Fidelity Funds - Chartbook.fid-intl.com

Fidelity Funds - Chartbook.fid-intl.com

Fidelity Funds - Chartbook.fid-intl.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Fidelity</strong><br />

<strong>Funds</strong><br />

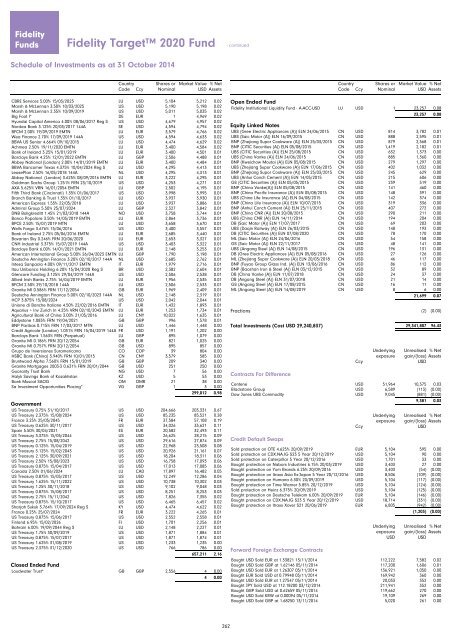

<strong>Fidelity</strong> Target 2020 Fund - continued<br />

Schedule of Investments as at 31 October 2014 <br />

Country<br />

Code Ccy<br />

Shares or<br />

Nominal<br />

Market Value<br />

USD % Net<br />

Assets<br />

CBRE Services 5.00% 15/03/2023 LU USD 5,104 5,212 0.02<br />

Marsh & McLennan 3.50% 10/03/2025 US USD 5,190 5,198 0.02<br />

Marsh & McLennan 2.35% 10/09/2019 US USD 5,011 5,035 0.02<br />

Big Foot I* DE EUR 1 4,969 0.02<br />

Hyundai Capital America 4.00% 08/06/2017 Reg S US USD 4,679 4,957 0.02<br />

Nordea Bank 3.125% 20/03/2017 144A SE USD 4,594 4,794 0.02<br />

BFCM 2.00% 19/09/2019 EMTN LU EUR 3,579 4,766 0.02<br />

Wea Finance 2.70% 17/09/2019 144A US USD 4,594 4,633 0.02<br />

BBVA US Senior 4.664% 09/10/2015 LU USD 4,474 4,629 0.02<br />

Achmea 2.50% 19/11/2020 EMTN LU EUR 3,400 4,584 0.02<br />

Bank of Ireland 3.25% 15/01/2019 LU EUR 3,400 4,501 0.01<br />

Barclays Bank 4.25% 12/01/2022 EMTN LU GBP 2,506 4,488 0.01<br />

Abbey National (London) 2.00% 14/01/2019 EMTN LU EUR 3,400 4,484 0.01<br />

BBVA Ban<strong>com</strong>er Texas 4.375% 10/04/2024 Reg S LU USD 4,295 4,413 0.01<br />

LeasePlan 2.50% 16/05/2018 144A NL USD 4,295 4,313 0.01<br />

Abbey National (London) 3.625% 08/09/2016 EMTN LU EUR 3,222 4,295 0.01<br />

Goldman Sachs Group 1.251% FRN 23/10/2019 US USD 4,253 4,271 0.01<br />

AXA 5.625% VRN 16/01/2054 EMTN LU GBP 2,502 4,195 0.01<br />

Fifth Third Bank (Cincinnati) 1.35% 01/06/2017 US USD 3,998 3,995 0.01<br />

Branch Banking & Trust 1.35% 01/10/2017 LU USD 3,937 3,930 0.01<br />

American Express 1.55% 22/05/2018 LU USD 3,937 3,886 0.01<br />

Admiral Group 5.50% 25/07/2024 LU GBP 2,327 3,842 0.01<br />

DNB Boligkreditt 1.45% 21/03/2018 144A NO USD 3,758 3,744 0.01<br />

Banco Popolare 3.50% 14/03/2019 EMTN LU EUR 2,864 3,736 0.01<br />

BPCE 2.50% 15/07/2019 MTN LU USD 3,658 3,670 0.01<br />

Wells Fargo 3.676% 15/06/2016 US USD 3,400 3,557 0.01<br />

Bank of Ireland 2.75% 05/06/2016 EMTN LU EUR 2,685 3,440 0.01<br />

Bavarian Sky 0.246% FRN 20/06/2020 LU EUR 2,653 3,327 0.01<br />

CNH Industrial 3.375% 15/07/2019 144A US USD 3,403 3,322 0.01<br />

Barclays Bank 6.00% 14/01/2021 EMTN LU EUR 2,148 3,253 0.01<br />

American International Group 5.00% 26/04/2023 EMTNLU GBP 1,790 3,198 0.01<br />

Deutsche Annington Finance 3.20% 02/10/2017 144A NL USD 2,685 2,762 0.01<br />

Intesa Sanpaolo 4.00% 09/11/2017 EMTN IT EUR 1,979 2,716 0.01<br />

Itau Unibanco Holding 6.20% 15/04/2020 Reg S BR USD 2,382 2,604 0.01<br />

Glencore Funding 3.125% 29/04/2019 144A US USD 2,506 2,538 0.01<br />

Allied Irish Banks 2.75% 16/04/2019 EMTN LU EUR 1,956 2,535 0.01<br />

BFCM 2.50% 29/10/2018 144A LU USD 2,506 2,533 0.01<br />

Granite MI 0.586% FRN 17/12/2054 GB EUR 1,969 2,409 0.01<br />

Deutsche Annington Finance 5.00% 02/10/2023 144A NL USD 2,148 2,319 0.01<br />

HCP 3.875% 15/08/2024 US USD 2,042 2,044 0.01<br />

Unione di Banche Italiane 4.50% 22/02/2016 EMTN IT EUR 1,432 1,893 0.01<br />

Aquarius + Inv Zurich In 4.25% VRN 02/10/2043 EMTN LU EUR 1,253 1,734 0.01<br />

Agricultural Bank of China 3.00% 21/05/2016 LU CNY 10,022 1,635 0.01<br />

Eddystone 1.083% FRN 19/04/2021 GB GBP 996 1,578 0.01<br />

BNP Paribas 0.715% FRN 17/03/2017 MTN LU USD 1,446 1,448 0.00<br />

Credit Agricole (London) 1.031% FRN 15/04/2019 144AFR USD 1,191 1,202 0.00<br />

Barclays Bank 1.563% FRN (Perpetual) LU GBP 895 1,079 0.00<br />

Granite MI 0.186% FRN 20/12/2054 GB EUR 821 1,025 0.00<br />

Granite MI 0.757% FRN 20/12/2054 GB USD 895 857 0.00<br />

Grupo de Inversiones Suramericana CO COP 39 804 0.00<br />

HSBC Bank (China) 3.940% FRN 10/01/2015 CN CNY 3,579 585 0.00<br />

Bruntwood Alpha 7.560% FRN 15/01/2019 GB GBP 209 340 0.00<br />

Granite Mortgages 2003-3 0.631% FRN 20/01/2044 GB USD 251 250 0.00<br />

Guaranty Trust Bank NG USD 7 56 0.00<br />

Halyk Savings Bank of Kazakhstan KZ USD 5 53 0.00<br />

Bank Muscat SAOG OM OMR 21 38 0.00<br />

Sa Investment Opportunities Placing* VG GBP 1 3 0.00<br />

299,012 0.98<br />

Government<br />

US Treasury 0.75% 31/10/2017 US USD 204,666 203,331 0.67<br />

US Treasury 2.375% 15/08/2024 US USD 85,235 85,521 0.28<br />

France 3.25% 25/05/2045 FR EUR 37,584 57,108 0.19<br />

US Treasury 0.625% 30/11/2017 US USD 34,026 33,621 0.11<br />

Spain 5.50% 30/04/2021 ES EUR 20,582 32,493 0.11<br />

US Treasury 3.375% 15/05/2044 US USD 26,625 28,215 0.09<br />

US Treasury 2.75% 15/08/2042 US USD 29,616 27,874 0.09<br />

US Treasury 0.125% 15/04/2019 US USD 22,968 23,508 0.08<br />

US Treasury 3.125% 15/02/2043 US USD 20,926 21,161 0.07<br />

US Treasury 2.125% 30/09/2021 US USD 18,204 18,311 0.06<br />

US Treasury 2.50% 15/08/2023 US USD 16,758 17,093 0.06<br />

US Treasury 0.875% 15/04/2017 US USD 17,013 17,085 0.06<br />

Canada 2.50% 01/06/2024 LU CAD 17,897 16,482 0.05<br />

US Treasury 0.875% 15/05/2017 US USD 12,249 12,286 0.04<br />

US Treasury 1.625% 15/11/2022 US USD 10,738 10,302 0.03<br />

US Treasury 1.25% 30/11/2018 US USD 9,102 9,048 0.03<br />

US Treasury 0.875% 15/08/2017 US USD 8,251 8,253 0.03<br />

US Treasury 2.75% 15/11/2042 US USD 7,826 7,355 0.02<br />

US Treasury 0.875% 15/10/2017 US USD 6,465 6,457 0.02<br />

Sharjah Sukuk 3.764% 17/09/2024 Reg S KY USD 4,474 4,622 0.02<br />

France 0.25% 25/07/2024 FR EUR 3,222 4,265 0.01<br />

US Treasury 0.875% 15/06/2017 US USD 2,552 2,558 0.01<br />

Finland 6.95% 15/02/2026 FI USD 1,701 2,256 0.01<br />

Bahrain 6.00% 19/09/2044 Reg S LU USD 2,148 2,227 0.01<br />

US Treasury 1.75% 30/09/2019 US USD 1,871 1,884 0.01<br />

US Treasury 0.875% 15/07/2017 US USD 1,871 1,874 0.01<br />

US Treasury 1.625% 31/08/2019 US USD 1,233 1,235 0.00<br />

US Treasury 2.375% 31/12/2020 US USD 766 786 0.00<br />

657,211 2.16<br />

Closed Ended Fund<br />

Loudwater Trust* GB GBP 2,556 4 0.00<br />

4 0.00<br />

Country<br />

Code Ccy<br />

Shares or<br />

Nominal<br />

Market Value % Net<br />

USD Assets<br />

Open Ended Fund<br />

<strong>Fidelity</strong> Institutional Liquidity Fund - A-ACC-USD LU USD 1 23,257 0.08<br />

23,257 0.08<br />

Equity Linked Notes<br />

UBS (Gree Electric Appliances (A)) ELN 24/06/2015 CN USD 814 3,782 0.01<br />

UBS (Saic Motor (A)) ELN 16/09/2015 CN USD 888 2,595 0.01<br />

BNP (Zhejiang Supor Cookware (A)) ELN 25/03/2015 CN USD 879 2,568 0.01<br />

BNP (CITIC Securities (A)) ELN 05/08/2015 CN USD 1,419 2,182 0.01<br />

UBS (CITIC Securities (A)) ELN 25/08/2015 CN USD 632 1,373 0.00<br />

UBS (China Vanke (A)) ELN 24/06/2015 CN USD 885 1,360 0.00<br />

BNP (Kweichow Moutai (A)) ELN 05/08/2015 CN USD 279 1,297 0.00<br />

UBS (Zhejiang Supor Cookware (A)) ELN 17/06/2015 CN USD 402 1,032 0.00<br />

BNP (Zhejiang Supor Cookware (A)) ELN 25/03/2015 CN USD 245 629 0.00<br />

UBS (Anhui Conch Cement (A)) ELN 14/05/2015 CN USD 215 606 0.00<br />

GS (CITIC Securities (A)) ELN 05/05/2015 CN USD 239 519 0.00<br />

BNP (China Vanke(A)) ELN 05/08/2015 CN USD 141 460 0.00<br />

BNP (China Pacific Insurance (A)) ELN 05/08/2015 CN USD 148 391 0.00<br />

UBS (China Life Insurance (A)) ELN 04/08/2015 CN USD 142 374 0.00<br />

BNP (China Life Insurance (A)) ELN 10/07/2015 CN USD 319 336 0.00<br />

BNP (Anhui Conch Cement (A)) ELN 25/11/2015 CN USD 407 272 0.00<br />

BNP (China CNR (A)) ELN 20/08/2015 CN USD 290 211 0.00<br />

UBS (China CNR (A)) ELN 14/11/2014 CN USD 194 204 0.00<br />

DB (Saic Motor (A)) ELN 17/07/2017 CN USD 69 203 0.00<br />

UBS (Daqin Railway (A)) ELN 26/03/2015 CN USD 148 193 0.00<br />

DB (CITIC Securities (A)) ELN 07/08/2020 CN USD 78 170 0.00<br />

ML (Saic Motor (A)) ELN 24/06/2016 CN USD 54 158 0.00<br />

GS (Saic Motor (A)) ELN 22/11/2017 CN USD 48 141 0.00<br />

UBS (Angang Steel (A)) ELN 14/08/2015 CN USD 196 131 0.00<br />

DB (Gree Electric Appliances (A)) ELN 05/08/2016 CN USD 27 126 0.00<br />

ML (Zhejiang Supor Cookware (A)) ELN 20/03/2018 CN USD 46 117 0.00<br />

BNP (Fuyao Group Glass Ind. (A)) ELN 13/06/2016 CN USD 86 112 0.00<br />

BNP (Baoshan Iron & Steel (A)) ELN 03/12/2015 CN USD 32 89 0.00<br />

DB (China Vanke (A)) ELN 11/07/2018 CN USD 24 37 0.00<br />

DB (Angang Steel (A)) ELN 31/07/2018 CN USD 21 14 0.00<br />

GS (Angang Steel (A)) ELN 17/08/2015 CN USD 16 11 0.00<br />

ML (Angang Steel (A)) ELN 14/08/2019 CN USD 8 6 0.00<br />

21,699 0.07<br />

Fractions (2) (0.00)<br />

Total Investments (Cost USD 29,240,837) 29,341,807 96.43<br />

1<br />

29 341 807 00<br />

Ccy<br />

Underlying<br />

exposure<br />

Unrealised % Net<br />

gain/(loss) Assets<br />

USD<br />

Contracts For Difference<br />

Contracts For Difference<br />

Centene USD 51,964 10,375 0.03<br />

Blackstone Group USD 6,589 (113) (0.00)<br />

Dow Jones UBS Commodity USD 9,045 (881) (0.00)<br />

9,381 0.03<br />

Ccy<br />

Underlying<br />

exposure<br />

Unrealised % Net<br />

gain/(loss) Assets<br />

USD<br />

Credit Default Swaps<br />

Credit Default Swaps<br />

Sold protection on OTE 4.625% 20/09/2019 EUR 5,104 595 0.00<br />

Sold protection on CDX.NA.IG S23 5 Year 20/12/2019 USD 5,104 90 0.00<br />

Sold protection on Caterpillar 5 Year 20/12/2016 USD 1,701 33 0.00<br />

Bought protection on Nabors Industries 6.15% 20/03/2019 USD 3,403 27 0.00<br />

Bought protection on Yum Brands 6.25% 20/09/2016 USD 3,403 (54) (0.00)<br />

Bought protection on Itraxx Asia Ex-Japan 5 Year 20/12/2016 USD 8,506 (109) (0.00)<br />

Bought protection on Humana 6.30% 20/09/2019 USD 5,104 (117) (0.00)<br />

Bought protection on Time Warner 5.85% 20/12/2019 USD 5,104 (124) (0.00)<br />

Sold protection on Heinz 6.375% 20/09/2019 USD 5,104 (125) (0.00)<br />

Bought protection on Deutsche Telekom 6.00% 20/09/2019 EUR 5,104 (146) (0.00)<br />

Bought protection on CDX.NA.IG S23 5 Year 20/12/2019 USD 18,714 (331) (0.00)<br />

Bought protection on Itraxx Xover S21 20/06/2019 EUR 6,805 (942) (0.00)<br />

(1,203) (0.00)<br />

Underlying<br />

exposure<br />

USD<br />

Unrealised % Net<br />

gain/(loss) Assets<br />

USD<br />

Forward Foreign Exchange Contracts<br />

Forward Foreign Exchange Contracts<br />

Bought USD Sold EUR at 1.33821 13/11/2014 112,222 7,582 0.02<br />

Bought USD Sold GBP at 1.62146 05/11/2014 117,200 1,606 0.01<br />

Bought USD Sold EUR at 1.26307 05/11/2014 136,921 1,050 0.00<br />

Bought EUR Sold USD at 0.79948 05/11/2014 169,942 360 0.00<br />

Bought USD Sold EUR at 1.27547 05/11/2014 20,033 352 0.00<br />

Bought JPY Sold USD at 112.18200 03/12/2014 211,941 352 0.00<br />

Bought GBP Sold USD at 0.62659 05/11/2014 119,662 270 0.00<br />

Bought USD Sold KRW at 0.00094 05/11/2014 19,109 269 0.00<br />

Bought USD Sold GBP at 1.68250 13/11/2014 5,020 261 0.00<br />

262