Annual Report & Accounts 2012 - Euromoney Institutional Investor ...

Annual Report & Accounts 2012 - Euromoney Institutional Investor ...

Annual Report & Accounts 2012 - Euromoney Institutional Investor ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> PLC <strong>Annual</strong> <strong>Report</strong> and <strong>Accounts</strong> <strong>2012</strong><br />

www.euromoneyplc.com<br />

Our Performance<br />

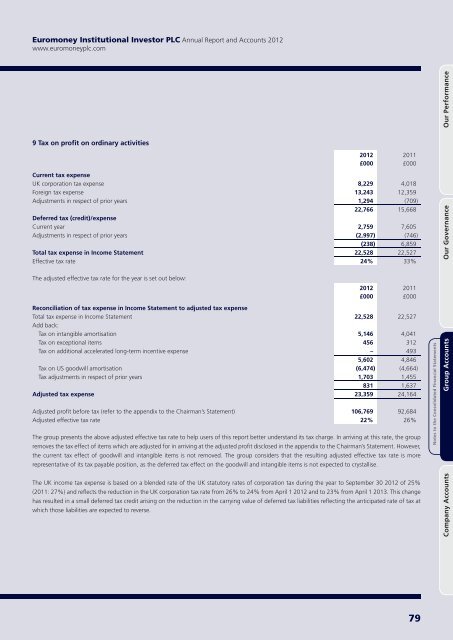

9 Tax on profit on ordinary activities<br />

<strong>2012</strong><br />

£000<br />

2011<br />

£000<br />

Current tax expense<br />

UK corporation tax expense 8,229 4,018<br />

Foreign tax expense 13,243 12,359<br />

Adjustments in respect of prior years 1,294 (709)<br />

22,766 15,668<br />

Deferred tax (credit)/expense<br />

Current year 2,759 7,605<br />

Adjustments in respect of prior years (2,997) (746)<br />

(238) 6,859<br />

Total tax expense in Income Statement 22,528 22,527<br />

Effective tax rate 24% 33%<br />

The adjusted effective tax rate for the year is set out below:<br />

Reconciliation of tax expense in Income Statement to adjusted tax expense<br />

Total tax expense in Income Statement 22,528 22,527<br />

Add back:<br />

Tax on intangible amortisation 5,146 4,041<br />

Tax on exceptional items 456 312<br />

Tax on additional accelerated long-term incentive expense – 493<br />

5,602 4,846<br />

Tax on US goodwill amortisation (6,474) (4,664)<br />

Tax adjustments in respect of prior years 1,703 1,455<br />

831 1,637<br />

Adjusted tax expense 23,359 24,164<br />

Adjusted profit before tax (refer to the appendix to the Chairman’s Statement) 106,769 92,684<br />

Adjusted effective tax rate 22% 26%<br />

The group presents the above adjusted effective tax rate to help users of this report better understand its tax charge. In arriving at this rate, the group<br />

removes the tax effect of items which are adjusted for in arriving at the adjusted profit disclosed in the appendix to the Chairman’s Statement. However,<br />

the current tax effect of goodwill and intangible items is not removed. The group considers that the resulting adjusted effective tax rate is more<br />

representative of its tax payable position, as the deferred tax effect on the goodwill and intangible items is not expected to crystallise.<br />

The UK income tax expense is based on a blended rate of the UK statutory rates of corporation tax during the year to September 30 <strong>2012</strong> of 25%<br />

(2011: 27%) and reflects the reduction in the UK corporation tax rate from 26% to 24% from April 1 <strong>2012</strong> and to 23% from April 1 2013. This change<br />

has resulted in a small deferred tax credit arising on the reduction in the carrying value of deferred tax liabilities reflecting the anticipated rate of tax at<br />

which those liabilities are expected to reverse.<br />

<strong>2012</strong><br />

£000<br />

2011<br />

£000<br />

Notes to the Consolidated Financial Statements<br />

Company <strong>Accounts</strong> Group <strong>Accounts</strong> Our Governance<br />

79