quarterly statement - TIAA-CREF

quarterly statement - TIAA-CREF

quarterly statement - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STATEMENT AS OF SEPTEMBER 30, 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICA<br />

NOTES TO FINANCIAL STATEMENTS<br />

B. The Company writes (sells) credit default swaps providing default protection to the buyer as part of a<br />

replication strategy. Additionally, the Company pays a premium to counterparties for default protection to<br />

hedge the risk of a negative credit event on selective investments in the Company’s portfolio. These swap<br />

contracts are entered into as fair value hedges.<br />

C. The carrying value of credit default swaps represents the premium received for selling the default protection<br />

amortized into investment income over the life of the swap. When the Company purchases credit default swap<br />

protection, the premium payment to the counterparty is expensed. Credit default swaps for which hedge<br />

accounting is not applied are carried at fair value. The changes in the carrying value of such credit default<br />

swap contracts are recognized at the end of the period as unrealized gains or losses.<br />

D. For the nine months ended September 30, 2011, the net unrealized gain from credit default swap contracts<br />

that do not qualify for hedge accounting treatment was $59,688,793<br />

9. Federal Income Tax<br />

No Material Change.<br />

10. Information Concerning Parent, Subsidiaries and Affiliates<br />

D. As of September 30, 2011 and December 31, 2010, the net amount due from subsidiaries and affiliates was<br />

$18,663,970 and $30,990,390, respectively. The net amounts due are generally settled on a daily basis<br />

except for <strong>TIAA</strong> Realty, Inc., ND Properties, Inc., Teachers Advisors, Inc. (“Advisors”), <strong>TIAA</strong>-<strong>CREF</strong> Tuition<br />

Financing, Inc. (“TFI”), Teachers Personal Investors Services, Inc. (“TPIS”), <strong>TIAA</strong>-<strong>CREF</strong> Individual and<br />

Institutional Services, LLC (“Services”), and <strong>TIAA</strong>-<strong>CREF</strong> Enterprises, Inc. which are settled <strong>quarterly</strong>.<br />

J. For the nine months ended September 30, 2011, the Company recognized $62,603,013 in OTTI for<br />

investments in subsidiary, controlled and affiliated companies. These impairments relate to a decline in the<br />

equity value and the impairment of the goodwill of subsidiaries for which the carrying value is not expected to<br />

recover.<br />

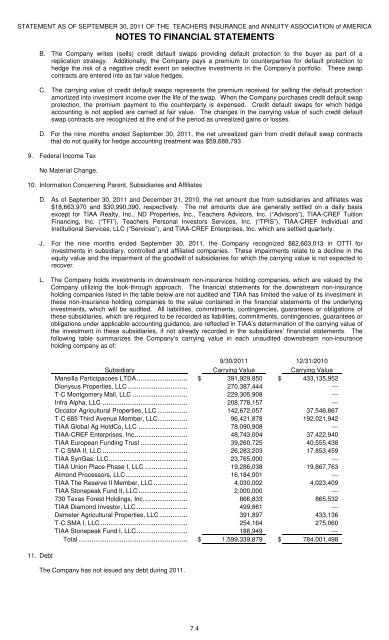

L. The Company holds investments in downstream non-insurance holding companies, which are valued by the<br />

Company utilizing the look-through approach. The financial <strong>statement</strong>s for the downstream non-insurance<br />

holding companies listed in the table below are not audited and <strong>TIAA</strong> has limited the value of its investment in<br />

these non-insurance holding companies to the value contained in the financial <strong>statement</strong>s of the underlying<br />

investments, which will be audited. All liabilities, commitments, contingencies, guarantees or obligations of<br />

these subsidiaries, which are required to be recorded as liabilities, commitments, contingencies, guarantees or<br />

obligations under applicable accounting guidance, are reflected in <strong>TIAA</strong>’s determination of the carrying value of<br />

the investment in these subsidiaries, if not already recorded in the subsidiaries’ financial <strong>statement</strong>s. The<br />

following table summarizes the Company’s carrying value in each unaudited downstream non-insurance<br />

holding company as of:<br />

11. Debt<br />

9/30/2011 12/31/2010<br />

Subsidiary Carrying Value Carrying Value<br />

Mansilla Participacoes LTDA.......................... $ 391,929,850 $ 433,135,952<br />

Dionysus Properties, LLC .............................. 270,387,444 ---<br />

T-C Montgomery Mall, LLC ............................ 229,305,908 ---<br />

Infra Alpha, LLC .......................................... 208,778,157 ---<br />

Occator Agricultural Properties, LLC ................ 142,672,057 37,546,867<br />

T-C 685 Third Avenue Member, LLC................ 96,421,878 192,021,942<br />

<strong>TIAA</strong> Global Ag HoldCo, LLC ......................... 78,090,908 ---<br />

<strong>TIAA</strong>-<strong>CREF</strong> Enterprises, Inc........................... 48,743,004 37,422,940<br />

<strong>TIAA</strong> European Funding Trust ........................ 39,260,725 40,555,438<br />

T-C SMA II, LLC.......................................... 26,283,203 17,853,459<br />

<strong>TIAA</strong> SynGas, LLC....................................... 23,765,000 ---<br />

<strong>TIAA</strong> Union Place Phase I, LLC ...................... 19,286,038 19,867,763<br />

Almond Processors, LLC............................... 16,184,001 ---<br />

<strong>TIAA</strong> The Reserve II Member, LLC.................. 4,030,002 4,023,409<br />

<strong>TIAA</strong> Stonepeak Fund II, LLC......................... 2,000,000 ---<br />

730 Texas Forest Holdings, Inc....................... 866,833 865,532<br />

<strong>TIAA</strong> Diamond Investor, LLC.......................... 499,861 ---<br />

Demeter Agricultural Properties, LLC ............... 391,897 433,136<br />

T-C SMA I, LLC........................................... 254,164 275,060<br />

<strong>TIAA</strong> Stonepeak Fund I, LLC.......................... 188,949 ---<br />

Total ..................................................... $ 1,599,339,879 $ 784,001,498<br />

The Company has not issued any debt during 2011.<br />

7.4