Annual Report 2011 - Fai

Annual Report 2011 - Fai

Annual Report 2011 - Fai

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

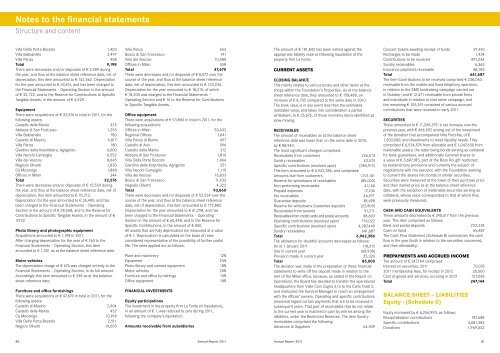

Notes to the financial statements<br />

Structure and content<br />

Villa Della Porta Bozzolo 1,403<br />

Villa Balbianello 2,497<br />

Villa Panza 408<br />

Total 9,198<br />

There were decreases and/or disposals of € 2,989 during<br />

the year, and thus at the balance sheet reference date, net of<br />

depreciation, this item amounted to € 142,562. Depreciation<br />

for the year amounted to € 37,651, and has been charged to<br />

the Financial Statements – Operating Section in the amount<br />

of € 32,722, and to the Reserve for Contributions to Specific<br />

Tangible Assets, in the amount of € 4,929.<br />

Equipment<br />

There were acquisitions of € 32,576 in total in <strong>2011</strong>, for the<br />

following assets:<br />

Castello della Manta 325<br />

Abbazia di San Fruttuoso 1,255<br />

Villa Balbianello 780<br />

Castello di Masino 4,817<br />

Villa Panza 180<br />

Giardino della Kolymbetra, Agrigento 6,000<br />

Villa Necchi Campiglio 6,552<br />

Villa dei Vescovi 8,645<br />

Negozio Olivetti 1,830<br />

Cà Mocenigo 1,848<br />

Offices in Milan 344<br />

Total 32,576<br />

There were decreases and/or disposals of € 15,554 during<br />

the year, and thus at the balance sheet reference date, net of<br />

depreciation, this item amounted to € 70,713.<br />

Depreciation for the year amounted to € 36,490, and has<br />

been charged to the Financial Statements – Operating<br />

Section in the amount of € 28,568, and to the Reserve for<br />

Contributions to Specific Tangible Assets, in the amount of €<br />

7,922.<br />

Photo library and photographic equipment<br />

Acquisitions amounted to € 1,198 in <strong>2011</strong>.<br />

After charging depreciation for the year of € 160 to the<br />

Financial Statements – Operating Section, this item<br />

amounted to € 1,301 as at the balance sheet reference date.<br />

Motor vehicles<br />

The depreciation charge of € 676 was charged entirely to the<br />

Financial Statements – Operating Section, in its full amount.<br />

Accordingly this item amounted to € 338 as at the balance<br />

sheet reference date.<br />

Furniture and office furnishings<br />

There were acquisitions of € 47,670 in total in <strong>2011</strong>, for the<br />

following assets:<br />

Castello di Masino 2,904<br />

Castello della Manta 452<br />

Cà Mocenigo 10,918<br />

Villa Della Porta Bozzolo 2,511<br />

Negozo Olivetti 19,003<br />

Villa Panza 653<br />

Bosco di San Francesco 191<br />

Villa dei Vescovi 10,480<br />

Offices in Milan 558<br />

Total 47,670<br />

There were decreases and/or disposals of € 8,072 over the<br />

course of the year, and thus at the balance sheet reference<br />

date, net of depreciation, this item amounted to € 123,236.<br />

Depreciation for the year amounted to € 18,215, of which<br />

€ 18,205 was charged to the Financial Statements –<br />

Operating Section and € 10 to the Reserve for Contributions<br />

to Specific Tangible Assets.<br />

Office equipment<br />

There were acquisitions of € 93,860 in total in <strong>2011</strong>, for the<br />

following acquisitions:<br />

Offices in Milan 53,432<br />

Regional Offices 1,041<br />

Villa Panza di Biumo 457<br />

Castello di Avio 996<br />

Castello della Manta 212<br />

Abbazia di San Fruttuoso 1,810<br />

Villa Della Porta Bozzolo 1,464<br />

Giardino della Kolymbetra, Agrigento 251<br />

Villa Necchi Campiglio 1,110<br />

Villa dei Vescovi 16,833<br />

Bosco di San Francesco 11,932<br />

Negozio Olivetti 4,322<br />

Total 93,860<br />

There were decreases and/or disposals of € 52,569 over the<br />

course of the year, and thus at the balance sheet reference<br />

date, net of depreciation, this item amounted to € 172,882.<br />

Depreciation for the year amounted to € 61,298, and has<br />

been charged to the Financial Statements – Operating<br />

Section in the amount of € 60,448, and to the Reserve for<br />

Specific Contributions, in the amount of € 850.<br />

All assets that are fully depreciated are measured at a value<br />

of € 1. Depreciation is calculated on the basis of rates<br />

considered representative of the possibility of further useful<br />

life. The rates applied are as follows:<br />

Plant and machinery 12%<br />

Equipment 25%<br />

Photo library and camera equipment 18%<br />

Motor vehicles 20%<br />

Furniture and office furnishings 10%<br />

Office equipment 18%<br />

FINANCIAL INVESTMENTS<br />

Equity participations<br />

The investment in the property firm La Fonte (in liquidation),<br />

in an amount of € 1, was reduced to zero during <strong>2011</strong>,<br />

following the company’s liquidation.<br />

Amounts receivable from subsidiaries<br />

The amount of € 181,842 has been netted against the<br />

appropriate liability reserve following liquidation of the<br />

property firm La Fonte.<br />

CURRENT ASSETS<br />

CLOSING BALANCE<br />

This mainly relates to various books and other items at the<br />

shops within the Foundation’s Properties. As at the balance<br />

sheet reference date, they amounted to € 158,488, an<br />

increase of € 8,705 compared to the same date in 2010.<br />

The book value is in any event less than the estimated<br />

realizable value, and takes into consideration a partial<br />

writedown, to € 35,676, of those inventory items identified as<br />

slow-moving.<br />

RECEIVABLES<br />

The amount of receivables as at the balance sheet<br />

reference date was lower than on the same date in 2010,<br />

by € 88,943.<br />

The most significant changes comprised:<br />

Receivables from customers 226,014<br />

Sundry receivables 43,574<br />

Specific contributions (resolved upon) (380,912)<br />

This item amounted to € 6,942,386, and comprised:<br />

Amounts due from customers 1,101,161<br />

Reserve for writedowns of receivables (85,000)<br />

Non-performing receivables 41,160<br />

Prepaid expenses 17,236<br />

Tax receivables 46,971<br />

Guarantee deposits 38,698<br />

Reserve for writedowns Guarantee deposits (22,803)<br />

Receivables from tenants 91,211<br />

Receivables from credit cards and postal accounts 68,603<br />

Operating contributions (resolved upon) 716,022<br />

Specific contributions (resolved upon) 4,287,440<br />

Sundry receivables 641,687<br />

Total 6,942,386<br />

The allowance for doubtful accounts decreased as follows:<br />

As at 1 January <strong>2011</strong> 118,612<br />

Use in current year (68,938)<br />

Provision made in current year 35,326<br />

Total 85,000<br />

The decision was made in the preparation of these financial<br />

statements to write off the deposit made in relation to the<br />

rent of the Milan office, because, as stated in the <strong>Report</strong> on<br />

Operations, the Board has decided to transfer the operational<br />

headquarters from Viale Coni Zugna 5/a to Via Carlo Foldi 2,<br />

and instructed the General Manager to reach an arrangement<br />

with the offices’ owners. Operating and specific contributions<br />

(resolved) regard certain payments that are to be received in<br />

subsequent years. That part of receivables that do not relate<br />

to the current year is matched in part by entries among the<br />

liabilities, under the Restricted Reserves. The item Sundry<br />

receivables comprised the following:<br />

Advances to Suppliers 64,509<br />

Concert tickets awaiting receipt of funds 29,410<br />

Recharges to be made 1,424<br />

Contributions to be received 491,234<br />

Sundry receivables 6,365<br />

Insurance payments receivable 48,745<br />

Total 641,687<br />

The item Contributions to be received comprised € 238,063<br />

receivable from the mobile and fixed telephony operators,<br />

in relation to the SMS fundraising campaign carried out<br />

in October; and € 12,471 receivable from private firms<br />

and individuals in relation to that same campaign; and<br />

the remaining € 105,515 consisted of various accrued<br />

contributions that were received in early <strong>2011</strong>.<br />

SECURITIES<br />

These amounted to € 11,269,379, a net increase over the<br />

previous year, with € 466,592 arising out of the investment<br />

of the donation that accompanied Villa Flecchia, of €<br />

1,500,000; and divestments to meet liquidity needs. They<br />

comprised € 6,534,574 from alienable and € 1,047,630 from<br />

inalienable assets, the latter being bonds serving as collateral<br />

for bank guarantees, and additionally Generali shares to<br />

a value of € 3,687,185, part of the Boso Roi gift restricted<br />

by testamentary provisions and currently the subject of<br />

negotiations with the executor, with the Foundation seeking<br />

to convert the shares into bonds or similar securities.<br />

Securities were measured at the lower of their purchase price<br />

and their market price as at the balance sheet reference<br />

date, with the exception of inalienable securities serving as<br />

collateral, whose value corresponded to that at which they<br />

were previously measured.<br />

CASH AND CASH EQUIVALENTS<br />

These amounts decreased by € 240,617 from the previous<br />

year. This item comprised as follows:<br />

Bank and postal deposits 222,224<br />

Cash on hand 65,487<br />

The Cash Flow Statement (Schedule B) summarizes the cash<br />

flow in the year (both in relation to the securities concerned,<br />

and their alienability).<br />

PREPAYMENTS AND ACCRUED INCOME<br />

The amount of € 247,144 comprised:<br />

Interest on securities, <strong>2011</strong> 70,076<br />

<strong>2011</strong> membership fees, for receipt in 2012 20,000<br />

Cost of goods and services, accruing in 2012 157,068<br />

Total 247,144<br />

BALANCE SHEET – LIABILITIES<br />

Equity - (Schedule C)<br />

Equity increased by € 6,256,993, as follows:<br />

Recapitalisation contributions 747,688<br />

Specific contributions 4,081,384<br />

Donations 1,969,043<br />

80 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 81