Annual Report & Accounts 2012 - Euromoney Institutional Investor ...

Annual Report & Accounts 2012 - Euromoney Institutional Investor ...

Annual Report & Accounts 2012 - Euromoney Institutional Investor ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> PLC <strong>Annual</strong> <strong>Report</strong> and <strong>Accounts</strong> <strong>2012</strong><br />

www.euromoneyplc.com<br />

Notes to the Consolidated<br />

Financial Statements continued<br />

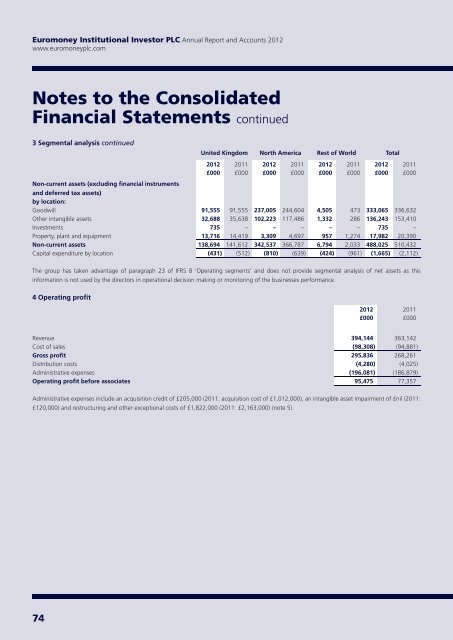

3 Segmental analysis continued<br />

United Kingdom North America Rest of World Total<br />

<strong>2012</strong><br />

£000<br />

Non-current assets (excluding financial instruments<br />

and deferred tax assets)<br />

by location:<br />

Goodwill 91,555 91,555 237,005 244,604 4,505 473 333,065 336,632<br />

Other intangible assets 32,688 35,638 102,223 117,486 1,332 286 136,243 153,410<br />

Investments 735 – – – – – 735 –<br />

Property, plant and equipment 13,716 14,419 3,309 4,697 957 1,274 17,982 20,390<br />

Non-current assets 138,694 141,612 342,537 366,787 6,794 2,033 488,025 510,432<br />

Capital expenditure by location (431) (512) (810) (639) (424) (961) (1,665) (2,112)<br />

2011<br />

£000<br />

<strong>2012</strong><br />

£000<br />

2011<br />

£000<br />

<strong>2012</strong><br />

£000<br />

2011<br />

£000<br />

<strong>2012</strong><br />

£000<br />

2011<br />

£000<br />

The group has taken advantage of paragraph 23 of IFRS 8 ‘Operating segments’ and does not provide segmental analysis of net assets as this<br />

information is not used by the directors in operational decision making or monitoring of the businesses performance.<br />

4 Operating profit<br />

<strong>2012</strong><br />

£000<br />

2011<br />

£000<br />

Revenue 394,144 363,142<br />

Cost of sales (98,308) (94,881)<br />

Gross profit 295,836 268,261<br />

Distribution costs (4,280) (4,025)<br />

Administrative expenses (196,081) (186,879)<br />

Operating profit before associates 95,475 77,357<br />

Administrative expenses include an acquisition credit of £205,000 (2011: acquisition cost of £1,012,000), an intangible asset impairment of £nil (2011:<br />

£120,000) and restructuring and other exceptional costs of £1,822,000 (2011: £2,163,000) (note 5).<br />

74