Punch Taverns plc 2007 Annual Report and Financial Statements

Punch Taverns plc 2007 Annual Report and Financial Statements

Punch Taverns plc 2007 Annual Report and Financial Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

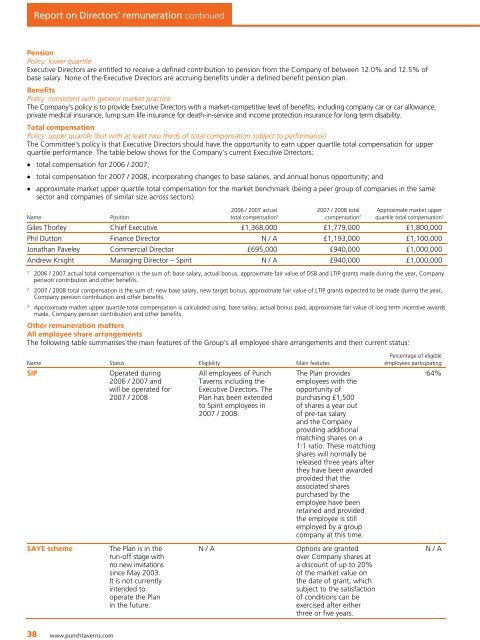

<strong>Report</strong> on Directors’ remuneration continued<br />

Pension<br />

Policy: lower quartile<br />

Executive Directors are entitled to receive a defined contribution to pension from the Company of between 12.0% <strong>and</strong> 12.5% of<br />

base salary. None of the Executive Directors are accruing benefits under a defined benefit pension plan.<br />

Benefits<br />

Policy: consistent with general market practice<br />

The Company’s policy is to provide Executive Directors with a market-competitive level of benefits, including company car or car allowance,<br />

private medical insurance, lump sum life insurance for death-in-service <strong>and</strong> income protection insurance for long term disability.<br />

Total compensation<br />

Policy: upper quartile (but with at least two thirds of total compensation subject to performance)<br />

The Committee’s policy is that Executive Directors should have the opportunity to earn upper quartile total compensation for upper<br />

quartile performance. The table below shows for the Company’s current Executive Directors:<br />

total compensation for 2006 / <strong>2007</strong>;<br />

total compensation for <strong>2007</strong> / 2008, incorporating changes to base salaries, <strong>and</strong> annual bonus opportunity; <strong>and</strong><br />

approximate market upper quartile total compensation for the market benchmark (being a peer group of companies in the same<br />

sector <strong>and</strong> companies of similar size across sectors).<br />

Name<br />

Position<br />

2006 / <strong>2007</strong> actual<br />

total compensation 1<br />

<strong>2007</strong> / 2008 total<br />

compensation 2<br />

Approximate market upper<br />

quartile total compensation 3<br />

Giles Thorley Chief Executive £1,368,000 £1,779,000 £1,800,000<br />

Phil Dutton Finance Director N / A £1,193,000 £1,100,000<br />

Jonathan Paveley Commercial Director £695,000 £940,000 £1,000,000<br />

Andrew Knight Managing Director – Spirit N / A £940,000 £1,000,000<br />

1<br />

2006 / <strong>2007</strong> actual total compensation is the sum of; base salary, actual bonus, approximate fair value of DSB <strong>and</strong> LTIP grants made during the year, Company<br />

pension contribution <strong>and</strong> other benefits.<br />

2<br />

<strong>2007</strong> / 2008 total compensation is the sum of; new base salary, new target bonus, approximate fair value of LTIP grants expected to be made during the year,<br />

Company pension contribution <strong>and</strong> other benefits.<br />

3<br />

Approximate market upper quartile total compensation is calculated using; base salary, actual bonus paid, approximate fair value of long term incentive awards<br />

made, Company pension contribution <strong>and</strong> other benefits.<br />

Other remuneration matters<br />

All employee share arrangements<br />

The following table summarises the main features of the Group’s all employee share arrangements <strong>and</strong> their current status:<br />

Name Status Eligibility Main features<br />

SIP<br />

Operated during<br />

2006 / <strong>2007</strong> <strong>and</strong><br />

will be operated for<br />

<strong>2007</strong> / 2008<br />

All employees of <strong>Punch</strong><br />

<strong>Taverns</strong> including the<br />

Executive Directors. The<br />

Plan has been extended<br />

to Spirit employees in<br />

<strong>2007</strong> / 2008.<br />

The Plan provides<br />

employees with the<br />

opportunity of<br />

purchasing £1,500<br />

of shares a year out<br />

of pre-tax salary<br />

<strong>and</strong> the Company<br />

providing additional<br />

matching shares on a<br />

1:1 ratio. These matching<br />

shares will normally be<br />

released three years after<br />

they have been awarded<br />

provided that the<br />

associated shares<br />

purchased by the<br />

employee have been<br />

retained <strong>and</strong> provided<br />

the employee is still<br />

employed by a group<br />

company at this time.<br />

Percentage of eligible<br />

employees participating<br />

64%<br />

SAYE scheme<br />

The Plan is in the<br />

run-off stage with<br />

no new invitations<br />

since May 2003.<br />

It is not currently<br />

intended to<br />

operate the Plan<br />

in the future.<br />

N / A<br />

Options are granted<br />

over Company shares at<br />

a discount of up to 20%<br />

of the market value on<br />

the date of grant, which<br />

subject to the satisfaction<br />

of conditions can be<br />

exercised after either<br />

three or five years.<br />

N / A<br />

38<br />

2 www.punchtaverns.com