Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

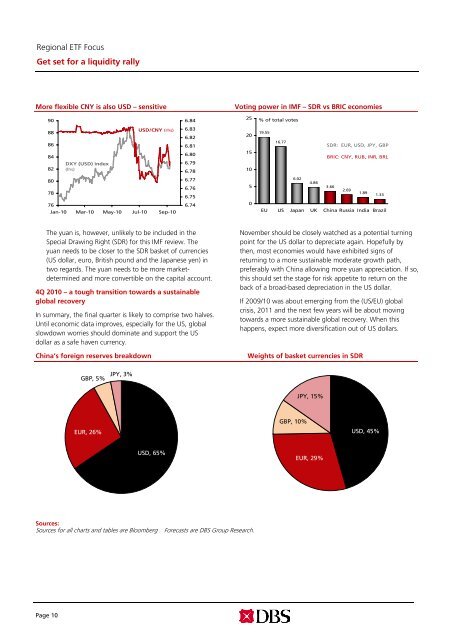

More flexible CNY is also USD – sensitive<br />

Voting power in IMF – SDR vs BRIC economies<br />

90<br />

6.84<br />

25<br />

% of total votes<br />

88<br />

86<br />

84<br />

82<br />

DXY (USD) index<br />

(lhs)<br />

USD/CNY (rhs)<br />

6.83<br />

6.82<br />

6.81<br />

6.80<br />

6.79<br />

6.78<br />

20<br />

15<br />

10<br />

19.55<br />

16.77<br />

SDR: EUR, USD, JPY, GBP<br />

BRIC: CNY, RUB, INR, BRL<br />

80<br />

78<br />

76<br />

Jan-10 Mar-10 May-10 Jul-10 Sep-10<br />

6.77<br />

6.76<br />

6.75<br />

6.74<br />

5<br />

0<br />

6.02<br />

4.86<br />

3.66<br />

2.69<br />

1.89<br />

1.33<br />

EU US Japan UK China Russia India Brazil<br />

The yuan is, however, unlikely to be included in <strong>the</strong><br />

Special Drawing Right (SDR) <strong>for</strong> this IMF review. The<br />

yuan needs to be closer to <strong>the</strong> SDR basket of currencies<br />

(US dollar, euro, British pound and <strong>the</strong> Japanese yen) in<br />

two regards. The yuan needs to be more marketdetermined<br />

and more convertible on <strong>the</strong> capital account.<br />

4Q 2010 – a tough transition towards a sustainable<br />

global recovery<br />

In summary, <strong>the</strong> final quarter is likely to comprise two halves.<br />

Until economic data improves, especially <strong>for</strong> <strong>the</strong> US, global<br />

slowdown worries should dominate and support <strong>the</strong> US<br />

dollar as a safe haven currency.<br />

China’s <strong>for</strong>eign reserves breakdown<br />

November should be closely watched as a potential turning<br />

point <strong>for</strong> <strong>the</strong> US dollar to depreciate again. Hopefully by<br />

<strong>the</strong>n, most economies would have exhibited signs of<br />

returning to a more sustainable moderate growth path,<br />

preferably with China allowing more yuan appreciation. If so,<br />

this should <strong>set</strong> <strong>the</strong> stage <strong>for</strong> risk appetite to return on <strong>the</strong><br />

back of a broad-based depreciation in <strong>the</strong> US dollar.<br />

If 2009/10 was about emerging from <strong>the</strong> (US/EU) global<br />

crisis, 2011 and <strong>the</strong> next few years will be about moving<br />

towards a more sustainable global recovery. When this<br />

happens, expect more diversification out of US dollars.<br />

Weights of basket currencies in SDR<br />

GBP, 5%<br />

JPY, 3%<br />

JPY, 15%<br />

EUR, 26%<br />

GBP, 10%<br />

USD, 45%<br />

USD, 65%<br />

EUR, 29%<br />

Sources:<br />

Sources <strong>for</strong> all charts and tables are Bloomberg . Forecasts are <strong>DBS</strong> Group Research.<br />

Page 10