Footwear Industry Footwear Industry - empirica

Footwear Industry Footwear Industry - empirica

Footwear Industry Footwear Industry - empirica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Footwear</strong><br />

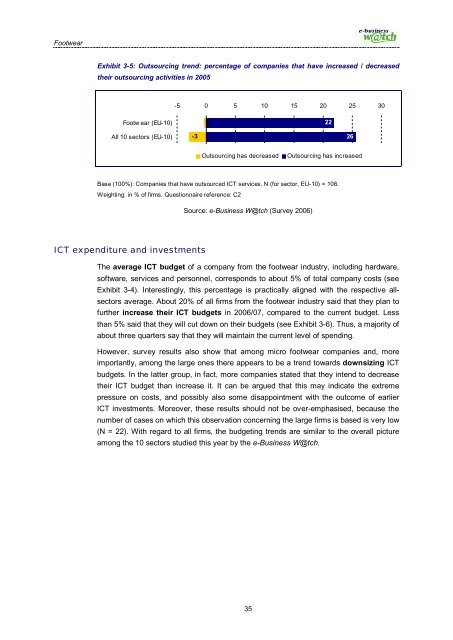

Exhibit 3-5: Outsourcing trend: percentage of companies that have increased / decreased<br />

their outsourcing activities in 2005<br />

-5 0 5 10 15 20 25 30<br />

<strong>Footwear</strong> (EU-10)<br />

0<br />

22<br />

All 10 sectors (EU-10)<br />

-3<br />

26<br />

Outsourcing has decreased<br />

Outsourcing has increased<br />

Base (100%): Companies that have outsourced ICT services. N (for sector, EU-10) = 108.<br />

Weighting: in % of firms. Questionnaire reference: C2<br />

Source: e-Business W@tch (Survey 2006)<br />

ICT expenditure and investments<br />

The average ICT budget of a company from the footwear industry, including hardware,<br />

software, services and personnel, corresponds to about 5% of total company costs (see<br />

Exhibit 3-4). Interestingly, this percentage is practically aligned with the respective allsectors<br />

average. About 20% of all firms from the footwear industry said that they plan to<br />

further increase their ICT budgets in 2006/07, compared to the current budget. Less<br />

than 5% said that they will cut down on their budgets (see Exhibit 3-6). Thus, a majority of<br />

about three quarters say that they will maintain the current level of spending.<br />

However, survey results also show that among micro footwear companies and, more<br />

importantly, among the large ones there appears to be a trend towards downsizing ICT<br />

budgets. In the latter group, in fact, more companies stated that they intend to decrease<br />

their ICT budget than increase it. It can be argued that this may indicate the extreme<br />

pressure on costs, and possibly also some disappointment with the outcome of earlier<br />

ICT investments. Moreover, these results should not be over-emphasised, because the<br />

number of cases on which this observation concerning the large firms is based is very low<br />

(N = 22). With regard to all firms, the budgeting trends are similar to the overall picture<br />

among the 10 sectors studied this year by the e-Business W@tch.<br />

35