Aegon Americas: Executing our strategy

Aegon Americas: Executing our strategy

Aegon Americas: Executing our strategy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

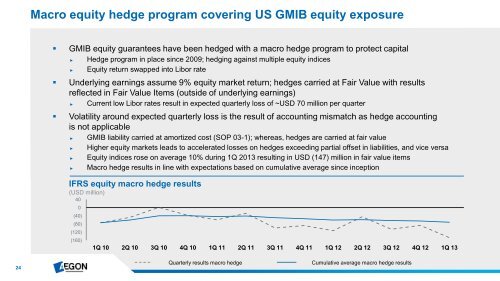

Macro equity hedge program covering US GMIB equity exposure<br />

• GMIB equity guarantees have been hedged with a macro hedge program to protect capital<br />

►<br />

►<br />

Hedge program in place since 2009; hedging against multiple equity indices<br />

Equity return swapped into Libor rate<br />

• Underlying earnings assume 9% equity market return; hedges carried at Fair Value with results<br />

reflected in Fair Value Items (outside of underlying earnings)<br />

►<br />

Current low Libor rates result in expected quarterly loss of ~USD 70 million per quarter<br />

• Volatility around expected quarterly loss is the result of accounting mismatch as hedge accounting<br />

is not applicable<br />

►<br />

►<br />

►<br />

►<br />

GMIB liability carried at amortized cost (SOP 03-1); whereas, hedges are carried at fair value<br />

Higher equity markets leads to accelerated losses on hedges exceeding partial offset in liabilities, and vice versa<br />

Equity indices rose on average 10% during 1Q 2013 resulting in USD (147) million in fair value items<br />

Macro hedge results in line with expectations based on cumulative average since inception<br />

IFRS equity macro hedge results<br />

(USD million)<br />

40<br />

0<br />

(40)<br />

(80)<br />

(120)<br />

(160)<br />

1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 1Q 12 2Q 12 3Q 12 4Q 12 1Q 13<br />

24<br />

Quarterly results macro hedge<br />

Cumulative average macro hedge results