Annual Report 2011 - Fai

Annual Report 2011 - Fai

Annual Report 2011 - Fai

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

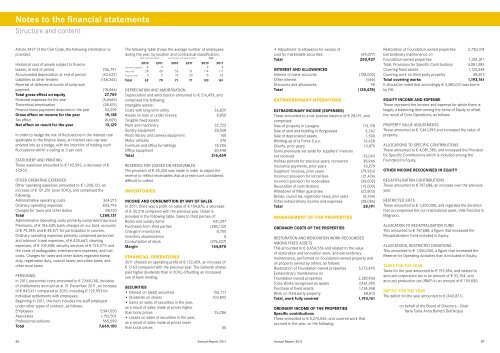

Notes to the financial statements<br />

Structure and content<br />

Article 2427 of the Civil Code, the following information is<br />

provided:<br />

Historical cost of assets subject to finance<br />

leases, at end of period 236,791<br />

Accumulated depreciation at end of period (42,622)<br />

Liabilities to other lenders (148,344)<br />

Reversal of deferred amounts of lump-sum<br />

payment (18,066)<br />

Total gross effect on equity 27,759<br />

Financial expenses for the year (5,6565)<br />

Theoretical amortisation (28,415)<br />

Finance lease payments deducted in the year 53,209<br />

Gross effect on income for the year 19,138<br />

Tax effect (6,009)<br />

Net effect on result for the year 13,129<br />

In order to hedge the risk of fluctuations in the interest rate<br />

applicable to the finance lease, an interest rate cap was<br />

entered into as a hedge, with the intention of holding such<br />

fluctuations within a ceiling at 3 per cent.<br />

STATIONERY AND PRINTING<br />

These expenses amounted to € 142,593, a decrease of €<br />

67,860.<br />

OTHER OPERATING EXPENSES<br />

Other operating expenses amounted to € 1,268,131, an<br />

increase of € 121,251 [over 2010], and comprised the<br />

following:<br />

Administrative operating costs 364,215<br />

Ordinary operating expenses 833,796<br />

Charges for taxes and other duties 88,120<br />

Total 1,268,131<br />

Administrative Operating costs primarily comprised Insurance<br />

Premiums, of € 186,439; bank charges on our bank accounts<br />

of € 79,248; and € 48,571 for participation in courses.<br />

Ordinary operating expenses primarily comprised personnel<br />

and advisors’ travel expenses, of € 435,667; cleaning<br />

expenses, of € 109,008; security services of € 125,277; and<br />

the costs of audioguides, entertainment expenses, and fuel<br />

costs. Charges for taxes and other duties regarded stamp<br />

duty, registration duty, council taxes, securities taxes, and<br />

other local taxes.<br />

PERSONNEL<br />

In <strong>2011</strong>, personnel costs amounted to € 7,669,150, inclusive<br />

of entitlements accrued as at 31 December <strong>2011</strong>, an increase<br />

of € 843,411 compared to 2010, including € 129,953 for<br />

individual settlements with employees.<br />

Beginning in <strong>2011</strong>, this item includes the staff employed<br />

under other types of contract, as follows:<br />

Employees 5,947,050<br />

Associates 1,156,501<br />

Professional advisors 565,599<br />

Total 7,669,150<br />

The following table shows the average number of employees<br />

during the year, by location and contractual classification.<br />

Milan and Rome offices At Properties, and regional offices Total<br />

2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong><br />

Executive employees 4 4 4 4<br />

Office staff 58 60 56 51 114 111<br />

Temporary staff 0 6 15 20 15 26<br />

Total 62 70 71 71 133 141<br />

DEPRECIATION AND AMORTISATION<br />

Depreciation and amortization amounted to € 216,459, and<br />

comprised the following:<br />

Intangible assets:<br />

Costs with long-term utility 66,829<br />

Assets on loan or under licence 8,850<br />

Tangible fixed assets<br />

Plant and machinery 32,722<br />

Sundry equipment 28,568<br />

Photo library and camera equipment 160<br />

Motor vehicles 676<br />

Furniture and office furnishings 18,206<br />

Office equipment 60,448<br />

Total 216,459<br />

RESERVES FOR LOSSES ON RECEIVABLES<br />

The provision of € 35,326 was made in order to adjust the<br />

reserve to reflect receivables that at present are considered<br />

difficult to collect.<br />

INVENTORIES<br />

INCOME AND CONSUMPTION BY WAY OF SALES<br />

In <strong>2011</strong>, there was a profit on sales of € 154,870, a decrease<br />

of € 30,218 compared with the previous year. Detail is<br />

provided in the following table. Sales to third parties of:<br />

Books and sundry items 431,297<br />

Purchases from third parties (285,132)<br />

Change in inventories 8,705<br />

Inventory obsolescence 0<br />

Consumption of stock (276,427)<br />

Margin 154,870<br />

FINANCIAL OPERATIONS<br />

<strong>2011</strong> showed an operating profit of € 122,459, an increase of<br />

€ 7,163 compared with the previous year. The Generali shares<br />

paid higher dividends than in 2010, offsetting an increased<br />

use of bank lending.<br />

SECURITIES<br />

• Interest on [debt] securities 150,717<br />

• Dividends on shares 103,892<br />

• Gains on sales of securities in the year,<br />

as a result of sales made at prices higher<br />

than book prices 26,286<br />

• Losses on sales of securities in the year,<br />

as a result of sales made at prices lower<br />

than book prices (0)<br />

• Adjustment to allowance for excess of<br />

cost for marketable securities (69,077)<br />

Total 250,937<br />

INTEREST AND ALLOWANCES<br />

Interest on bank accounts (128,002)<br />

Other interest (566)<br />

Discounts and allowances 90<br />

Total (128,478)<br />

EXTRAORDINARY OPERATIONS<br />

EXTRAORDINARY INCOME (EXPENSES)<br />

These amounted to a net positive balance of € 28,191, and<br />

comprised:<br />

Sale of property in Lavagna 113,178<br />

Sale of land and building in Borgosesia 5,262<br />

Sale of depreciated assets 1,500<br />

Winding-up of la Fonte S.a.s. 16,628<br />

Clients, prior years 10,875<br />

Sums previously set aside for suppliers’ invoices<br />

not received 33,043<br />

Holiday periods for previous years, recovered 38,966<br />

Insurance payments, prior years 10,279<br />

Suppliers’ invoices, prior years (79,963)<br />

Incorrect provision for rental fees (21,424)<br />

Incorrect provision for receivables (30,000)<br />

Revocation of contributions (15,000)<br />

Writedown of Milan guarantee (22,803)<br />

Refuse, council tax, registration taxes, prior years (9,264)<br />

Other extraordinary income and expenses (28,086)<br />

Total 28,191<br />

MANAGEMENT OF THE PROPERTIES<br />

ORDINARY COSTS OF THE PROPERTIES<br />

RESTORATION AND RENOVATION WORK RECOGNISED<br />

AMONG FIXED ASSETS<br />

This amounted to € 8,654,556 and related to the value<br />

of restoration and renovation work, and extraordinary<br />

maintenance, performed on Foundation-owned property and<br />

on property owned by others, as follows:<br />

Restoration of Foundation-owned properties 5,173,495<br />

Extraordinary maintenance on<br />

Foundation-owned properties 2,287,900<br />

Total, Works recognised as assets 7,461,395<br />

Purchase of fixed assets 1,124,348<br />

Work on third-party property 68,813<br />

Total, work fully covered 1,193,161<br />

ORDINARY INCOME OF THE PROPERTIES<br />

Specific contributions<br />

These amounted to € 5,274,546, and covered work that<br />

accrued in the year, on the following:<br />

Restoration of Foundation-owned properties 2,730,074<br />

Extraordinary maintenance on<br />

Foundation-owned properties 1,351,311<br />

Total, Provisions for Specific Contributions 4,081,385<br />

Covering fixed assets 1,124,348<br />

Covering work on third-party property 68,813<br />

Total covering works 1,193,161<br />

It should be noted that accordingly € 3,380,010 was borne<br />

by FAI.<br />

EQUITY INCOME AND EXPENSE<br />

These represent the income and expense for which there is<br />

largely a balancing item among the items of Equity to offset<br />

the result of Core Operations, as follows:<br />

PROPERTY VALUE ADJUSTMENTS<br />

These amounted to € 7,461,395 and increased the value of<br />

property.<br />

ALLOCATIONS TO SPECIFIC CONTRIBUTIONS<br />

These amounted to € 4,081,385, and increased the Provision<br />

for Specific Contributions which is included among the<br />

Foundation’s Equity.<br />

OTHER INCOME RECOGNISED IN EQUITY<br />

RECAPITALISATION CONTRIBUTIONS<br />

These amounted to € 747,688, an increase over the previous<br />

year.<br />

RESTRICTED GIFTS<br />

These amounted to € 1,500,000, and regarded the donation<br />

that accompanied the non-institutional asset, Villa Flecchia in<br />

Magnano.<br />

ALLOCATION TO RECAPITALISATION FUND<br />

This amounted to € 747,688, a figure that increased the<br />

Recapitalization Fund included in Equity.<br />

ALLOCATIONS, RESTRICTED DONATIONS<br />

This amounted to € 1,500,000, a figure that increased the<br />

Reserve for Operating Activities that is included in Equity.<br />

TAXES FOR THE YEAR<br />

Taxes for the year amounted to € 192,594, and related to<br />

accrued corporation tax in an amount of € 32,764, and<br />

accrued production tax (IRAP) in an amount of € 159,830.<br />

DEFICIT FOR THE YEAR<br />

The deficit for the year amounted to € (442,871).<br />

on behalf of the Board of Directors - Chair<br />

Ilaria Carla Anna Borletti Dell’Acqua<br />

86 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 87