Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

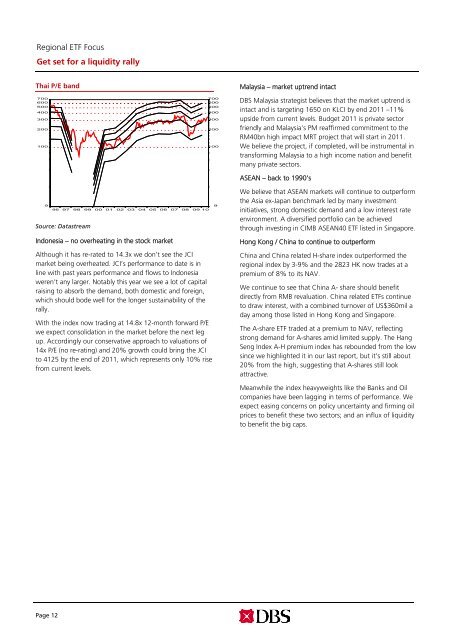

Thai P/E band<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

Malaysia – market uptrend intact<br />

<strong>DBS</strong> Malaysia strategist believes that <strong>the</strong> market uptrend is<br />

intact and is targeting 1650 on KLCI by end 2011 –11%<br />

upside from current levels. Budget 2011 is private sector<br />

friendly and Malaysia’s PM reaffirmed commitment to <strong>the</strong><br />

RM40bn high impact MRT project that will start in 2011.<br />

We believe <strong>the</strong> project, if completed, will be instrumental in<br />

trans<strong>for</strong>ming Malaysia to a high income nation and benefit<br />

many private sectors.<br />

ASEAN – back to 1990’s<br />

9<br />

96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: Datastream<br />

Indonesia – no overheating in <strong>the</strong> stock market<br />

Source: DATASTREAM<br />

Although it has re-rated to 14.3x we don’t see <strong>the</strong> JCI<br />

market being overheated. JCI’s per<strong>for</strong>mance to date is in<br />

line with past years per<strong>for</strong>mance and flows to Indonesia<br />

weren’t any larger. Notably this year we see a lot of capital<br />

raising to absorb <strong>the</strong> demand, both domestic and <strong>for</strong>eign,<br />

which should bode well <strong>for</strong> <strong>the</strong> longer sustainability of <strong>the</strong><br />

<strong>rally</strong>.<br />

With <strong>the</strong> index now trading at 14.8x 12-month <strong>for</strong>ward P/E<br />

we expect consolidation in <strong>the</strong> market be<strong>for</strong>e <strong>the</strong> next leg<br />

up. Accordingly our conservative approach to valuations of<br />

14x P/E (no re-rating) and 20% growth could bring <strong>the</strong> JCI<br />

to 4125 by <strong>the</strong> end of 2011, which represents only 10% rise<br />

from current levels.<br />

9<br />

We believe that ASEAN markets will continue to outper<strong>for</strong>m<br />

<strong>the</strong> Asia ex-Japan benchmark led by many investment<br />

initiatives, strong domestic demand and a low interest rate<br />

environment. A diversified portfolio can be achieved<br />

through investing in CIMB ASEAN40 ETF listed in Singapore.<br />

Hong Kong / China to continue to outper<strong>for</strong>m<br />

China and China related H-share index outper<strong>for</strong>med <strong>the</strong><br />

regional index by 3-9% and <strong>the</strong> 2823 HK now trades at a<br />

premium of 8% to its NAV.<br />

We continue to see that China A- share should benefit<br />

directly from RMB revaluation. China related ETFs continue<br />

to draw interest, with a combined turnover of US$360mil a<br />

day among those listed in Hong Kong and Singapore.<br />

The A-share ETF traded at a premium to NAV, reflecting<br />

strong demand <strong>for</strong> A-shares amid limited supply. The Hang<br />

Seng Index A-H premium index has rebounded from <strong>the</strong> low<br />

since we highlighted it in our last report, but it’s still about<br />

20% from <strong>the</strong> high, suggesting that A-shares still look<br />

attractive.<br />

Meanwhile <strong>the</strong> index heavyweights like <strong>the</strong> Banks and Oil<br />

companies have been lagging in terms of per<strong>for</strong>mance. We<br />

expect easing concerns on policy uncertainty and firming oil<br />

prices to benefit <strong>the</strong>se two sectors; and an influx of <strong>liquidity</strong><br />

to benefit <strong>the</strong> big caps.<br />

Page 12