Kewal Kiran Clothing Ltd (KEWKIR) - ICICI Direct

Kewal Kiran Clothing Ltd (KEWKIR) - ICICI Direct

Kewal Kiran Clothing Ltd (KEWKIR) - ICICI Direct

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Result Update<br />

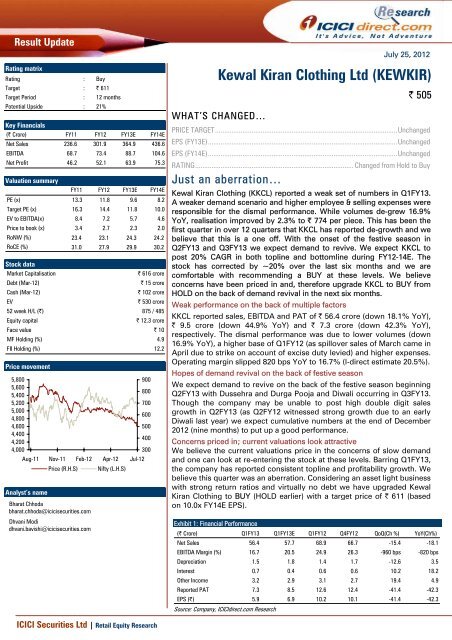

Rating matrix<br />

Rating : Buy<br />

Target : | 611<br />

Target Period : 12 months<br />

Potential Upside : 21%<br />

Key Financials<br />

(| Crore) FY11 FY12 FY13E FY14E<br />

Net Sales 236.6 301.9 364.9 436.6<br />

EBITDA 68.7 73.4 88.7 104.6<br />

Net Profit 46.2 52.1 63.9 75.3<br />

Valuation summary<br />

FY11 FY12 FY13E FY14E<br />

PE (x) 13.3 11.8 9.6 8.2<br />

Target PE (x) 16.3 14.4 11.8 10.0<br />

EV to EBITDA(x) 8.4 7.2 5.7 4.6<br />

Price to book (x) 3.4 2.7 2.3 2.0<br />

RoNW (%) 23.4 23.1 24.3 24.2<br />

RoCE (%) 31.0 27.9 29.9 30.2<br />

Stock data<br />

Market Capitalisation<br />

| 616 crore<br />

Debt (Mar-12)<br />

| 15 crore<br />

Cash (Mar-12)<br />

| 102 crore<br />

EV<br />

| 530 crore<br />

52 week H/L (|) 875 / 485<br />

Equity capital<br />

| 12.3 crore<br />

Face value | 10<br />

MF Holding (%) 4.9<br />

FII Holding (%) 12.2<br />

Price movement<br />

5,800<br />

5,600<br />

5,400<br />

5,200<br />

5,000<br />

4,800<br />

4,600<br />

4,400<br />

4,200<br />

4,000<br />

Aug-11<br />

Analyst’s name<br />

Nov-11<br />

Price (R.H.S)<br />

Feb-12<br />

Bharat Chhoda<br />

bharat.chhoda@icicisecurities.com<br />

Dhvani Modi<br />

dhvani.bavishi@icicisecurities.com<br />

Apr-12<br />

Nifty (L.H.S)<br />

Jul-12<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

WHAT’S CHANGED…<br />

July 25, 2012<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Ltd</strong> (<strong>KEWKIR</strong>)<br />

| 505<br />

PRICE TARGET....................................................................................................Unchanged<br />

EPS (FY13E)........................................................................................................Unchanged<br />

EPS (FY14E)........................................................................................................Unchanged<br />

RATING....................................................................................... Changed from Hold to Buy<br />

Just an aberration…<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> (KKCL) reported a weak set of numbers in Q1FY13.<br />

A weaker demand scenario and higher employee & selling expenses were<br />

responsible for the dismal performance. While volumes de-grew 16.9%<br />

YoY, realisation improved by 2.3% to | 774 per piece. This has been the<br />

first quarter in over 12 quarters that KKCL has reported de-growth and we<br />

believe that this is a one off. With the onset of the festive season in<br />

Q2FY13 and Q3FY13 we expect demand to revive. We expect KKCL to<br />

post 20% CAGR in both topline and bottomline during FY12-14E. The<br />

stock has corrected by ~20% over the last six months and we are<br />

comfortable with recommending a BUY at these levels. We believe<br />

concerns have been priced in and, therefore upgrade KKCL to BUY from<br />

HOLD on the back of demand revival in the next six months.<br />

Weak performance on the back of multiple factors<br />

KKCL reported sales, EBITDA and PAT of | 56.4 crore (down 18.1% YoY),<br />

| 9.5 crore (down 44.9% YoY) and | 7.3 crore (down 42.3% YoY),<br />

respectively. The dismal performance was due to lower volumes (down<br />

16.9% YoY), a higher base of Q1FY12 (as spillover sales of March came in<br />

April due to strike on account of excise duty levied) and higher expenses.<br />

Operating margin slipped 820 bps YoY to 16.7% (I-direct estimate 20.5%).<br />

Hopes of demand revival on the back of festive season<br />

We expect demand to revive on the back of the festive season beginning<br />

Q2FY13 with Dussehra and Durga Pooja and Diwali occurring in Q3FY13.<br />

Though the company may be unable to post high double digit sales<br />

growth in Q2FY13 (as Q2FY12 witnessed strong growth due to an early<br />

Diwali last year) we expect cumulative numbers at the end of December<br />

2012 (nine months) to put up a good performance.<br />

Concerns priced in; current valuations look attractive<br />

We believe the current valuations price in the concerns of slow demand<br />

and one can look at re-entering the stock at these levels. Barring Q1FY13,<br />

the company has reported consistent topline and profitability growth. We<br />

believe this quarter was an aberration. Considering an asset light business<br />

with strong return ratios and virtually no debt we have upgraded <strong>Kewal</strong><br />

<strong>Kiran</strong> <strong>Clothing</strong> to BUY (HOLD earlier) with a target price of | 611 (based<br />

on 10.0x FY14E EPS).<br />

Exhibit 1: Financial Performance<br />

(| Crore) Q1FY13 Q1FY13E Q1FY12 Q4FY12 QoQ(Ch %) YoY(Ch%)<br />

Net Sales 56.4 57.7 68.9 66.7 -15.4 -18.1<br />

EBITDA Margin (%) 16.7 20.5 24.9 26.3 -960 bps -820 bps<br />

Depreciation 1.5 1.8 1.4 1.7 -12.6 3.5<br />

Interest 0.7 0.4 0.6 0.6 10.2 18.2<br />

Other Income 3.2 2.9 3.1 2.7 19.4 4.9<br />

Reported PAT 7.3 8.5 12.6 12.4 -41.4 -42.3<br />

EPS (|) 5.9 6.9 10.2 10.1 -41.4 -42.3<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

<strong>ICICI</strong> Securities <strong>Ltd</strong> | Retail Equity Research

Exhibit 2: Assumption Sheet<br />

Particulars FY11 FY12 FY13E FY14E<br />

Volumes (Lakh pieces) 33.6 37.6 45.2 51.5<br />

Average realisation per piece (|) 685 750 770 800<br />

Average cost of woven fabric (|/metre) 125 170 175 180<br />

Average cost of knitted fabric (|/kg) 349 493 508 522<br />

Selling expenses as a % of sales (%) 11.1 11.0 12.0 11.5<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Q1FY13 Result Highlights<br />

• KKCL’s Q1FY13 sales de-grew 18.1% to | 56.4 crore. This degrowth<br />

was led by a dampened demand situation, which led to<br />

volume de-growth of 16.9% YoY to 6.85 lakh pieces (I-direct<br />

estimate: 7 lakh pieces). Realisation improved 2.3% YoY to | 774<br />

per piece<br />

• Operationally also, the performance was disappointing. The<br />

company reported an operating margin of 16.7% (down 820 bps<br />

YoY), lower than our estimate of 20.5%. Operating margins were<br />

dented due to higher employee costs and also higher promotional<br />

expenses incurred by the company<br />

• Consequently, PAT de-grew 42.3% YoY to | 7.3 crore, lower than<br />

our estimate of | 8.5 crore<br />

KKCL reported de-growth (18.1% YoY) in sales for the first<br />

time in over 12 quarters<br />

Exhibit 3: Topline growth trajectory<br />

| crore<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

-<br />

45.1<br />

72.5 63.0 54.7 68.9<br />

100.4<br />

64.2 66.7 56.4<br />

363.9<br />

435.3<br />

Q1FY11<br />

Q2FY11<br />

Q3FY11<br />

Q4FY11<br />

Q1FY12<br />

Q2FY12<br />

Q3FY12<br />

Q4FY12<br />

Q1FY13<br />

FY13E<br />

FY14E<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

<strong>ICICI</strong> Securities <strong>Ltd</strong> | Retail Equity Research Page 2

Garment volumes dipped 16.9% YoY and 23.5% QoQ on the<br />

Exhibit 4: Apparel volumes trend<br />

back of weaker demand....<br />

51.5<br />

49<br />

45.2<br />

Pieces (lakhs)<br />

38<br />

27<br />

16<br />

5<br />

.<br />

12.4<br />

8.2<br />

7.8 9.0 6.9<br />

Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 FY13E FY14E<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

…and realisations increased 2.3% YoY to | 774 per piece<br />

Exhibit 5: Apparel realisations trend<br />

820<br />

800<br />

780<br />

760<br />

|<br />

740<br />

720<br />

700<br />

680<br />

760<br />

744<br />

801 800<br />

774 770<br />

720<br />

660<br />

Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 FY13E FY14E<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Exhibit 6: EBITDA margin trend<br />

35.0<br />

30.0<br />

25.0<br />

20.0<br />

28.5<br />

30.6<br />

27.1<br />

29.2<br />

24.9 26.1<br />

18.6<br />

26.3<br />

16.7<br />

24.4 24.0<br />

%<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

Q1FY11<br />

Q2FY11<br />

Q3FY11<br />

Q4FY11<br />

Q1FY12<br />

Q2FY12<br />

Q3FY12<br />

Q4FY12<br />

Q1FY13<br />

FY13E<br />

FY14E<br />

EBITDA Margin (%)<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

<strong>ICICI</strong> Securities <strong>Ltd</strong> | Retail Equity Research Page 3

Sales de-growth and a strong dip in operating margins<br />

dented the bottomline performance<br />

Exhibit 7: Bottomline trend<br />

80.0<br />

75.3<br />

70.0<br />

63.9<br />

60.0<br />

50.0<br />

|crore<br />

40.0<br />

30.0<br />

20.0<br />

10.0<br />

8.8<br />

15.0<br />

11.3 11.1 12.6<br />

18.4<br />

8.8<br />

12.4<br />

7.3<br />

0.0<br />

Q1FY11<br />

Q2FY11<br />

Q3FY11<br />

Q4FY11<br />

Q1FY12<br />

Q2FY12<br />

Q3FY12<br />

Q4FY12<br />

Q1FY13<br />

FY13E<br />

FY14E<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Increased overall expenditure led to a weak operational<br />

performance. Sponsoring the Pune Warriors IPL team (for<br />

the second year) and a new ad film for Killer water saver<br />

jeans cost the company a sum of | 3.28 crore<br />

Exhibit 8: Cost analysis as percentage of sales<br />

Particulars Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13<br />

Raw Materal Cost 37.2 35.9 34.3 30.9 39.5 43.1 42.4 34.5<br />

Purchase of traded goods 0.7 2.1 4.7 9.0 3.9 3.0 3.0 4.6<br />

Manufacturing Expenses 7.1 7.8 7.1 7.4 8.5 8.2 7.1 9.1<br />

Administrative Expenses 3.7 4.1 4.2 4.1 3.1 4.1 5.1 5.1<br />

Employee Expenses 9.8 9.5 11.6 10.8 8.4 10.6 9.9 14.3<br />

Selling Expenses 11.2 13.8 9.3 13.3 10.9 12.9 6.7 16.3<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Exhibit 9: Store mix<br />

Particulars COCO # COMFO @ FOFO ^ Total<br />

K-Lounge 1 11 123 135<br />

K-Lounge for her 2 2<br />

Killer EBO 1 56 57<br />

LawmanPg3-EBO 2 10 12<br />

Integriti-EBO 43 43<br />

LawmanPg3 cum integriti-EBO 1 1<br />

Easies-EBO 1 1<br />

Addiction-EBO 2 2<br />

Factory outlet 5 5<br />

Total 1 19 238 258<br />

# COCO - Company owned Company operated<br />

@ COMFO - Company owned Management Franchisee operated<br />

^ FOFO- Franchisee owned Franchisee operated<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

During the quarter, the company made a net addition of six retail stores<br />

including three Killer Exclusive Brand Outlets (EBO), two Lawman Pg3<br />

EBOs and one Easies EBOs.<br />

<strong>ICICI</strong> Securities <strong>Ltd</strong> | Retail Equity Research Page 4

Valuation<br />

We believe current valuations price in the concerns of slow demand and<br />

one can look at re-entering the stock at these levels. Barring Q1FY13, the<br />

company has reported consistent topline and profitability growth and we<br />

believe this quarter was an aberration. Considering an asset light business<br />

with strong return ratios and virtually no debt we have upgraded <strong>Kewal</strong><br />

<strong>Kiran</strong> <strong>Clothing</strong> to BUY (HOLD earlier) with a target price of | 611 (based<br />

on 10.0x FY14E EPS).<br />

Exhibit 10: P/E band (One year forward)<br />

900<br />

750<br />

600<br />

450<br />

300<br />

150<br />

15x<br />

12x<br />

9x<br />

6x<br />

3x<br />

-<br />

Apr-05<br />

Oct-05<br />

Apr-06<br />

Oct-06<br />

Apr-07<br />

Oct-07<br />

Apr-08<br />

Oct-08<br />

Apr-09<br />

Oct-09<br />

Apr-10<br />

Oct-10<br />

Apr-11<br />

Oct-11<br />

Apr-12<br />

Avg. Price 3x 6x 9x 12x 15x<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

<strong>ICICI</strong> Securities <strong>Ltd</strong> | Retail Equity Research Page 5

Financial summary<br />

Profit and loss statement<br />

(| Crore)<br />

(Year-end March) FY11 FY12 FY13E FY14E<br />

Total operating Income 236.6 301.9 364.9 436.6<br />

Growth (%) 34.3 27.6 21.2 19.6<br />

Raw Material Expenses 89.8 130.9 148.6 180.3<br />

Employee Expenses 25.8 29.2 42.0 50.2<br />

Manufacturing Expenses 17.2 23.6 27.3 32.6<br />

Selling Expenses 26.2 32.9 43.8 50.2<br />

Other expenses 8.9 11.9 14.6 18.6<br />

Total Operating Expenditure 167.9 228.5 276.3 331.9<br />

EBITDA 68.7 73.4 88.7 104.6<br />

Growth (%) 47.2 6.8 20.9 18.0<br />

Depreciation 5.7 6.2 7.0 8.1<br />

Interest 2.1 2.6 1.7 1.7<br />

Other Income 8.3 11.8 15.5 17.5<br />

PBT 69.3 76.3 95.4 112.3<br />

Others - - - -<br />

Total Tax 23.0 24.2 31.5 37.0<br />

PAT 46.2 52.1 64.0 75.3<br />

Growth (%) 42.2 12.8 22.7 17.7<br />

EPS (|) 37.5 42.3 51.9 61.1<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Cash flow statement<br />

(| Crore)<br />

(Year-end March) FY11 FY12 FY13E FY14E<br />

Profit before Tax 69.3 76.3 95.4 112.3<br />

Add: Depreciation 5.7 6.2 7.0 8.1<br />

(Inc)/dec in Current Assets -21.2 -18.0 -22.2 -24.9<br />

Inc/(dec) in CL and Provisions 12.8 4.6 15.1 7.2<br />

Taxes paid -21.5 -24.4 -31.5 -37.0<br />

Others -6.2 -7.8 -1.3 1.1<br />

CF from operating activities 38.9 36.9 62.6 66.9<br />

(Inc)/dec in Investments -12.7 -10.4 -4.2 -4.8<br />

(Inc)/dec in Fixed Assets -5.1 -7.7 -7.7 -11.7<br />

Others 5.5 4.6 0.0 0.0<br />

CF from investing activities -12.3 -13.5 -11.9 -16.5<br />

Inc/(dec) in loan funds -10.2 9.2 -5.8 -1.3<br />

Dividend paid & dividend tax -18.0 -32.9 -26.0 -27.4<br />

Others -2.1 -2.1 -1.7 -1.7<br />

CF from financing activities -30.3 -25.8 -33.5 -30.4<br />

Net Cash flow -3.7 -2.4 17.2 20.0<br />

Investment in liquid funds 27.4 0.0 0.0 0.0<br />

Opening Cash 80.2 103.9 101.6 118.7<br />

Closing Cash 103.9 101.5 118.7 138.7<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Balance sheet<br />

(| Crore)<br />

(Year-end March) FY11 FY12 FY13E FY14E<br />

Liabilities<br />

Equity Capital 12.3 12.3 12.3 12.3<br />

Reserve and Surplus 185.4 213.2 251.2 299.2<br />

Total Shareholders funds 197.8 225.5 263.6 311.5<br />

Total Debt 5.6 14.9 9.1 7.9<br />

Deferred Tax Liability -1.6 -1.7 -1.8 -1.8<br />

Other long term liabilities 3.26 3.87 3.94 4.02<br />

Total Liabilities 204.9 242.6 274.9 321.5<br />

Assets<br />

Gross Block 67.3 74.5 79.8 91.7<br />

Less: Acc Depreciation 26.7 31.0 38.1 46.1<br />

Net Block 40.6 43.4 44.8 48.6<br />

Capital WIP 2.1 0.9 3.3 3.0<br />

Total Fixed Assets 42.7 44.3 48.0 51.6<br />

Investments 18.3 31.6 35.8 40.6<br />

Inventory 36.8 32.1 48.0 59.8<br />

Debtors 29.9 50.5 52.0 59.8<br />

Loans and Advances 14.7 15.2 20.0 25.2<br />

Other Current Assets 2.1 7.4 7.8 8.4<br />

Cash 103.9 101.5 118.7 138.7<br />

Total Current Assets 187.5 206.8 246.5 292.0<br />

Creditors 15.3 15.8 20.0 24.7<br />

Other current liabililites 7.5 10.1 10.2 11.2<br />

Provisions 22.4 15.1 26.0 27.4<br />

Total Current Liabilities 45.3 41.0 56.1 63.3<br />

Net Current Assets 142.2 165.8 190.4 228.6<br />

Others Non-current Assets 1.71 0.87 0.62 0.66<br />

Application of Funds 204.9 242.6 274.9 321.5<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Key ratios<br />

(Year-end March) FY11 FY12 FY13E FY14E<br />

Per share data (|)<br />

EPS 37.5 42.3 51.9 61.1<br />

Cash EPS 42.2 47.4 57.6 67.7<br />

BV 160.5 183.0 213.8 252.7<br />

DPS 16.5 17.0 18.0 19.0<br />

Cash Per Share 84.3 82.4 96.3 112.6<br />

Operating Ratios<br />

EBITDA Margin (%) 29.2 24.4 24.4 24.0<br />

PBT Margin (%) 29.4 25.4 26.2 25.8<br />

PAT Margin (%) 19.6 17.4 17.6 17.3<br />

Inventory days 56.9 36.1 48.0 50.0<br />

Debtor days 46.4 61.4 52.0 50.0<br />

Creditor days 62.3 44.0 49.0 50.0<br />

Return Ratios (%)<br />

RoE 23.4 23.1 24.3 24.2<br />

RoCE 31.0 27.9 29.9 30.2<br />

RoIC 53.3 42.7 50.2 51.0<br />

Valuation Ratios (x)<br />

P/E 13.3 11.8 9.6 8.2<br />

EV / EBITDA 8.4 7.2 5.7 4.6<br />

EV / Net Sales 2.4 1.8 1.4 1.1<br />

Market Cap / Sales 2.9 2.1 1.7 1.4<br />

Price to Book Value 3.4 2.7 2.3 2.0<br />

Solvency Ratios<br />

Debt/EBITDA 0.2 0.4 0.2 0.2<br />

Debt / Equity 0.0 0.1 0.0 0.0<br />

Current Ratio 8.2 8.0 8.2 8.1<br />

Quick Ratio 6.6 6.8 6.6 6.5<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

<strong>ICICI</strong> Securities <strong>Ltd</strong> | Retail Equity Research Page 6

<strong>ICICI</strong>direct.com coverage universe (Textiles)<br />

CMP<br />

M Cap EPS (|) P/E (x) EV/EBITDA (x)<br />

RoCE (%) RoE (%)<br />

Sector / Company<br />

(|) TP(|) Rating (| Cr) FY12 FY13E FY14E FY12 FY13E FY14E FY12 FY13E FY14E FY12 FY13E FY14E FY12 FY13E FY14E<br />

Alok Industries (ALOTEX) 17 21 Buy 1,350 4.6 6.1 8.2 3.6 2.8 2.1 4.5 4.5 3.9 12.6 12.0 12.9 10.4 12.7 15.5<br />

JBF Industries (JBFIND) 140 120 Sell 1,010 31.0 38.3 46.6 4.5 3.7 3.0 4.6 5.1 5.1 17.0 12.5 11.5 14.7 16.2 17.3<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> (<strong>KEWKIR</strong>) 500 611 Buy 616 42.3 51.9 61.1 11.8 9.6 8.2 7.2 5.7 4.6 27.9 29.9 30.2 23.1 24.3 24.2<br />

Lovable Lingerie (LOVLIN) 320 350 Hold 538 10.5 13.9 17.9 30.5 23.0 17.9 23.5 18.3 14.2 14.4 16.5 18.4 11.4 13.5 15.4<br />

Page Industries (PAGIND) 2,851 3,115 Hold 3,180 80.7 104.7 135.4 35.3 27.2 21.1 24.4 18.7 14.7 53.2 52.3 53.0 54.3 52.8 51.6<br />

Rupa & Company (RUPACO) 140 - Unrated 1,113 5.5 6.2 7.8 25.6 22.6 18.0 14.6 13.5 11.2 22.9 21.4 23.7 21.9 21.1 22.4<br />

Vardhman Texriles (MAHSPI) 240 229 Hold 1,527 22.6 29.3 38.2 10.6 8.2 6.3 6.4 4.4 4.1 7.7 8.9 9.8 7.2 8.8 10.7<br />

Exhibit 11: Recommendation History<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

Aug-11<br />

Sep-11<br />

Nov-11<br />

Dec-11<br />

Feb-12<br />

Mar-12<br />

May-12<br />

Jun-12<br />

Jul-12<br />

Price<br />

Target Price<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Exhibit 12: Recent Releases<br />

Date Event CMP Target Price Rating<br />

5-Oct-11 Q2FY12 Preview 776 531 SELL<br />

24-Oct-11 Q2FY12 Result Update 786 716 HOLD<br />

6-Jan-12 Q3FY12 Preview 710 716 HOLD<br />

23-Jan-12 Q3FY12 Result Update 637 588 HOLD<br />

4-Apr-12 Q4FY12 Preview 649 588 HOLD<br />

15-May-12 Q4FY12 Result Update 597 611 HOLD<br />

5-Jul-12 Q1FY13 Preview 563 611 HOLD<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Shareholding Pattern<br />

80<br />

(%)<br />

60<br />

40<br />

20<br />

0<br />

74.1<br />

74.1<br />

74.1<br />

74.1<br />

12.4<br />

4.1<br />

9.5<br />

12.1<br />

5.0<br />

8.8<br />

12.1<br />

5.0<br />

8.9<br />

12.2<br />

4.9<br />

Q2FY12 Q3FY12 Q4FY12 Q1FY13<br />

Promoters FIIs DIIs Public<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

8.8<br />

Exhibit 13: The road ahead<br />

500<br />

450<br />

51.9<br />

400<br />

350<br />

42.3<br />

37.5<br />

300<br />

| crore<br />

250<br />

437<br />

200<br />

365<br />

150<br />

302<br />

237 69 73<br />

89<br />

105<br />

100<br />

46 52 64 75<br />

50<br />

-<br />

FY11 FY12 FY13E FY14E<br />

Net Sales EBITDA Net Profit EPS (RHS)<br />

61.1<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

|<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

<strong>ICICI</strong> Securities <strong>Ltd</strong> | Retail Equity Research Page 7

RATING RATIONALE<br />

<strong>ICICI</strong>direct.com endeavours to provide objective opinions and recommendations. <strong>ICICI</strong>direct.com assigns<br />

ratings to its stocks according to their notional target price vs. current market price and then categorises them<br />

as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional<br />

target price is defined as the analysts' valuation for a stock.<br />

Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction;<br />

Buy: > 10%/ 15% for large caps/midcaps, respectively;<br />

Hold: Up to +/-10%;<br />

Sell: -10% or more;<br />

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com<br />

<strong>ICICI</strong>direct.com Research Desk,<br />

<strong>ICICI</strong> Securities Limited,<br />

1 st Floor, Akruti Trade Centre,<br />

Road No. 7, MIDC,<br />

Andheri (East)<br />

Mumbai – 400 093<br />

research@icicidirect.com<br />

ANALYST CERTIFICATION<br />

We /I, Bharat Chhoda MBA Dhvani Modi MBA research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our<br />

personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or<br />

view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the <strong>ICICI</strong> Securities Inc.<br />

Disclosures:<br />

<strong>ICICI</strong> Securities Limited (<strong>ICICI</strong> Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading<br />

underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of<br />

companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. <strong>ICICI</strong> Securities<br />

generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts<br />

cover.<br />

The information and opinions in this report have been prepared by <strong>ICICI</strong> Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and<br />

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without<br />

prior written consent of <strong>ICICI</strong> Securities. While we would endeavour to update the information herein on reasonable basis, <strong>ICICI</strong> Securities, its subsidiaries and associated companies, their directors and<br />

employees (“<strong>ICICI</strong> Securities and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent <strong>ICICI</strong> Securities<br />

from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or <strong>ICICI</strong> Securities<br />

policies, in circumstances where <strong>ICICI</strong> Securities is acting in an advisory capacity to this company, or in certain other circumstances.<br />

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This<br />

report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial<br />

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. <strong>ICICI</strong> Securities will not treat recipients as customers by virtue of their<br />

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific<br />

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment<br />

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate<br />

the investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. <strong>ICICI</strong> Securities and affiliates accept no liabilities for any<br />

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the<br />

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to<br />

change without notice.<br />

<strong>ICICI</strong> Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. <strong>ICICI</strong> Securities and affiliates might have received<br />

compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment<br />

banking or other advisory services in a merger or specific transaction. It is confirmed that Bharat Chhoda MBA Dhvani Modi MBA research analysts and the authors of this report have not received any<br />

compensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of <strong>ICICI</strong> Securities, which include earnings<br />

from Investment Banking and other business.<br />

<strong>ICICI</strong> Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the<br />

research report.<br />

It is confirmed that Bharat Chhoda MBA Dhvani Modi MBA research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member<br />

of the companies mentioned in the report.<br />

<strong>ICICI</strong> Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. <strong>ICICI</strong> Securities and affiliates may act upon or make use<br />

of information contained in the report prior to the publication thereof.<br />

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,<br />

publication, availability or use would be contrary to law, regulation or which would subject <strong>ICICI</strong> Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities<br />

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and<br />

to observe such restriction.<br />

<strong>ICICI</strong> Securities <strong>Ltd</strong> | Retail Equity Research Page 8