Punch Taverns plc 2007 Annual Report and Financial Statements

Punch Taverns plc 2007 Annual Report and Financial Statements

Punch Taverns plc 2007 Annual Report and Financial Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Report</strong> on Directors’ remuneration continued<br />

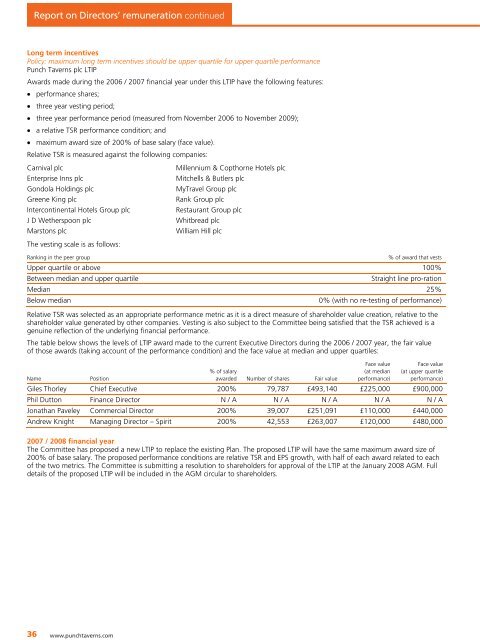

Long term incentives<br />

Policy: maximum long term incentives should be upper quartile for upper quartile performance<br />

<strong>Punch</strong> <strong>Taverns</strong> <strong>plc</strong> LTIP<br />

Awards made during the 2006 / <strong>2007</strong> financial year under this LTIP have the following features:<br />

performance shares;<br />

three year vesting period;<br />

three year performance period (measured from November 2006 to November 2009);<br />

a relative TSR performance condition; <strong>and</strong><br />

maximum award size of 200% of base salary (face value).<br />

Relative TSR is measured against the following companies:<br />

Carnival <strong>plc</strong><br />

Enterprise Inns <strong>plc</strong><br />

Gondola Holdings <strong>plc</strong><br />

Greene King <strong>plc</strong><br />

Intercontinental Hotels Group <strong>plc</strong><br />

J D Wetherspoon <strong>plc</strong><br />

Marstons <strong>plc</strong><br />

Millennium & Copthorne Hotels <strong>plc</strong><br />

Mitchells & Butlers <strong>plc</strong><br />

MyTravel Group <strong>plc</strong><br />

Rank Group <strong>plc</strong><br />

Restaurant Group <strong>plc</strong><br />

Whitbread <strong>plc</strong><br />

William Hill <strong>plc</strong><br />

The vesting scale is as follows:<br />

Ranking in the peer group<br />

% of award that vests<br />

Upper quartile or above 100%<br />

Between median <strong>and</strong> upper quartile<br />

Straight line pro-ration<br />

Median 25%<br />

Below median<br />

0% (with no re-testing of performance)<br />

Relative TSR was selected as an appropriate performance metric as it is a direct measure of shareholder value creation, relative to the<br />

shareholder value generated by other companies. Vesting is also subject to the Committee being satisfied that the TSR achieved is a<br />

genuine reflection of the underlying financial performance.<br />

The table below shows the levels of LTIP award made to the current Executive Directors during the 2006 / <strong>2007</strong> year, the fair value<br />

of those awards (taking account of the performance condition) <strong>and</strong> the face value at median <strong>and</strong> upper quartiles:<br />

Face value<br />

(at median<br />

performance)<br />

Face value<br />

(at upper quartile<br />

performance)<br />

Name<br />

Position<br />

% of salary<br />

awarded Number of shares Fair value<br />

Giles Thorley Chief Executive 200% 79,787 £493,140 £225,000 £900,000<br />

Phil Dutton Finance Director N / A N / A N / A N / A N / A<br />

Jonathan Paveley Commercial Director 200% 39,007 £251,091 £110,000 £440,000<br />

Andrew Knight Managing Director – Spirit 200% 42,553 £263,007 £120,000 £480,000<br />

<strong>2007</strong> / 2008 financial year<br />

The Committee has proposed a new LTIP to replace the existing Plan. The proposed LTIP will have the same maximum award size of<br />

200% of base salary. The proposed performance conditions are relative TSR <strong>and</strong> EPS growth, with half of each award related to each<br />

of the two metrics. The Committee is submitting a resolution to shareholders for approval of the LTIP at the January 2008 AGM. Full<br />

details of the proposed LTIP will be included in the AGM circular to shareholders.<br />

36<br />

2 www.punchtaverns.com