Taxability of Real Estate transactions

Taxability of Real Estate transactions

Taxability of Real Estate transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

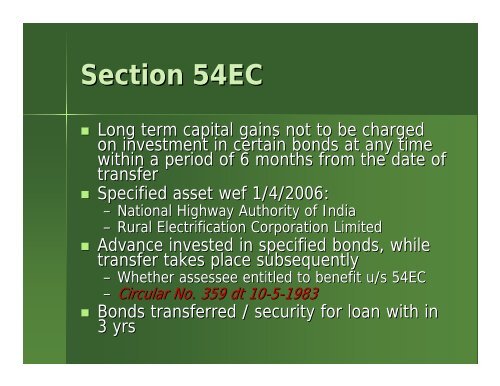

Section 54EC<br />

• Long term capital gains not to be charged<br />

on investment in certain bonds at any time<br />

within a period <strong>of</strong> 6 months from the date <strong>of</strong><br />

transfer<br />

• Specified asset wef 1/4/2006:<br />

– National Highway Authority <strong>of</strong> India<br />

– Rural Electrification Corporation Limited<br />

• Advance invested in specified bonds, while<br />

transfer takes place subsequently<br />

– Whether assessee entitled to benefit u/s 54EC<br />

– Circular No. 359 dt 10-5-1983<br />

1983<br />

• Bonds transferred / security for loan with in<br />

3 yrs