quarterly statement - TIAA-CREF

quarterly statement - TIAA-CREF

quarterly statement - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

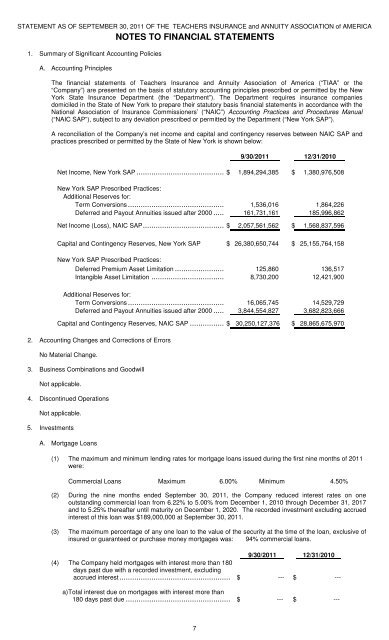

STATEMENT AS OF SEPTEMBER 30, 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICA<br />

1. Summary of Significant Accounting Policies<br />

A. Accounting Principles<br />

NOTES TO FINANCIAL STATEMENTS<br />

The financial <strong>statement</strong>s of Teachers Insurance and Annuity Association of America (“<strong>TIAA</strong>” or the<br />

“Company”) are presented on the basis of statutory accounting principles prescribed or permitted by the New<br />

York State Insurance Department (the “Department”). The Department requires insurance companies<br />

domiciled in the State of New York to prepare their statutory basis financial <strong>statement</strong>s in accordance with the<br />

National Association of Insurance Commissioners’ (“NAIC”) Accounting Practices and Procedures Manual<br />

(“NAIC SAP”), subject to any deviation prescribed or permitted by the Department (“New York SAP”).<br />

A reconciliation of the Company’s net income and capital and contingency reserves between NAIC SAP and<br />

practices prescribed or permitted by the State of New York is shown below:<br />

9/30/2011 12/31/2010<br />

Net Income, New York SAP ...........................................$ 1,894,294,385 $ 1,380,976,508<br />

New York SAP Prescribed Practices:<br />

Additional Reserves for:<br />

Term Conversions............................................... 1,536,016 1,864,226<br />

Deferred and Payout Annuities issued after 2000 ....... 161,731,161 185,996,862<br />

Net Income (Loss), NAIC SAP........................................$ 2,057,561,562 $ 1,568,837,596<br />

Capital and Contingency Reserves, New York SAP $ 26,380,650,744 $ 25,155,764,158<br />

New York SAP Prescribed Practices:<br />

Deferred Premium Asset Limitation ......................... 125,860 136,517<br />

Intangible Asset Limitation .................................... 8,730,200 12,421,900<br />

Additional Reserves for:<br />

Term Conversions............................................... 16,065,745 14,529,729<br />

Deferred and Payout Annuities issued after 2000 ....... 3,844,554,827 3,682,823,666<br />

Capital and Contingency Reserves, NAIC SAP ..................$ 30,250,127,376 $ 28,865,675,970<br />

2. Accounting Changes and Corrections of Errors<br />

No Material Change.<br />

3. Business Combinations and Goodwill<br />

Not applicable.<br />

4. Discontinued Operations<br />

Not applicable.<br />

5. Investments<br />

A. Mortgage Loans<br />

(1) The maximum and minimum lending rates for mortgage loans issued during the first nine months of 2011<br />

were:<br />

Commercial Loans Maximum 6.00 % Minimum 4.50%<br />

(2) During the nine months ended September 30, 2011, the Company reduced interest rates on one<br />

outstanding commercial loan from 6.22% to 5.00% from December 1, 2010 through December 31, 2017<br />

and to 5.25% thereafter until maturity on December 1, 2020. The recorded investment excluding accrued<br />

interest of this loan was $189,000,000 at September 30, 2011.<br />

(3) The maximum percentage of any one loan to the value of the security at the time of the loan, exclusive of<br />

insured or guaranteed or purchase money mortgages was: 94% commercial loans.<br />

9/30/2011 12/31/2010<br />

(4) The Company held mortgages with interest more than 180<br />

days past due with a recorded investment, excluding<br />

accrued interest.................................................... $ --- $ ---<br />

a) Total interest due on mortgages with interest more than<br />

180 days past due ................................................. $ --- $ ---<br />

7