Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Hong Kong / China (Overweight) (Joanne Goh, joannegohsc@dbs.com)<br />

Near term outlook<br />

The Chinese A-share market recovered from its low of 2477<br />

to 2827 currently. We remain hopeful that <strong>the</strong> market has<br />

passed its worst in terms of policy actions.<br />

With inflation risks returning we believe that market will be<br />

fixated on interest rates. China's 2Q GDP came in at 10.3%<br />

YoY compared to 11.9% in 1Q. GDP in 1H10 grew by<br />

11.1%. 3Q GDP is expected to be 9.5% The numbers<br />

suggest that policies should remain status quo <strong>for</strong> now as<br />

<strong>the</strong> economy returns to a more sustainable path. It won't be<br />

necessary to introduce more fiscal stimulus measures or ease<br />

<strong>the</strong> current monetary policy stance.<br />

We believe that <strong>the</strong> tightening measures in China will be an<br />

on-going process but <strong>the</strong> impact will gradually fade. The<br />

rumoured RRR hike (which was temporary <strong>for</strong> two months<br />

and restricted to six banks) , if true, also signals that more<br />

tightening may be <strong>for</strong>thcoming. Indeed China raised rates<br />

on 19 Oct as one of <strong>the</strong> first steps to stem inflationary<br />

expectations. As complications arise from currency,<br />

domestic demand, social and political pressure we believe<br />

China will tread carefully along <strong>the</strong> tightening path.<br />

Investors are gene<strong>rally</strong> less enthusiastic on <strong>the</strong> Chinese<br />

market on two major concerns - <strong>the</strong> banking and <strong>the</strong><br />

property sectors because of <strong>the</strong> exceptional loan growth last<br />

year. While this year's loan growth has normalized, <strong>the</strong><br />

lingering effect especially on loan quality and capital raising<br />

requirements still haunt. We believe uncertainties will<br />

remain, as <strong>the</strong>re are doubts on <strong>the</strong> data quality emerging<br />

out of <strong>the</strong>se two sectors. In our view <strong>the</strong> promising demand<br />

outlook in China and low valuations justify investors'<br />

position in <strong>the</strong> banking sector.<br />

However <strong>the</strong> China property sector should go through a<br />

longer adjustment process as supply situation, sticky<br />

housing prices, austerity measures, corporates' balance<br />

sheet should continue to weigh on this sector.<br />

We prefer direct beneficiaries of domestic demand like<br />

retail, food and beverage, and industries, which<br />

manufacture <strong>for</strong> China's domestic demand. Companies that<br />

are strong in <strong>the</strong> inner cities should have stronger growths<br />

going <strong>for</strong>ward as economic activities began to shift inwards.<br />

High wage pressures from <strong>the</strong> coastal regions and <strong>the</strong> near<br />

completion of <strong>the</strong> railway transportation should justify <strong>the</strong><br />

economic sense.<br />

The property and <strong>the</strong> banking sector in Hong Kong<br />

meanwhile has a lot to cheer about. Despite <strong>the</strong> austerity<br />

measures delivered by <strong>the</strong> government, property prices<br />

continue to rise. We believe this is because of <strong>the</strong> recent<br />

auctions of “prized” parcels of land in <strong>the</strong> Kowloon area,<br />

which has never been available <strong>for</strong> a long time. Moreover<br />

with abundant <strong>liquidity</strong> from Hong Kong and China as a<br />

result of lower interest rates and cheaper HKD, we continue<br />

to see as<strong>set</strong> price rise in Hong Kong.<br />

The unemployment picture is also looking better. Hong<br />

Kong is perceived as <strong>the</strong> “gateway” to China where<br />

demand growth is strong. Moreover, Hong Kong is <strong>the</strong> only<br />

place in <strong>the</strong> world where onshore CNY can be exchanged<br />

into USD currently. We expect more overseas companies<br />

from all sectors to <strong>set</strong> up offices in Hong Kong, hence<br />

improving <strong>the</strong> employment outlook. (For details, please see<br />

“HK: Hovering at an inflection point”, Chris Leung, 4Q<br />

Economics-Markets-Strategy, 10 Sep 2010).<br />

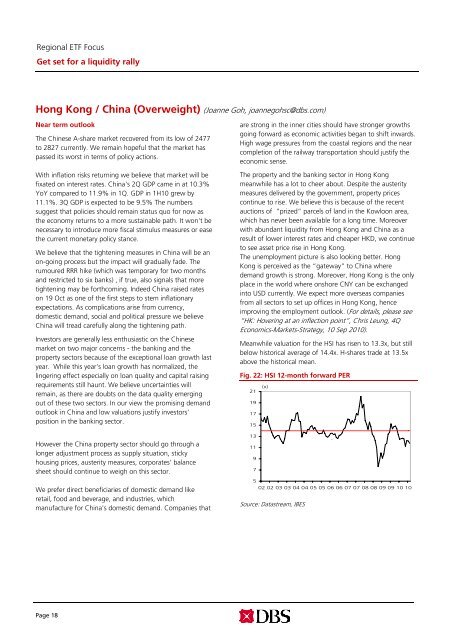

Meanwhile valuation <strong>for</strong> <strong>the</strong> HSI has risen to 13.3x, but still<br />

below historical average of 14.4x. H-shares trade at 13.5x<br />

above <strong>the</strong> historical mean.<br />

Fig. 22: HSI 12-month <strong>for</strong>ward PER<br />

21<br />

19<br />

17<br />

15<br />

13<br />

11<br />

9<br />

7<br />

5<br />

(x)<br />

02 02 03 03 04 04 05 05 06 06 07 07 08 08 09 09 10 10<br />

Source: Datastream, IBES<br />

'<br />

Page 18