Annual Report 2012 - Swiss Life

Annual Report 2012 - Swiss Life

Annual Report 2012 - Swiss Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

203 Consolidated Financial Statements<br />

Deferred tax liabilities have not been recognised on the aggregate amount of temporary differences<br />

with consolidated investments in subsidiaries to the extent the Group considers such undistributed<br />

earnings as being indefinitely reinvested. The foreign entities are controlled by the Group and these<br />

earnings are not expected to be repatriated in the foreseeable future. The amount of such temporary<br />

differences was approximately CHF 5.6 billion as at 31 December <strong>2012</strong> (2011: CHF 4.4 billion). If such<br />

earnings are ever repatriated, no material tax liabilities would be incurred due to participation exemption<br />

rules, unrecognised tax loss carryforwards and applicable double taxation treaties.<br />

Deferred tax assets are recognised for tax-loss carryforwards only to the extent that realisation of the<br />

related tax benefit is probable. <strong>Swiss</strong> tax assets are calculated in accordance with cantonal and municipal<br />

tax legislation. The uncertainty of the utilisation of tax losses is taken into account in establishing the<br />

valuation allowance. For the following tax-loss carryforwards, which will expire as follows, no deferred<br />

tax asset has been recognised:<br />

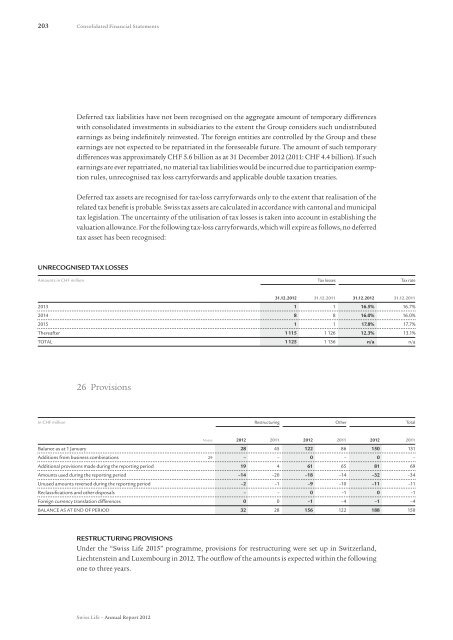

Unrecognised tax losses<br />

Amounts in CHF million Tax losses Tax rate<br />

31.12.<strong>2012</strong> 31.12.2011 31.12.<strong>2012</strong> 31.12.2011<br />

2013 1 1 16.5% 16.7%<br />

2014 8 8 16.0% 16.0%<br />

2015 1 1 17.8% 17.7%<br />

Thereafter 1 115 1 126 12.3% 13.1%<br />

Total 1 125 1 136 n/a n/a<br />

26 Provisions<br />

In CHF million Restructuring Other Total<br />

Notes <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Balance as at 1 January 28 45 122 86 150 131<br />

Additions from business combinations 29 – – 0 – 0 –<br />

Additional provisions made during the reporting period 19 4 61 65 81 69<br />

Amounts used during the reporting period –14 –20 –18 –14 –32 –34<br />

Unused amounts reversed during the reporting period –2 –1 –9 –10 –11 –11<br />

Reclassifications and other disposals – – 0 –1 0 –1<br />

Foreign currency translation differences 0 0 –1 –4 –1 –4<br />

Balance as at end of period 32 28 156 122 188 150<br />

Restructuring Provisions<br />

Under the “<strong>Swiss</strong> <strong>Life</strong> 2015” programme, provisions for restructuring were set up in Switzerland,<br />

Liechtenstein and Luxembourg in <strong>2012</strong>. The outflow of the amounts is expected within the following<br />

one to three years.<br />

<strong>Swiss</strong> <strong>Life</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>