Annual Report & Accounts 2012 - Euromoney Institutional Investor ...

Annual Report & Accounts 2012 - Euromoney Institutional Investor ...

Annual Report & Accounts 2012 - Euromoney Institutional Investor ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> PLC <strong>Annual</strong> <strong>Report</strong> and <strong>Accounts</strong> <strong>2012</strong><br />

www.euromoneyplc.com<br />

Our Performance<br />

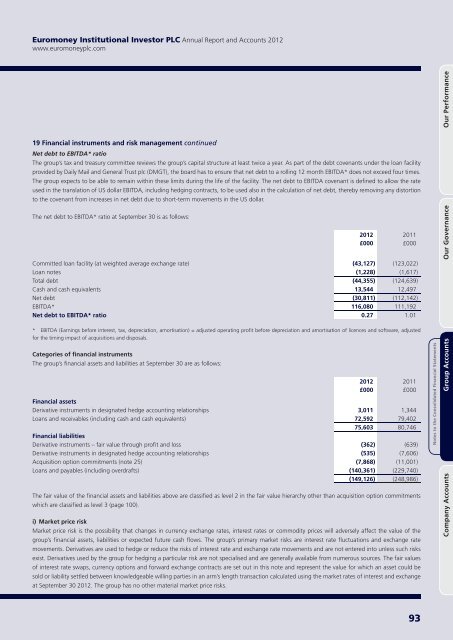

19 Financial instruments and risk management continued<br />

Net debt to EBITDA* ratio<br />

The group’s tax and treasury committee reviews the group’s capital structure at least twice a year. As part of the debt covenants under the loan facility<br />

provided by Daily Mail and General Trust plc (DMGT), the board has to ensure that net debt to a rolling 12 month EBITDA* does not exceed four times.<br />

The group expects to be able to remain within these limits during the life of the facility. The net debt to EBITDA covenant is defined to allow the rate<br />

used in the translation of US dollar EBITDA, including hedging contracts, to be used also in the calculation of net debt, thereby removing any distortion<br />

to the covenant from increases in net debt due to short-term movements in the US dollar.<br />

The net debt to EBITDA* ratio at September 30 is as follows:<br />

Committed loan facility (at weighted average exchange rate) (43,127) (123,022)<br />

Loan notes (1,228) (1,617)<br />

Total debt (44,355) (124,639)<br />

Cash and cash equivalents 13,544 12,497<br />

Net debt (30,811) (112,142)<br />

EBITDA* 116,080 111,192<br />

Net debt to EBITDA* ratio 0.27 1.01<br />

* EBITDA (Earnings before interest, tax, depreciation, amortisation) = adjusted operating profit before depreciation and amortisation of licences and software, adjusted<br />

for the timing impact of acquisitions and disposals.<br />

Categories of financial instruments<br />

The group’s financial assets and liabilities at September 30 are as follows:<br />

Financial assets<br />

Derivative instruments in designated hedge accounting relationships 3,011 1,344<br />

Loans and receivables (including cash and cash equivalents) 72,592 79,402<br />

75,603 80,746<br />

Financial liabilities<br />

Derivative instruments – fair value through profit and loss (362) (639)<br />

Derivative instruments in designated hedge accounting relationships (535) (7,606)<br />

Acquisition option commitments (note 25) (7,868) (11,001)<br />

Loans and payables (including overdrafts) (140,361) (229,740)<br />

(149,126) (248,986)<br />

The fair value of the financial assets and liabilities above are classified as level 2 in the fair value hierarchy other than acquisition option commitments<br />

which are classified as level 3 (page 100).<br />

i) Market price risk<br />

Market price risk is the possibility that changes in currency exchange rates, interest rates or commodity prices will adversely affect the value of the<br />

group’s financial assets, liabilities or expected future cash flows. The group’s primary market risks are interest rate fluctuations and exchange rate<br />

movements. Derivatives are used to hedge or reduce the risks of interest rate and exchange rate movements and are not entered into unless such risks<br />

exist. Derivatives used by the group for hedging a particular risk are not specialised and are generally available from numerous sources. The fair values<br />

of interest rate swaps, currency options and forward exchange contracts are set out in this note and represent the value for which an asset could be<br />

sold or liability settled between knowledgeable willing parties in an arm’s length transaction calculated using the market rates of interest and exchange<br />

at September 30 <strong>2012</strong>. The group has no other material market price risks.<br />

<strong>2012</strong><br />

£000<br />

<strong>2012</strong><br />

£000<br />

2011<br />

£000<br />

2011<br />

£000<br />

Notes to the Consolidated Financial Statements<br />

Company <strong>Accounts</strong> Group <strong>Accounts</strong> Our Governance<br />

93