quarterly statement - TIAA-CREF

quarterly statement - TIAA-CREF

quarterly statement - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STATEMENT AS OF SEPTEMBER 30, 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICA<br />

NOTES TO FINANCIAL STATEMENTS<br />

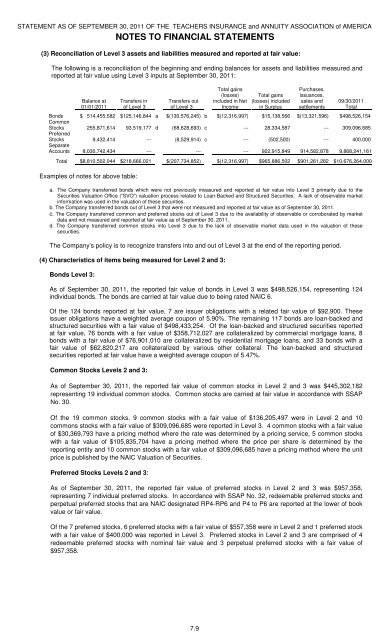

(3) Reconciliation of Level 3 assets and liabilities measured and reported at fair value:<br />

The following is a reconciliation of the beginning and ending balances for assets and liabilities measured and<br />

reported at fair value using Level 3 inputs at September 30, 2011:<br />

Balance at<br />

01/01/2011<br />

Transfers in<br />

of Level 3<br />

Transfers out<br />

of Level 3<br />

Total gains<br />

(losses)<br />

included in Net<br />

Income<br />

Total gains<br />

(losses) included<br />

in Surplus<br />

Purchases,<br />

issuances,<br />

sales and<br />

settlements<br />

09/30/2011<br />

Total<br />

Bonds $ 514,455,582 $125,146,844 a $(130,576,245) b $(12,316,997) $15,138,566 $(13,321,596) $498,526,154<br />

Common<br />

Stocks 255,871,614 93,519,177 d (68,628,693) c --- 28,334,587 --- 309,096,685<br />

Preferred<br />

Stocks 9,432,414 --- (8,529,914) c --- (502,500) --- 400,000<br />

Separate<br />

Accounts 8,030,742,434 --- --- --- 922,915,849 914,582,878 9,868,241,161<br />

Total $8,810,502,044 $218,666,021 $(207,734,852) $(12,316,997) $965,886,502 $901,261,282 $10,676,264,000<br />

Examples of notes for above table:<br />

a. The Company transferred bonds which were not previously measured and reported at fair value into Level 3 primarily due to the<br />

Securities Valuation Office (“SVO”) valuation process related to Loan-Backed and Structured Securities. A lack of observable market<br />

information was used in the valuation of these securities.<br />

b. The Company transferred bonds out of Level 3 that were not measured and reported at fair value as of September 30, 2011.<br />

c. The Company transferred common and preferred stocks out of Level 3 due to the availability of observable or corroborated by market<br />

data and not measured and reported at fair value as of September 30, 2011.<br />

d. The Company transferred common stocks into Level 3 due to the lack of observable market data used in the valuation of these<br />

securities.<br />

The Company’s policy is to recognize transfers into and out of Level 3 at the end of the reporting period.<br />

(4) Characteristics of items being measured for Level 2 and 3:<br />

Bonds Level 3:<br />

As of September 30, 2011, the reported fair value of bonds in Level 3 was $498,526,154, representing 124<br />

individual bonds. The bonds are carried at fair value due to being rated NAIC 6.<br />

Of the 124 bonds reported at fair value, 7 are issuer obligations with a related fair value of $92,900. These<br />

issuer obligations have a weighted average coupon of 5.90%. The remaining 117 bonds are loan-backed and<br />

structured securities with a fair value of $498,433,254. Of the loan-backed and structured securities reported<br />

at fair value, 76 bonds with a fair value of $358,712,027 are collateralized by commercial mortgage loans, 8<br />

bonds with a fair value of $76,901,010 are collateralized by residential mortgage loans, and 33 bonds with a<br />

fair value of $62,820,217 are collateralized by various other collateral. The loan-backed and structured<br />

securities reported at fair value have a weighted average coupon of 5.47%.<br />

Common Stocks Levels 2 and 3:<br />

As of September 30, 2011, the reported fair value of common stocks in Level 2 and 3 was $445,302,182<br />

representing 19 individual common stocks. Common stocks are carried at fair value in accordance with SSAP<br />

No. 30.<br />

Of the 19 common stocks, 9 common stocks with a fair value of $136,205,497 were in Level 2 and 10<br />

commons stocks with a fair value of $309,096,685 were reported in Level 3. 4 common stocks with a fair value<br />

of $30,369,793 have a pricing method where the rate was determined by a pricing service, 5 common stocks<br />

with a fair value of $105,835,704 have a pricing method where the price per share is determined by the<br />

reporting entity and 10 common stocks with a fair value of $309,096,685 have a pricing method where the unit<br />

price is published by the NAIC Valuation of Securities.<br />

Preferred Stocks Levels 2 and 3:<br />

As of September 30, 2011, the reported fair value of preferred stocks in Level 2 and 3 was $957,358,<br />

representing 7 individual preferred stocks. In accordance with SSAP No. 32, redeemable preferred stocks and<br />

perpetual preferred stocks that are NAIC designated RP4-RP6 and P4 to P6 are reported at the lower of book<br />

value or fair value.<br />

Of the 7 preferred stocks, 6 preferred stocks with a fair value of $557,358 were in Level 2 and 1 preferred stock<br />

with a fair value of $400,000 was reported in Level 3. Preferred stocks in Level 2 and 3 are comprised of 4<br />

redeemable preferred stocks with nominal fair value and 3 perpetual preferred stocks with a fair value of<br />

$957,358.<br />

7.9