quarterly statement - TIAA-CREF

quarterly statement - TIAA-CREF

quarterly statement - TIAA-CREF

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STATEMENT AS OF SEPTEMBER 30, 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICA<br />

Level 1 financial instruments<br />

NOTES TO FINANCIAL STATEMENTS<br />

Unadjusted quoted prices for these securities are provided to the Company by independent pricing services.<br />

Common stock and separate account assets in Level 1 primarily include mutual fund investments valued by the<br />

respective mutual fund companies and exchange listed equities.<br />

Level 2 financial instruments<br />

Common stocks and preferred stocks included in Level 2 include those which are traded in an inactive market or<br />

for which prices for identical securities are not available.<br />

Derivative assets and liabilities classified in Level 2 represent over-the-counter instruments that include, but are<br />

not limited to, fair value hedges using foreign currency swaps, foreign currency forwards, interest rate swaps and<br />

credit default swaps. Fair values for these instruments are determined internally using market observable inputs<br />

that include, but are not limited to, forward currency rates, interest rates, credit default rates and published<br />

observable market indices.<br />

Separate account assets in Level 2 consist principally of short term government agency notes and commercial<br />

paper. Preferred stocks in Level 2 are those carried on a lower of cost or market basis using daily trade prices<br />

based on prices for similar securities observable in the market.<br />

Fair values and changes in the fair value of separate account assets generally accrue directly to the policyholders,<br />

except for the accumulation units purchased by <strong>TIAA</strong> and thus there is no net impact to the Company’s revenues<br />

and expenses or surplus.<br />

Level 3 financial instruments<br />

Bonds classified as Level 3 include asset-backed securities that were manually priced.<br />

Typical inputs to models used by independent pricing services include but are not limited to benchmark yields,<br />

reported trades, broker-dealer quotes, issuer spreads, benchmark securities, bids, offers, reference data, and<br />

industry and economic events. Because most bonds and preferred stocks do not trade daily, independent pricing<br />

services regularly derive fair values using recent trades of securities with similar features. When recent trades are<br />

not available, pricing models are used to estimate the fair values of securities by discounting future cash flows at<br />

estimated market interest rates.<br />

If an independent pricing service is unable to provide the fair value for a security due to insufficient market<br />

information, such as for a private placement transaction, the Company will determine the fair value internally using<br />

a matrix pricing model. This model estimates fair value using discounted cash flows at a market yield considering<br />

the appropriate treasury rate plus a spread. The spread is derived by reference to similar securities, and may be<br />

adjusted based on specific characteristics of the security, including inputs that are not readily observable in the<br />

market. The Company assesses the significance of unobservable inputs for each security priced internally and<br />

classifies that security in Level 3 as a result of the significance of unobservable inputs.<br />

Separate account assets classified as Level 3 primarily include directly owned real estate properties, real estate<br />

joint ventures and real estate limited partnerships. Directly owned real estate properties are valued on a <strong>quarterly</strong><br />

basis based on independent third party appraisals. Real estate joint venture interests are valued based on the fair<br />

value of the underlying real estate, any related mortgage loans payable and other factors such as ownership<br />

percentage, ownership rights, buy/sell agreements, distribution provisions and capital call obligations. Real estate<br />

limited partnership interests are valued based on the most recent net asset value of the partnership.<br />

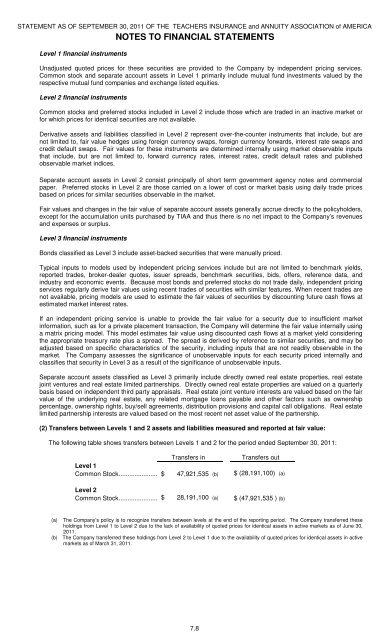

(2) Transfers between Levels 1 and 2 assets and liabilities measured and reported at fair value:<br />

The following table shows transfers between Levels 1 and 2 for the period ended September 30, 2011:<br />

Transfers in<br />

Transfers out<br />

Level 1<br />

Common Stock...................... $ 47,921,535 (b) $ (28,191,100) (a)<br />

Level 2<br />

Common Stock.........................$ 28,191,100 (a) $ (47,921,535 ) (b)<br />

(a) The Company’s policy is to recognize transfers between levels at the end of the reporting period. The Company transferred these<br />

holdings from Level 1 to Level 2 due to the lack of availability of quoted prices for identical assets in active markets as of June 30,<br />

2011.<br />

(b) The Company transferred these holdings from Level 2 to Level 1 due to the availability of quoted prices for identical assets in active<br />

markets as of March 31, 2011.<br />

7.8