Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

India (Underweight) (Joanne Goh, joannegohsc@dbs.com)<br />

Near term outlook<br />

We are less negative on India compared to <strong>the</strong> last quarter.<br />

Growth seems to be losing steam but we believe it is<br />

normalizing after <strong>the</strong> scorching pace in <strong>the</strong> previous quarter,<br />

notwithstanding <strong>the</strong> higher inflation and rates hikes that<br />

could also possibly dampen demand.<br />

The re<strong>for</strong>m agenda supports a longer-term positive outlook.<br />

It is also enough to support <strong>the</strong> 8% GDP growth target as<br />

well as alleviating <strong>the</strong> high budget deficit and inflation<br />

concerns in <strong>the</strong> near term.<br />

While strong nominal GDP growth could be positive <strong>for</strong><br />

earnings growth in India, we are cognizant of higher<br />

operating costs eating into profits especially after recent fuel<br />

and wage hikes. Inflation at its extreme may also snap<br />

consumer demand and hurt top line growth, in our view.<br />

Valuation in India is expensive and earnings expectations<br />

barely changed throughout <strong>the</strong> year. We suspect Sensex will<br />

continue to rise and thus valuations as well as risk <strong>for</strong> <strong>the</strong><br />

market.<br />

We maintain Underweight on India on valuation grounds.<br />

Drivers:<br />

• The economy is primarily driven by domestic<br />

consumption. Long term infrastructure development and<br />

<strong>the</strong> need to improve living conditions (reduce slum areas,<br />

improve education and reduce poverty) imply long-term<br />

potential growth of 7.5%. The growth rate may be<br />

understated considering <strong>the</strong> huge population and <strong>the</strong><br />

government's recent re<strong>for</strong>m ef<strong>for</strong>ts.<br />

• Post re-election of <strong>the</strong> ruling UPA government last year,<br />

<strong>the</strong> government is expected to step up its re<strong>for</strong>m ef<strong>for</strong>ts<br />

and better quality growth can be achieved.<br />

• We believe growth can surprise on <strong>the</strong> upside following<br />

<strong>the</strong> 2010/11 budget, which is thought to be wellbalanced.<br />

Government <strong>for</strong>ecasts 9% growth this year<br />

and double-digit growth rates in <strong>the</strong> coming years.<br />

• Relaxation in FDI rules and capital flows should encourage<br />

more investor flows into India. Stock market re<strong>for</strong>ms like<br />

privatization and increase in <strong>for</strong>eign ownership will<br />

improve market efficiency.<br />

• A strong domestic savers' pool contributes to <strong>the</strong> longterm<br />

growth potential of <strong>the</strong> market.<br />

Risks:<br />

• India valuations trade towards <strong>the</strong> higher end of <strong>the</strong><br />

range and do not provide enough cushion should risk<br />

aversion persists. The market is more volatile than most<br />

Asian markets.<br />

• Supply constraints as a result of under-investment will<br />

continue to challenge <strong>the</strong> inflation outlook in our view.<br />

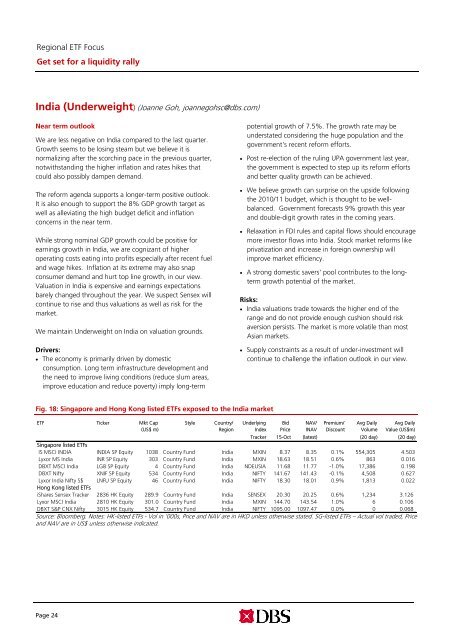

Fig. 18: Singapore and Hong Kong listed ETFs exposed to <strong>the</strong> India market<br />

ETF Ticker Mkt Cap Style Country/ Underlying Bid NAV/ Premium/ Avg Daily Avg Daily<br />

(US$ m) Region Index Price INAV Discount Volume Value (US$m)<br />

Tracker 15-Oct (latest) (20 day) (20 day)<br />

Singapore listed ETFs<br />

IS MSCI INDIA INDIA SP Equity 1038 Country Fund India MXIN 8.37 8.35 0.1% 554,305 4.503<br />

Lyxor MS India INR SP Equity 303 Country Fund India MXIN 18.63 18.51 0.6% 863 0.016<br />

DBXT MSCI India LG8 SP Equity 4 Country Fund India NDEUSIA 11.68 11.77 -1.0% 17,386 0.198<br />

DBXT Nifty XNIF SP Equity 534 Country Fund India NIFTY 141.67 141.43 -0.1% 4,508 0.627<br />

Lyxor India Nifty S$ LNFU SP Equity 46 Country Fund India NIFTY 18.30 18.01 0.9% 1,813 0.022<br />

Hong Kong listed ETFs<br />

iShares Sensex Tracker 2836 HK Equity 289.9 Country Fund India SENSEX 20.30 20.25 0.6% 1,234 3.126<br />

Lyxor MSCI India 2810 HK Equity 301.0 Country Fund India MXIN 144.70 143.54 1.0% 6 0.106<br />

DBXT S&P CNX Nifty 3015 HK Equity 534.7 Country Fund India NIFTY 1095.00 1097.47 0.0% 0 0.068<br />

Source: Bloomberg. Notes: HK-listed ETFs - Vol in ‘000s, Price and NAV are in HKD unless o<strong>the</strong>rwise stated. SG-listed ETFs – Actual vol traded, Price<br />

and NAV are in US$ unless o<strong>the</strong>rwise indicated.<br />

Page 24