Annual Report 2011 - Fai

Annual Report 2011 - Fai

Annual Report 2011 - Fai

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

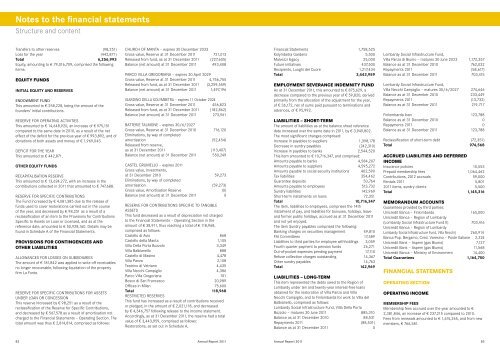

Notes to the financial statements<br />

Structure and content<br />

Transfers to other reserves (98,251)<br />

Loss for the year (442,871)<br />

Total 6,256,993<br />

Equity, amounting to € 79,016,709, comprised the following<br />

items:<br />

EQUITY FUNDS<br />

INITIAL EQUITY AND RESERVES<br />

ENDOWMENT FUND<br />

This amounted to € 258,228, being the amount of the<br />

founders’ initial contributions.<br />

RESERVE FOR OPERATING ACTIVITIES<br />

This amounted to € 14,648,920, an increase of € 975,151<br />

compared to the same date in 2010, as a result of the net<br />

effect of the deficit for the previous year of € 993,892, and of<br />

donations of both assets and money of € 1,969,043.<br />

DEFICIT FOR THE YEAR<br />

This amounted to € 442,871.<br />

OTHER EQUITY FUNDS<br />

RECAPITALISATION RESERVE<br />

This amounted to € 13,624,272, with an increase in the<br />

contributions collected in <strong>2011</strong> that amounted to € 747,688.<br />

RESERVE FOR SPECIFIC CONTRIBUTIONS<br />

The Fund increased by € 4,081,385 due to the release of<br />

funds used to cover restorations carried out in the course<br />

of the year, and decreased by € 98,251 as a result of a<br />

reclassification of an item to the Provisions for Contributions<br />

Specific to Assets on Loan or Licensed, and as at the<br />

reference date, amounted to € 50,928,160. Details may be<br />

found in Schedule A of the Financial Statements.<br />

PROVISIONS FOR CONTINGENCIES AND<br />

OTHER LIABILITIES<br />

ALLOWANCES FOR LOSSES ON SUBSIDIARIES<br />

The amount of € 181,842 was applied to write off receivables<br />

no longer recoverable, following liquidation of the property<br />

firm La Fonte.<br />

RESERVE FOR SPECIFIC CONTRIBUTIONS FOR ASSETS<br />

UNDER LOAN OR CONCESSION<br />

This reserve increased by € 98,251 as a result of the<br />

reclassification of the Reserve for Specific Contributions,<br />

and decreased by € 567,578 as a result of amortisation not<br />

charged to the Financial Statements – Operating Section. The<br />

total amount was thus € 2,814,814, comprised as follows:<br />

CHURCH OF MANTA – expires 30 December 2033<br />

Gross value, Reserve at 31 December <strong>2011</strong> 721,013<br />

Released from fund, as at 31 December <strong>2011</strong> (227,605)<br />

Balance (net amount) at 31 December <strong>2011</strong> 493,408<br />

PARCO VILLA GREGORIANA – expires 30 April 2029<br />

Gross value, Reserve at 31 December <strong>2011</strong> 4,756,755<br />

Released from fund, as at 31 December <strong>2011</strong> (3,259,559)<br />

Balance (net amount) at 31 December <strong>2011</strong> 1,497,196<br />

GIARDINO DELLA KOLYMBETRA – expires 11 October 2024<br />

Gross value, Reserve at 31 December <strong>2011</strong> 456,823<br />

Released from fund, as at 31 December <strong>2011</strong> (182,862)<br />

Balance (net amount) at 31 December <strong>2011</strong> 273,961<br />

BATTERIE TALMONE – expires 30/6/2027<br />

Gross value, Reserve at 31 December 2010 716,120<br />

Eliminations, by way of completed<br />

amortisation (52,454)<br />

Released from reserve,<br />

as at 31 December <strong>2011</strong> (113,407)<br />

Balance (net amount) at 31 December <strong>2011</strong> 550,249<br />

CASTEL GRUMELLO – expires <strong>2011</strong><br />

Gross value, Investments,<br />

at 31 December 2010 59,273<br />

Eliminations, by way of completed<br />

amortisation (59,273)<br />

Gross value, Amortisation Reserve (0)<br />

Balance (net amount) at 31 December <strong>2011</strong> 0<br />

RESERVE FOR CONTRIBUTIONS SPECIFIC TO TANGIBLE<br />

ASSETS<br />

This fund decreased as a result of depreciation not charged<br />

to the Financial Statements – Operating Section in the<br />

amount of € 38,911, thus reaching a total of € 118,968,<br />

comprised as follows:<br />

Castello di Avio 868<br />

Castello della Manta 1,105<br />

Villa Della Porta Bozzolo 3,349<br />

Villa Balbianello 888<br />

Castello di Masino 4,478<br />

Villa Panza 2,108<br />

Teatrino di Vetriano 4,435<br />

Villa Necchi Campiglio 4,386<br />

Parco Villa Gregoriana 761<br />

Bosco di San Francesco 20,989<br />

Offices in Milan 75,600<br />

Total 118,968<br />

RESTRICTED RESERVES<br />

This fund has increased as a result of contributions received<br />

or pledged, in the amount of € 2,021,118, and decreased<br />

by € 4,346,757 following release to the income statement.<br />

Accordingly, as at 31 December <strong>2011</strong>, the reserve had a total<br />

value of € 3,443,959, comprised as follows:<br />

Restorations, as set out in Schedule A,<br />

Financial Statements 1,758,525<br />

Kolymbetra Gardens 5,500<br />

Malvezzi legacy 25,000<br />

Future initiatives 437,500<br />

Recipients, Luoghi del Cuore 1,217,434<br />

Total 3,443,959<br />

EMPLOYMENT SEVERANCE INDEMNITY FUND<br />

As at 31 December <strong>2011</strong>, this amounted to € 875,629, a<br />

decrease compared to the previous year of € 59,820, derived<br />

primarily from the allocation of the adjustment for the year,<br />

of € 36,172, net of sums paid pursuant to terminations and<br />

advances, of € 95,992.<br />

LIABILITIES – SHORT-TERM<br />

The amount of liabilities as at the balance sheet reference<br />

date increased over the same date in <strong>2011</strong>, by € 3,949,802.<br />

The most significant changes comprised:<br />

Increase in payables to suppliers 1,398,178<br />

Decrease in sundry payables (242,310)<br />

Increase in payables to banks 2,544,520<br />

This item amounted to € 10,716,347, and comprised:<br />

Amounts payable to banks 4,584,207<br />

Amounts payable to suppliers 4,595,272<br />

Amounts payable to social security institutions 402,590<br />

Tax liabilities 354,462<br />

Guarantee deposits 50,764<br />

Amounts payable to employees 513,732<br />

Sundry liabilities 142,969<br />

Short-term instalments on loans 72,351<br />

Total 10,716,347<br />

The item, liabilities to employees, comprises the 14th<br />

instalment of pay, and liabilities for bonuses, holidays, leave<br />

and former public holidays, accrued as at 31 December <strong>2011</strong><br />

and not yet enjoyed.<br />

The item Sundry payables comprised the following:<br />

Banking charges on securities management 49,810<br />

FAI Committees 17,589<br />

Liabilities to third parties for employee withholdings 3,059<br />

Fourth quarter payment to pension funds 26,271<br />

Out-of-pocket expenses pending payment 17,110<br />

Refuse collection charges outstanding 14,367<br />

Other sundry payables 14,763<br />

Total 142,969<br />

LIABILITIES – LONG-TERM<br />

This item represented the debts owed to the Region of<br />

Lombardy under ten and twenty-year interest-free loans<br />

obtained for the restoration of Villa Panza and Villa<br />

Necchi Campiglio, and to Finlombarda for work to Villa del<br />

Balbianello, comprised as follows:<br />

Lombardy Social Infrastructure Fund, Villa Della Porta<br />

Bozzolo – matures 30 June <strong>2011</strong> 885,310<br />

Balance as at 31 December 2010 88,531<br />

Repayments <strong>2011</strong> (88,531)<br />

Balance as at 31 December <strong>2011</strong> 0<br />

Lombardy Social Infrastructure Fund,<br />

Villa Panza di Biumo – matures 30 June 2023 1,172,357<br />

Balance as at 31 December 2010 762,032<br />

Repayments <strong>2011</strong> (58,617)<br />

Balance as at 31 December <strong>2011</strong> 703,415<br />

Lombardy Social Infrastructure Fund,<br />

Villa Necchi Campiglio – matures 30/6/2027 274,646<br />

Balance as at 31 December 2010 233,449<br />

Repayments <strong>2011</strong> (13,732)<br />

Balance as at 31 December <strong>2011</strong> 219,717<br />

Finlombarda loan 123,788<br />

Balance as at 31 December 2010 0<br />

Repayments <strong>2011</strong> 0<br />

Balance as at 31 December <strong>2011</strong> 123,788<br />

Reclassification of short-term debt (72,351)<br />

Total 974,568<br />

ACCRUED LIABILITIES AND DEFERRED<br />

INCOME<br />

Insurance policies 10,553<br />

Prepaid membership fees 1,064,462<br />

Contributions, 2012 accruals 59,000<br />

Rentals <strong>2011</strong> 5,801<br />

<strong>2011</strong> items, sundry clients 5,500<br />

Total 1,145,316<br />

MEMORANDUM ACCOUNTS<br />

Guarantees provided by third parties:<br />

Unicredit Banca – Finlombarda 165,000<br />

Unicredit Banca – Region of Lombardy<br />

(Lombardy Social Infrastructure Fund II) 703,416<br />

Unicredit Banca – Region of Lombardy<br />

Lombardy Social Infrastructure Fund, Villa Necchi) 260,914<br />

Banca Pop. Bergamo, Cred. Varesino – Poste Italiane 2,324<br />

Unicredit Bank – Aspem (gas Biumo) 7,127<br />

Unicredit Bank – Aspem (gas Biumo) 11,568<br />

Unicredit Banca – Ministry of Environment 14,400<br />

Total Guarantees 1,164,750<br />

FINANCIAL STATEMENTS<br />

OPERATING SECTION<br />

OPERATING INCOME<br />

MEMBERSHIP FEES<br />

Membership fees accrued over the year amounted to €<br />

2,381,846, an increase of € 237,215 compared to 2010.<br />

Fees from renewals amounted to € 1,615,265, and from new<br />

members, € 766,581.<br />

82 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 83