Study of Microfinance Sector Capacity Building in Sierra Leone

Study of Microfinance Sector Capacity Building in Sierra Leone

Study of Microfinance Sector Capacity Building in Sierra Leone

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

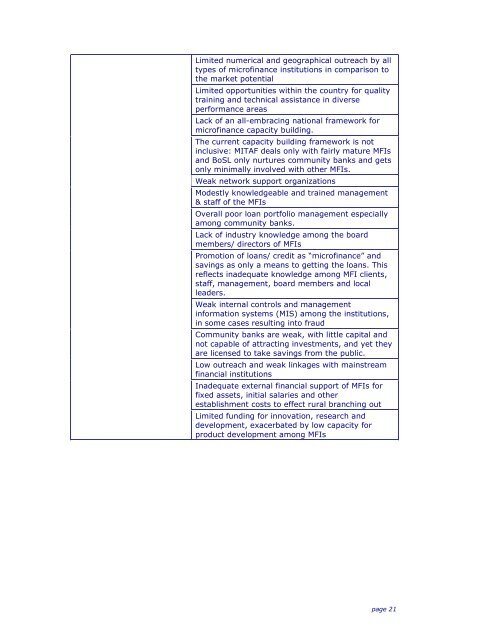

Limited numerical and geographical outreach by all<br />

types <strong>of</strong> micr<strong>of</strong><strong>in</strong>ance <strong>in</strong>stitutions <strong>in</strong> comparison to<br />

the market potential<br />

Limited opportunities with<strong>in</strong> the country for quality<br />

tra<strong>in</strong><strong>in</strong>g and technical assistance <strong>in</strong> diverse<br />

performance areas<br />

Lack <strong>of</strong> an all-embrac<strong>in</strong>g national framework for<br />

micr<strong>of</strong><strong>in</strong>ance capacity build<strong>in</strong>g.<br />

The current capacity build<strong>in</strong>g framework is not<br />

<strong>in</strong>clusive: MITAF deals only with fairly mature MFIs<br />

and BoSL only nurtures community banks and gets<br />

only m<strong>in</strong>imally <strong>in</strong>volved with other MFIs.<br />

Weak network support organizations<br />

Modestly knowledgeable and tra<strong>in</strong>ed management<br />

& staff <strong>of</strong> the MFIs<br />

Overall poor loan portfolio management especially<br />

among community banks.<br />

Lack <strong>of</strong> <strong>in</strong>dustry knowledge among the board<br />

members/ directors <strong>of</strong> MFIs<br />

Promotion <strong>of</strong> loans/ credit as “micr<strong>of</strong><strong>in</strong>ance” and<br />

sav<strong>in</strong>gs as only a means to gett<strong>in</strong>g the loans. This<br />

reflects <strong>in</strong>adequate knowledge among MFI clients,<br />

staff, management, board members and local<br />

leaders.<br />

Weak <strong>in</strong>ternal controls and management<br />

<strong>in</strong>formation systems (MIS) among the <strong>in</strong>stitutions,<br />

<strong>in</strong> some cases result<strong>in</strong>g <strong>in</strong>to fraud<br />

Community banks are weak, with little capital and<br />

not capable <strong>of</strong> attract<strong>in</strong>g <strong>in</strong>vestments, and yet they<br />

are licensed to take sav<strong>in</strong>gs from the public.<br />

Low outreach and weak l<strong>in</strong>kages with ma<strong>in</strong>stream<br />

f<strong>in</strong>ancial <strong>in</strong>stitutions<br />

Inadequate external f<strong>in</strong>ancial support <strong>of</strong> MFIs for<br />

fixed assets, <strong>in</strong>itial salaries and other<br />

establishment costs to effect rural branch<strong>in</strong>g out<br />

Limited fund<strong>in</strong>g for <strong>in</strong>novation, research and<br />

development, exacerbated by low capacity for<br />

product development among MFIs<br />

page 21