Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Meanwhile, deregulation of <strong>the</strong> cross-strait direct<br />

transportation and tourism (since 2H08) may be yielding<br />

positive return. Though it is not easy to identify whe<strong>the</strong>r <strong>the</strong><br />

growth in Taiwan’s services industry is cyclical or structural<br />

because of <strong>the</strong> sharp swing in global economic cycle as a<br />

result of <strong>the</strong> financial crisis, one interesting observation is<br />

that services employment recovered ahead of<br />

manufacturing employment, particularly in <strong>the</strong> sub-sectors<br />

of accommodation and food services (Chart 4). This is<br />

probably a sign demonstrating <strong>the</strong> benefits realized from<br />

cross-strait links of tourism and transportation.<br />

Chart 4: Services employment vs, manufacturing<br />

persons, th<br />

6250<br />

6150<br />

6050<br />

5950<br />

5850<br />

5750<br />

5650<br />

Latest: Jul10<br />

Services (LHS)<br />

Manufacturing (RHS)<br />

persons, th<br />

3000<br />

2950<br />

2900<br />

2850<br />

2800<br />

2750<br />

2700<br />

2650<br />

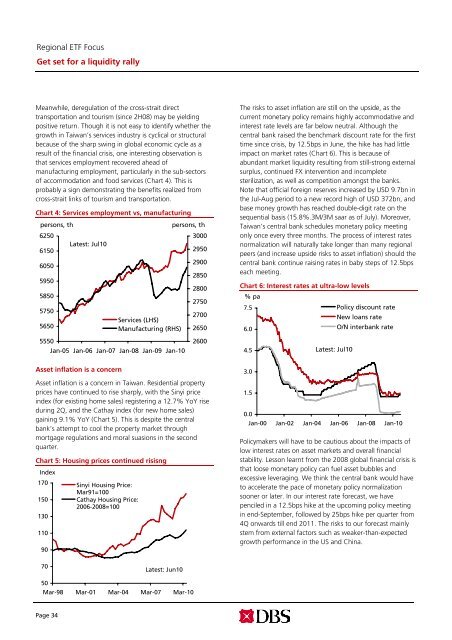

The risks to as<strong>set</strong> inflation are still on <strong>the</strong> upside, as <strong>the</strong><br />

current monetary policy remains highly accommodative and<br />

interest rate levels are far below neutral. Although <strong>the</strong><br />

central bank raised <strong>the</strong> benchmark discount rate <strong>for</strong> <strong>the</strong> first<br />

time since crisis, by 12.5bps in June, <strong>the</strong> hike has had little<br />

impact on market rates (Chart 6). This is because of<br />

abundant market <strong>liquidity</strong> resulting from still-strong external<br />

surplus, continued FX intervention and incomplete<br />

sterilization, as well as competition amongst <strong>the</strong> banks.<br />

Note that official <strong>for</strong>eign reserves increased by USD 9.7bn in<br />

<strong>the</strong> Jul-Aug period to a new record high of USD 372bn, and<br />

base money growth has reached double-digit rate on <strong>the</strong><br />

sequential basis (15.8%.3M/3M saar as of July). Moreover,<br />

Taiwan’s central bank schedules monetary policy meeting<br />

only once every three months. The process of interest rates<br />

normalization will natu<strong>rally</strong> take longer than many regional<br />

peers (and increase upside risks to as<strong>set</strong> inflation) should <strong>the</strong><br />

central bank continue raising rates in baby steps of 12.5bps<br />

each meeting.<br />

Chart 6: Interest rates at ultra-low levels<br />

% pa<br />

7.5<br />

6.0<br />

Policy discount rate<br />

New loans rate<br />

O/N interbank rate<br />

5550<br />

Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10<br />

2600<br />

4.5<br />

Latest: Jul10<br />

As<strong>set</strong> inflation is a concern<br />

As<strong>set</strong> inflation is a concern in Taiwan. Residential property<br />

prices have continued to rise sharply, with <strong>the</strong> Sinyi price<br />

index (<strong>for</strong> existing home sales) registering a 12.7% YoY rise<br />

during 2Q, and <strong>the</strong> Cathay index (<strong>for</strong> new home sales)<br />

gaining 9.1% YoY (Chart 5). This is despite <strong>the</strong> central<br />

bank’s attempt to cool <strong>the</strong> property market through<br />

mortgage regulations and moral suasions in <strong>the</strong> second<br />

quarter.<br />

Chart 5: Housing prices continued risisng<br />

Index<br />

170<br />

150<br />

130<br />

110<br />

90<br />

Sinyi Housing Price:<br />

Mar91=100<br />

Cathay Housing Price:<br />

2006-2008=100<br />

3.0<br />

1.5<br />

0.0<br />

Jan-00 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10<br />

Policymakers will have to be cautious about <strong>the</strong> impacts of<br />

low interest rates on as<strong>set</strong> markets and overall financial<br />

stability. Lesson learnt from <strong>the</strong> 2008 global financial crisis is<br />

that loose monetary policy can fuel as<strong>set</strong> bubbles and<br />

excessive leveraging. We think <strong>the</strong> central bank would have<br />

to accelerate <strong>the</strong> pace of monetary policy normalization<br />

sooner or later. In our interest rate <strong>for</strong>ecast, we have<br />

penciled in a 12.5bps hike at <strong>the</strong> upcoming policy meeting<br />

in end-September, followed by 25bps hike per quarter from<br />

4Q onwards till end 2011. The risks to our <strong>for</strong>ecast mainly<br />

stem from external factors such as weaker-than-expected<br />

growth per<strong>for</strong>mance in <strong>the</strong> US and China.<br />

70<br />

Latest: Jun10<br />

50<br />

Mar-98 Mar-01 Mar-04 Mar-07 Mar-10<br />

Page 34