br />

54F<br />

• Land appurtenant to a building is a question <strong>of</strong> fact<br />

• Land appurtenant thereto implies lands which are<br />

necessary for the effective enjoyment <strong>of</strong> the<br />

building as a residential house<br />

• Tests as per judicial precedents<br />

S Radha Krishnan vs CIT (1984) 145 ITR 170 Madras)<br />

CIT vs M Kalpagam (1997) 227 ITR 733 (Madras)<br />

CIT vs Zaibunisa Begum (1985) 151 ITR 320 (AP)<br />

L & T vs Trustees (1988) 4 SCC 260