quarterly statement - TIAA-CREF

quarterly statement - TIAA-CREF

quarterly statement - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STATEMENT AS OF SEPTEMBER 30, 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICA<br />

NOTES TO FINANCIAL STATEMENTS<br />

The Company did not recognize any OTTI on securities it lacked the ability to retain.<br />

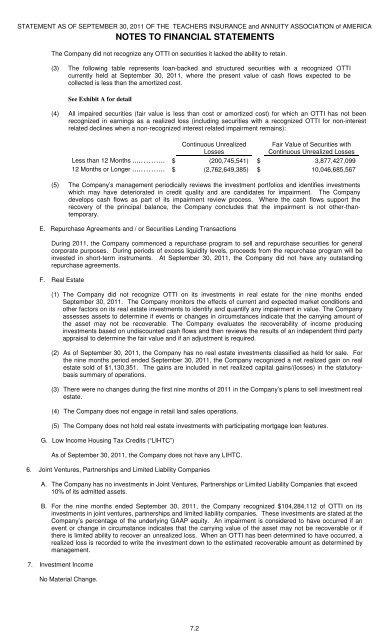

(3) The following table represents loan-backed and structured securities with a recognized OTTI<br />

currently held at September 30, 2011, where the present value of cash flows expected to be<br />

collected is less than the amortized cost.<br />

See Exhibit A for detail<br />

(4) All impaired securities (fair value is less than cost or amortized cost) for which an OTTI has not been<br />

recognized in earnings as a realized loss (including securities with a recognized OTTI for non-interest<br />

related declines when a non-recognized interest related impairment remains):<br />

Continuous Unrealized<br />

Losses<br />

Fair Value of Securities with<br />

Continuous Unrealized Losses<br />

Less than 12 Months .....……... $ (200,745,541) $ 3,877,427,099<br />

12 Months or Longer .....……... $ (2,762,649,385) $ 10,046,685,567<br />

(5) The Company’s management periodically reviews the investment portfolios and identifies investments<br />

which may have deteriorated in credit quality and are candidates for impairment. The Company<br />

develops cash flows as part of its impairment review process. Where the cash flows support the<br />

recovery of the principal balance, the Company concludes that the impairment is not other-thantemporary.<br />

E. Repurchase Agreements and / or Securities Lending Transactions<br />

During 2011, the Company commenced a repurchase program to sell and repurchase securities for general<br />

corporate purposes. During periods of excess liquidity levels, proceeds from the repurchase program will be<br />

invested in short-term instruments. At September 30, 2011, the Company did not have any outstanding<br />

repurchase agreements.<br />

F. Real Estate<br />

(1) The Company did not recognize OTTI on its investments in real estate for the nine months ended<br />

September 30, 2011. The Company monitors the effects of current and expected market conditions and<br />

other factors on its real estate investments to identify and quantify any impairment in value. The Company<br />

assesses assets to determine if events or changes in circumstances indicate that the carrying amount of<br />

the asset may not be recoverable. The Company evaluates the recoverability of income producing<br />

investments based on undiscounted cash flows and then reviews the results of an independent third party<br />

appraisal to determine the fair value and if an adjustment is required.<br />

(2) As of September 30, 2011, the Company has no real estate investments classified as held for sale. For<br />

the nine months period ended September 30, 2011, the Company recognized a net realized gain on real<br />

estate sold of $1,130,351. The gains are included in net realized capital gains/(losses) in the statutorybasis<br />

summary of operations.<br />

(3) There were no changes during the first nine months of 2011 in the Company’s plans to sell investment real<br />

estate.<br />

(4) The Company does not engage in retail land sales operations.<br />

(5) The Company does not hold real estate investments with participating mortgage loan features.<br />

G. Low Income Housing Tax Credits (“LIHTC”)<br />

As of September 30, 2011, the Company does not have any LIHTC.<br />

6. Joint Ventures, Partnerships and Limited Liability Companies<br />

A. The Company has no investments in Joint Ventures, Partnerships or Limited Liability Companies that exceed<br />

10% of its admitted assets.<br />

B. For the nine months ended September 30, 2011, the Company recognized $104,284,112 of OTTI on its<br />

investments in joint ventures, partnerships and limited liability companies. These investments are stated at the<br />

Company’s percentage of the underlying GAAP equity. An impairment is considered to have occurred if an<br />

event or change in circumstance indicates that the carrying value of the asset may not be recoverable or if<br />

there is limited ability to recover an unrealized loss. When an OTTI has been determined to have occurred, a<br />

realized loss is recorded to write the investment down to the estimated recoverable amount as determined by<br />

management.<br />

7. Investment Income<br />

No Material Change.<br />

7.2