Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Indonesia: inflows & monetary policy (Tieying Ma, matieying@dbs.com, re-published from same<br />

name report, 13 October 2010)<br />

Foreign inflows have been strong, across financial as<strong>set</strong>s<br />

including bonds, equities and money market instruments<br />

Inflows have not inflated <strong>the</strong> real economy thus far<br />

• Going <strong>for</strong>ward inflows will continue to rise, due to looser<br />

monetary conditions in <strong>the</strong> advanced economies and<br />

rising sentiment toward Indonesia. Policymakers will face<br />

growing challenges of managing inflows<br />

• The most likely policy option BI will choose is to rein<strong>for</strong>ce<br />

quantitative measures to absorb <strong>liquidity</strong> (RRR and OMO).<br />

Raising interest rates will also become unavoidable when<br />

inflation pressures increase<br />

• Accelerating currency appreciation is not expected. And<br />

<strong>the</strong> authorities’ stance on capital controls seems to be<br />

cautious<br />

Rising inflows<br />

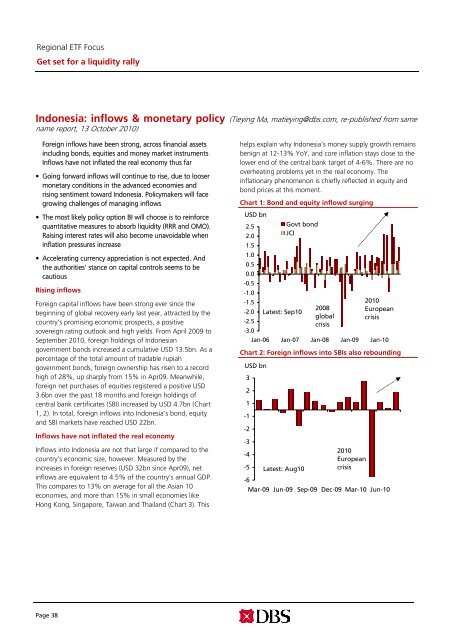

Foreign capital inflows have been strong ever since <strong>the</strong><br />

beginning of global recovery early last year, attracted by <strong>the</strong><br />

country’s promising economic prospects, a positive<br />

sovereign rating outlook and high yields. From April 2009 to<br />

September 2010, <strong>for</strong>eign holdings of Indonesian<br />

government bonds increased a cumulative USD 13.5bn. As a<br />

percentage of <strong>the</strong> total amount of tradable rupiah<br />

government bonds, <strong>for</strong>eign ownership has risen to a record<br />

high of 28%, up sharply from 15% in Apr09. Meanwhile,<br />

<strong>for</strong>eign net purchases of equities registered a positive USD<br />

3.6bn over <strong>the</strong> past 18 months and <strong>for</strong>eign holdings of<br />

central bank certificates (SBI) increased by USD 4.7bn (Chart<br />

1, 2). In total, <strong>for</strong>eign inflows into Indonesia’s bond, equity<br />

and SBI markets have reached USD 22bn.<br />

Inflows have not inflated <strong>the</strong> real economy<br />

Inflows into Indonesia are not that large if compared to <strong>the</strong><br />

country’s economic size, however. Measured by <strong>the</strong><br />

increases in <strong>for</strong>eign reserves (USD 32bn since Apr09), net<br />

inflows are equivalent to 4.5% of <strong>the</strong> country’s annual GDP.<br />

This compares to 13% on average <strong>for</strong> all <strong>the</strong> Asian 10<br />

economies, and more than 15% in small economies like<br />

Hong Kong, Singapore, Taiwan and Thailand (Chart 3). This<br />

helps explain why Indonesia’s money supply growth remains<br />

benign at 12-13% YoY, and core inflation stays close to <strong>the</strong><br />

lower end of <strong>the</strong> central bank target of 4-6%. There are no<br />

overheating problems yet in <strong>the</strong> real economy. The<br />

inflationary phenomenon is chiefly reflected in equity and<br />

bond prices at this moment.<br />

Chart 1: Bond and equity inflowd surging<br />

USD bn<br />

2.5 Govt bond<br />

2.0<br />

JCI<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

2010<br />

2008<br />

-2.0 Latest: Sep10<br />

European<br />

global crisis<br />

-2.5<br />

crisis<br />

-3.0<br />

Jan-06 Jan-07 Jan-08 Jan-09 Jan-10<br />

Chart 2: Foreign inflows into SBIs also rebounding<br />

USD bn<br />

3<br />

2<br />

1<br />

-1<br />

-2<br />

-3<br />

-4<br />

-5<br />

-6<br />

Latest: Aug10<br />

2010<br />

European<br />

crisis<br />

Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10<br />

Page 38