ICICI Securities Limited Sterlite Technologies (STEOPT)

ICICI Securities Limited Sterlite Technologies (STEOPT)

ICICI Securities Limited Sterlite Technologies (STEOPT)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ICICI</strong> <strong>Securities</strong> <strong>Limited</strong><br />

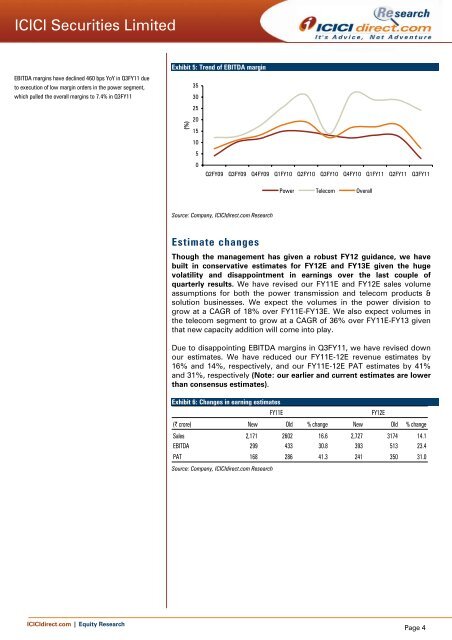

EBITDA margins have declined 460 bps YoY in Q3FY11 due<br />

to execution of low margin orders in the power segment,<br />

which pulled the overall margins to 7.4% in Q3FY11<br />

<strong>ICICI</strong>direct.com | Equity Research<br />

Exhibit 5: Trend of EBITDA margin<br />

(%)<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Q2FY09 Q3FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Estimate changes<br />

Power Telecom Overall<br />

Though the management has given a robust FY12 guidance, we have<br />

built in conservative estimates for FY12E and FY13E given the huge<br />

volatility and disappointment in earnings over the last couple of<br />

quarterly results. We have revised our FY11E and FY12E sales volume<br />

assumptions for both the power transmission and telecom products &<br />

solution businesses. We expect the volumes in the power division to<br />

grow at a CAGR of 18% over FY11E-FY13E. We also expect volumes in<br />

the telecom segment to grow at a CAGR of 36% over FY11E-FY13 given<br />

that new capacity addition will come into play.<br />

Due to disappointing EBITDA margins in Q3FY11, we have revised down<br />

our estimates. We have reduced our FY11E-12E revenue estimates by<br />

16% and 14%, respectively, and our FY11E-12E PAT estimates by 41%<br />

and 31%, respectively (Note: our earlier and current estimates are lower<br />

than consensus estimates).<br />

Exhibit 6: Changes in earning estimates<br />

FY11E FY12E<br />

(| crore) New Old % change New Old % change<br />

Sales 2,171 2602 16.6 2,727 3174 14.1<br />

EBITDA 299 433 30.8 393 513 23.4<br />

PAT 168 286 41.3 241 350 31.0<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Page 4