NEVER A DULL MOMENT - Maxis

NEVER A DULL MOMENT - Maxis

NEVER A DULL MOMENT - Maxis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

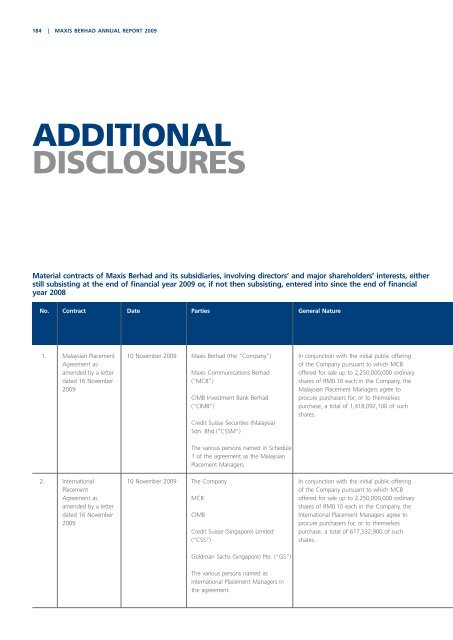

184 | MAXIS BERHAD ANNUAL REPORT 2009<br />

additional<br />

disclosures<br />

Material contracts of <strong>Maxis</strong> Berhad and its subsidiaries, involving directors’ and major shareholders’ interests, either<br />

still subsisting at the end of financial year 2009 or, if not then subsisting, entered into since the end of financial<br />

year 2008<br />

No. Contract Date Parties General Nature<br />

1.<br />

Malaysian Placement<br />

Agreement as<br />

amended by a letter<br />

dated 16 November<br />

2009<br />

10 November 2009<br />

<strong>Maxis</strong> Berhad (the “Company”)<br />

<strong>Maxis</strong> Communications Berhad<br />

(“MCB”)<br />

CIMB Investment Bank Berhad<br />

(“CIMB”)<br />

Credit Suisse Securities (Malaysia)<br />

Sdn. Bhd.(“CSSM”)<br />

In conjunction with the initial public offering<br />

of the Company pursuant to which MCB<br />

offered for sale up to 2,250,000,000 ordinary<br />

shares of RM0.10 each in the Company, the<br />

Malaysian Placement Managers agree to<br />

procure purchasers for, or to themselves<br />

purchase, a total of 1,418,092,100 of such<br />

shares.<br />

The various persons named in Schedule<br />

1 of the agreement as the Malaysian<br />

Placement Managers<br />

2.<br />

International<br />

Placement<br />

Agreement as<br />

amended by a letter<br />

dated 16 November<br />

2009<br />

10 November 2009<br />

The Company<br />

MCB<br />

CIMB<br />

Credit Suisse (Singapore) Limited<br />

(“CSS”)<br />

In conjunction with the initial public offering<br />

of the Company pursuant to which MCB<br />

offered for sale up to 2,250,000,000 ordinary<br />

shares of RM0.10 each in the Company, the<br />

International Placement Managers agree to<br />

procure purchasers for, or to themselves<br />

purchase, a total of 617,532,900 of such<br />

shares.<br />

Goldman Sachs (Singapore) Pte. (“GS”)<br />

The various persons named as<br />

International Placement Managers in<br />

the agreement.