Footwear Industry Footwear Industry - empirica

Footwear Industry Footwear Industry - empirica

Footwear Industry Footwear Industry - empirica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Footwear</strong><br />

Survey findings also shown in Exhibit 5-3 indicate that footwear companies experience<br />

the main impact in operational improvements, in particular logistic flows along the value<br />

chain. Direct e-business impacts on the performance of the companies (e.g. revenue<br />

growth) and on savings (e.g. for procurement costs) are less pronounced, or at least<br />

more difficult to confirm by survey results and case studies. But this holds true for most of<br />

the sectors studied.<br />

Impact on organisation<br />

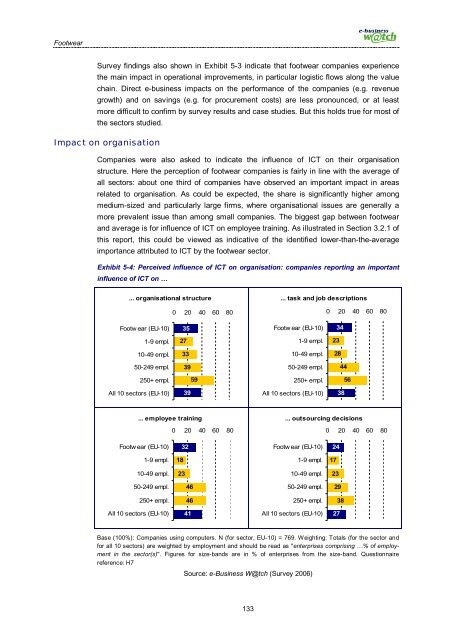

Companies were also asked to indicate the influence of ICT on their organisation<br />

structure. Here the perception of footwear companies is fairly in line with the average of<br />

all sectors: about one third of companies have observed an important impact in areas<br />

related to organisation. As could be expected, the share is significantly higher among<br />

medium-sized and particularly large firms, where organisational issues are generally a<br />

more prevalent issue than among small companies. The biggest gap between footwear<br />

and average is for influence of ICT on employee training. As illustrated in Section 3.2.1 of<br />

this report, this could be viewed as indicative of the identified lower-than-the-average<br />

importance attributed to ICT by the footwear sector.<br />

Exhibit 5-4: Perceived influence of ICT on organisation: companies reporting an important<br />

influence of ICT on …<br />

... organisational structure<br />

0 20 40 60 80<br />

... task and job descriptions<br />

0 20 40 60 80<br />

<strong>Footwear</strong> (EU-10)<br />

35<br />

<strong>Footwear</strong> (EU-10)<br />

34<br />

1-9 empl.<br />

27<br />

1-9 empl.<br />

23<br />

10-49 empl.<br />

33<br />

10-49 empl.<br />

28<br />

50-249 empl.<br />

39<br />

50-249 empl.<br />

44<br />

250+ empl.<br />

59<br />

250+ empl.<br />

56<br />

All 10 sectors (EU-10)<br />

39<br />

All 10 sectors (EU-10)<br />

38<br />

... employee training<br />

0 20 40 60 80<br />

... outsourcing decisions<br />

0 20 40 60 80<br />

<strong>Footwear</strong> (EU-10)<br />

32<br />

<strong>Footwear</strong> (EU-10)<br />

24<br />

1-9 empl.<br />

18<br />

1-9 empl.<br />

17<br />

10-49 empl.<br />

23<br />

10-49 empl.<br />

23<br />

50-249 empl.<br />

46<br />

50-249 empl.<br />

29<br />

250+ empl.<br />

46<br />

250+ empl.<br />

38<br />

All 10 sectors (EU-10)<br />

41<br />

All 10 sectors (EU-10)<br />

27<br />

Base (100%): Companies using computers. N (for sector, EU-10) = 769. Weighting: Totals (for the sector and<br />

for all 10 sectors) are weighted by employment and should be read as "enterprises comprising …% of employment<br />

in the sector(s)". Figures for size-bands are in % of enterprises from the size-band. Questionnaire<br />

reference: H7<br />

Source: e-Business W@tch (Survey 2006)<br />

133