Punch Taverns plc 2007 Annual Report and Financial Statements

Punch Taverns plc 2007 Annual Report and Financial Statements

Punch Taverns plc 2007 Annual Report and Financial Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Financial</strong> review continued<br />

Acquisitions <strong>and</strong> disposals<br />

On 14 September 2006 the Group acquired the Mill House Inns<br />

group, which operated a managed estate of 82 pubs at the<br />

date of acquisition. The consideration for the acquisition was<br />

£164m, which was funded from new short-term borrowings.<br />

On 17 April <strong>2007</strong>, the Group completed the acquisition<br />

of 50% of Matthew Clark (Holdings) Limited, the holding<br />

company of the Matthew Clark group of companies. Under<br />

the terms of the arrangement, <strong>Punch</strong> <strong>and</strong> Constellation Europe<br />

each own 50% of Matthew Clark. The consideration for<br />

the acquisition was £35m in cash from existing resources.<br />

Two strategic disposals were completed in the year. On 16 May<br />

<strong>2007</strong>, 869 leased <strong>and</strong> tenanted pubs were sold to Admiral<br />

<strong>Taverns</strong> for a total consideration of £328m; for the financial<br />

year ended 19 August 2006 these pubs generated EBITDA of<br />

£30.1m. On 17 September 2006, the Group disposed of its<br />

wholly owned subsidiary Spirit Managed (Old Orleans) Limited,<br />

which operated 31 managed pub restaurants, to Regent Inns<br />

for a consideration of £25.6m.<br />

In addition to these package acquisitions <strong>and</strong> disposals, we<br />

continue to actively churn the estate through the sale of<br />

individual outlets that are judged to have a less sustainable<br />

future as a pub, <strong>and</strong> through the acquisition of high quality<br />

individual <strong>and</strong> small packages of pubs. During the year 85<br />

high quality pubs were acquired for £64m <strong>and</strong> 86 pubs were<br />

sold raising £51m.<br />

Financing costs<br />

Net underlying financing costs increased by 5% to £328m in<br />

the year, principally due to the increase in average net debt<br />

following the full year inclusion of the Spirit business. The<br />

weighted average interest rate for Group loans <strong>and</strong> borrowings<br />

on an IFRS basis, including the effect of interest rate swaps,<br />

at the balance sheet date reduced to 6.7% (6.9% in the prior<br />

year) following the successful refinance of £825m of debt<br />

during July <strong>2007</strong>.<br />

Interest cover across the year was maintained at 2.0 times,<br />

all at effectively fixed rates of interest.<br />

Taxation<br />

The underlying tax charge of £58m represents an effective<br />

tax rate of 20%, the equivalent rate for the previous year was<br />

22%. The effective tax rate is significantly below the UK<br />

st<strong>and</strong>ard rate of 30% due largely to the impact of indexation<br />

allowances on the inherent property gains.<br />

The effective cash tax rate for the year at 7%, based on income<br />

tax payments of £19m, continues to be significantly below that<br />

of the income statement tax charge as we benefit from the<br />

utilisation of brought forward losses.<br />

Exceptional items<br />

In order to provide a trend measure of underlying performance,<br />

profit is presented excluding items which we consider will<br />

distort comparability; whether due to their significant nonrecurring<br />

nature or as a result of specific accounting treatments.<br />

Included in the income statement for the year is £42m of<br />

exceptional operating costs largely reflecting the one-off costs<br />

relating to the reorganisation <strong>and</strong> integration of the Spirit <strong>and</strong><br />

Mill House Inns acquisitions, offset by a £22m credit relating to<br />

reduced property provisions.<br />

In addition, there was a financing credit of £43m, of which<br />

£54m arose from the movement in fair value of interest rate<br />

swaps which do not qualify for hedge accounting, offset by a<br />

£11m charge relating to one-off refinancing costs in the year.<br />

Whilst the interest rate swaps are considered to be effective<br />

in matching the amortising profile of existing floating rate<br />

borrowings, they did not meet the definition of an effective<br />

hedge due to the relative size of the mark to market difference<br />

of the swaps at the date of acquisition.<br />

The tax effect of the above items, together with the release of<br />

various tax provisions relating to tax matters which have now<br />

been settled, had the net effect of a £31m exceptional tax<br />

credit in the year.<br />

Earnings per share<br />

Adjusted basic earnings per share rose by 13% to 84.4p,<br />

compared with 74.9p in 2006. Adjusted diluted earnings<br />

per share of 82.6p was 12% ahead of last year.<br />

Basic reported earnings per share was ahead of underlying<br />

earnings at 104.9p, reflecting the impact of the net exceptional<br />

credit of £54m.<br />

Dividends<br />

The Board is recommending a final dividend for <strong>2007</strong> of 10.2p<br />

per share, up 13% on the final dividend last year. Together with<br />

the interim dividend of 5.1p paid on 29 June <strong>2007</strong>, this gives<br />

a total dividend for the year of 15.3p, up 14% on last year.<br />

Subject to approval at the AGM, the total cost for the final<br />

dividend will be £27m <strong>and</strong> the dividend will be paid on 23<br />

January 2008 to shareholders on the register at 4 January 2008.<br />

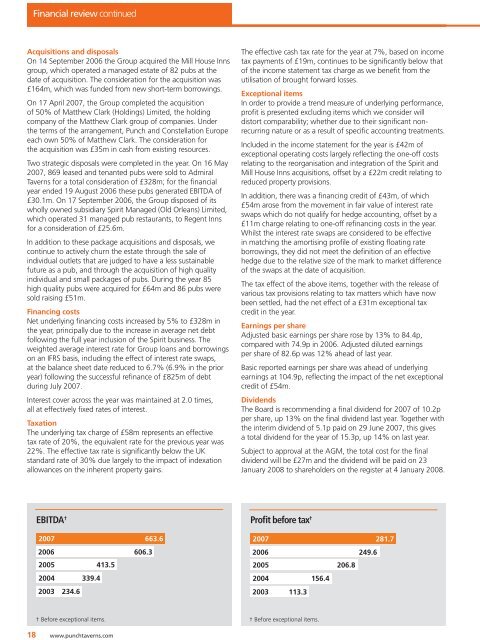

EBITDA † Profit before tax †<br />

<strong>2007</strong><br />

663.6<br />

<strong>2007</strong><br />

281.7<br />

2006<br />

606.3<br />

2006<br />

249.6<br />

2005<br />

413.5<br />

2005<br />

206.8<br />

2004 339.4<br />

2004 156.4<br />

2003 234.6<br />

2003 113.3<br />

† Before exceptional items.<br />

† Before exceptional items.<br />

18 www.punchtaverns.com