Annual Report 2012 - Swiss Life

Annual Report 2012 - Swiss Life

Annual Report 2012 - Swiss Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

192 Consolidated Financial Statements<br />

date thereafter, upon notice and subject to the consent of the <strong>Swiss</strong> Financial Market Supervisory<br />

Authority. The notes bear interest from 16 November 2005 to 16 November 2015 at a rate of 5% p.a. If<br />

the notes are not redeemed on 16 November 2015, the interest rate will be the aggregate of Euribor for<br />

3-month deposits and a margin of 2.43%.<br />

In March 1999, <strong>Swiss</strong> <strong>Life</strong> AG privately placed a subordinated perpetual step-up loan comprising<br />

three simultaneous advances of EUR 443 million (at a rate of interest of Euribor plus a margin of<br />

1.05%, increasing by 100 basis points as from April 2009), CHF 290 million (at a rate of interest of<br />

Libor plus a margin of 1.05%, increasing by 100 basis points as from April 2009) and EUR 215 million<br />

(at a rate of interest of 5.3655%, as from October 2009 the rate of interest is the aggregate of Euribor<br />

plus a margin of 2.05%). In 2009, <strong>Swiss</strong> <strong>Life</strong> AG renounced the right to call the loan on its first call<br />

date. Following the purchase offer by <strong>Swiss</strong> <strong>Life</strong> Insurance Finance Ltd. in <strong>2012</strong>, EUR 192 million<br />

remain outstanding. <strong>Swiss</strong> <strong>Life</strong> AG can next call the outstanding loan on 6 April 2014 or at five-year<br />

intervals thereafter, upon notice and subject to the consent of the <strong>Swiss</strong> Financial Market Supervisory<br />

Authority.<br />

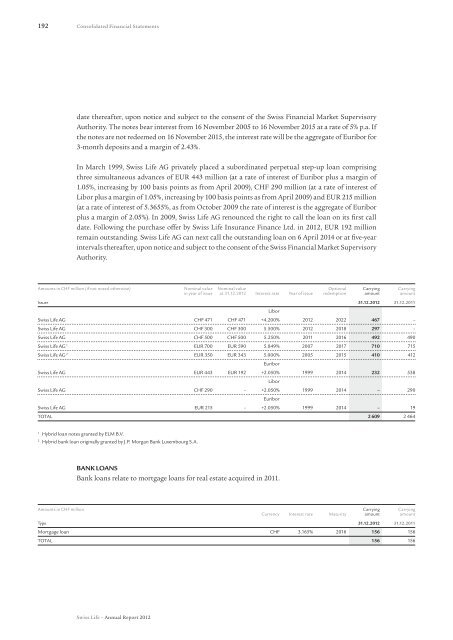

Amounts in CHF million (if not noted otherwise) Nominal value Nominal value Optional Carrying Carrying<br />

in year of issue at 31.12.<strong>2012</strong> Interest rate Year of issue redemption amount amount<br />

Issuer 31.12.<strong>2012</strong> 31.12.2011<br />

Libor<br />

<strong>Swiss</strong> <strong>Life</strong> AG CHF 471 CHF 471 +4.200% <strong>2012</strong> 2022 467 –<br />

<strong>Swiss</strong> <strong>Life</strong> AG CHF 300 CHF 300 5.500% <strong>2012</strong> 2018 297 –<br />

<strong>Swiss</strong> <strong>Life</strong> AG CHF 500 CHF 500 5.250% 2011 2016 492 490<br />

<strong>Swiss</strong> <strong>Life</strong> AG 1 EUR 700 EUR 590 5.849% 2007 2017 710 715<br />

<strong>Swiss</strong> <strong>Life</strong> AG 2 EUR 350 EUR 343 5.000% 2005 2015 410 412<br />

Euribor<br />

<strong>Swiss</strong> <strong>Life</strong> AG EUR 443 EUR 192 +2.050% 1999 2014 232 538<br />

Libor<br />

<strong>Swiss</strong> <strong>Life</strong> AG CHF 290 – +2.050% 1999 2014 – 290<br />

Euribor<br />

<strong>Swiss</strong> <strong>Life</strong> AG EUR 215 – +2.050% 1999 2014 – 19<br />

Total 2 609 2 464<br />

1<br />

Hybrid loan notes granted by ELM B.V.<br />

2<br />

Hybrid bank loan originally granted by J.P. Morgan Bank Luxembourg S.A.<br />

Bank loans<br />

Bank loans relate to mortgage loans for real estate acquired in 2011.<br />

Amounts in CHF million Carrying Carrying<br />

Currency Interest rate Maturity amount amount<br />

Type 31.12.<strong>2012</strong> 31.12.2011<br />

Mortgage loan CHF 3.165% 2016 156 156<br />

Total 156 156<br />

<strong>Swiss</strong> <strong>Life</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>