<strong>Fidelity</strong> <strong>Funds</strong> Emerging Europe, Middle East and Africa Fund Schedule of Investments as at 31 October 2014 Country Code Ccy Shares or Nominal Market Value USD % Net Assets Securities Admitted to or Dealt on an Official Stock Exchange Securities Admitted to or Dealt on an Official Stock Exchange Energy Surgutneftegas OAO Perpetual (Pref'd) RU USD 42,157,752 28,905,849 3.29 28,905,849 3.29 Materials Petra Diamonds GB GBP 2,837,712 7,534,843 0.86 Omnia Holdings ZA ZAR 370,661 7,385,029 0.84 First Quantum Minerals CA CAD 253,864 3,827,426 0.44 Aquarius Platinum AU GBP 10,377,137 2,738,794 0.31 21,486,092 2.45 Industrials Bidvest Group ZA ZAR 1,205,829 33,129,165 3.77 Group Five ZA ZAR 750,846 2,565,605 0.29 Blue Label Tele<strong>com</strong>s ZA ZAR 1,605,921 1,418,016 0.16 37,112,786 4.23 Information Technology IBS Group Holding RU EUR 195,253 6,240,878 0.71 Check Point Software Technologies IL USD 80,169 5,948,523 0.68 12,189,401 1.39 Consumer Discretionary Naspers ZA ZAR 784,722 97,549,418 11.11 Steinhoff International Holdings ZA ZAR 9,697,355 49,531,862 5.64 Woolworths Holdings (South Africa) ZA ZAR 4,289,674 30,453,498 3.47 Imperial Holdings ZA ZAR 691,205 11,890,458 1.35 Spur ZA ZAR 3,434,982 9,699,578 1.10 Famous Brands ZA ZAR 612,776 6,021,209 0.69 JUMBO GR EUR 541,355 5,937,412 0.68 FF Group GR EUR 144,123 4,714,994 0.54 City Lodge Hotels ZA ZAR 173,349 1,930,989 0.22 Metair Investments ZA ZAR 558,880 1,898,027 0.22 219,627,445 25.02 Consumer Staples AVI ZA ZAR 2,608,956 16,988,222 1.94 Nigerian Breweries NG NGN 17,197,172 16,800,492 1.91 Shoprite Holdings ZA ZAR 1,071,020 15,497,878 1.77 Coca-Cola Icecek AS TR TRY 436,967 9,971,305 1.14 Clover Industries ZA ZAR 4,113,221 7,338,386 0.84 Distell Group ZA ZAR 378,618 4,577,567 0.52 SABMiller GB ZAR 79,526 4,473,374 0.51 Capevin Holdings ZA ZAR 2,922,901 2,295,015 0.26 77,942,239 8.88 Healthcare Aspen Pharmacare Holdings ZA ZAR 965,016 34,384,710 3.92 Netcare ZA ZAR 4,058,890 12,259,010 1.40 46,643,720 5.31 Tele<strong>com</strong>munication Services MTN Group ZA ZAR 1,298,771 28,699,518 3.27 Bezeq The Israeli Tele<strong>com</strong>munication IL ILS 8,826,006 14,954,007 1.70 Safari<strong>com</strong> KE KES 37,686,732 5,140,058 0.59 Telkom SA SOC ZA ZAR 687,986 3,648,655 0.42 52,442,238 5.97 Financials Remgro ZA ZAR 2,095,259 48,003,864 5.47 Turkiye Halk Bankasi AS TR TRY 5,295,994 35,397,205 4.03 Discovery ZA ZAR 2,572,498 23,374,271 2.66 SberBank of Russia Perpetual (Pref'd) RU USD 14,462,135 19,129,542 2.18 Zenith Bank NG NGN 138,961,388 17,765,603 2.02 Brait SE MT ZAR 2,218,025 16,648,245 1.90 First Gulf Bank AE AED 3,013,300 14,889,710 1.70 Barclays Africa Group ZA ZAR 812,038 12,807,872 1.46 Qatar National Bank SAQ QA QAR 164,569 9,684,774 1.10 Equity Bank KE KES 13,603,128 7,755,836 0.88 FBN Holdings NG NGN 105,548,298 7,370,717 0.84 Guaranty Trust Bank NG NGN 48,636,196 7,332,458 0.84 Access Bank NG NGN 138,049,006 7,076,234 0.81 Turkiye Garanti Bankasi AS TR TRY 1,781,533 6,959,990 0.79 PSG Group ZA ZAR 629,058 6,551,500 0.75 Coronation Fund Managers ZA ZAR 731,870 6,329,795 0.72 Rand Merchant Insurance Holdings ZA ZAR 1,597,260 5,687,761 0.65 Dubai Islamic Bank AE AED 2,347,516 4,831,674 0.55 National of Ras Al-Khaimah AE AED 1,783,625 4,273,203 0.49 Diamond Bank NG NGN 83,781,951 3,031,459 0.35 Zeder Investments ZA ZAR 1,594,106 837,331 0.10 265,739,044 30.27 Securities Admitted to or Dealt on Other Regulated Markets Securities Admitted to or Dealt on Other Regulated Markets Energy KazMunaiGas Exploration Production KZ USD 159,616 2,545,874 0.29 Kalahari Energy* BW USD 257,336 3 0.00 2,545,877 0.29 Country Code Ccy Shares or Nominal Market Value % Net USD Assets Materials MMC Norilsk Nickel RU USD 1,258,942 23,428,908 2.67 23,428,908 2.67 Industrials Global Ports Investments CY USD 28,883 179,077 0.02 179,077 0.02 Consumer Staples X5 Retail Group RU USD 1,080,827 19,725,099 2.25 Magnit RU USD 244,382 16,373,580 1.87 East African Breweries KE KES 3,648,125 11,623,427 1.32 47,722,106 5.44 Tele<strong>com</strong>munication Services KCell KZ USD 239,796 3,210,864 0.37 3,210,864 0.37 Financials Guaranty Trust Bank NG USD 1,369,955 10,548,655 1.20 Halyk Savings Bank of Kazakhstan KZ USD 1,013,844 9,935,675 1.13 Bank Muscat SAOG OM OMR 3,977,721 7,274,491 0.83 Sa Investment Opportunities Placing* VG GBP 15 600,090 0.07 28,358,911 3.23 Fractions (3) (0.00) Total Investments (Cost USD 832,806,071) 867,534,554 98.82 1 867 534 554 00 Underlying exposure USD Unrealised % Net gain/(loss) Assets USD Forward Foreign Exchange Contracts Forward Foreign Exchange Contracts A-ACC Shares (PLN) (hedged) Bought USD Sold RUB at 0.02508 10/11/2014 404,020 32,472 0.00 Bought USD Sold ZAR at 0.09195 10/11/2014 81,556 1,325 0.00 Bought USD Sold PLN at 0.30202 10/11/2014 50,717 867 0.00 Bought USD Sold NGN at 0.00604 10/11/2014 207,049 499 0.00 Bought USD Sold TRY at 0.45439 10/11/2014 12,585 138 0.00 Bought USD Sold TRY at 0.43474 10/11/2014 38,744 (1,270) (0.00) Bought USD Sold TRY at 0.43777 10/11/2014 55,689 (1,449) (0.00) Bought PLN Sold USD at 3.30796 10/11/2014 93,290 (1,655) (0.00) Bought USD Sold TRY at 0.43581 10/11/2014 73,982 (2,248) (0.00) Bought USD Sold TRY at 0.43454 10/11/2014 120,367 (3,998) (0.00) Bought RUB Sold USD at 40.17500 10/11/2014 63,890 (4,314) (0.00) Bought USD Sold ZAR at 0.08822 10/11/2014 1,389,780 (34,688) (0.00) Bought PLN Sold USD at 3.30054 10/11/2014 2,611,450 (52,084) (0.01) (66,405) (0.01) Other Assets and Liabilities 10,425,914 1.19 Net Assets 877,894,063 100.00 877 894 063 00 GEOGRAPHICAL SPLIT Country Country Code % Net Assets South Africa ZA 54.99 Russia RU 12.96 Nigeria NG 7.97 Turkey TR 5.96 Kenya KE 2.79 United Arab Emirates AE 2.73 Israel IL 2.38 Malta MT 1.90 Kazakstan KZ 1.79 UK GB 1.37 Greece GR 1.21 Qatar QA 1.10 Oman OM 0.83 Canada CA 0.44 Australia AU 0.31 Virgin Islands (British) VG 0.07 Cyprus CY 0.02 Botswana BW 0.00 Cash and other net assets 1.18 * Security with price determined by the Directors. The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements. The percentage of net assets in the schedule of investments and in the geographical split is subject to rounding. 28

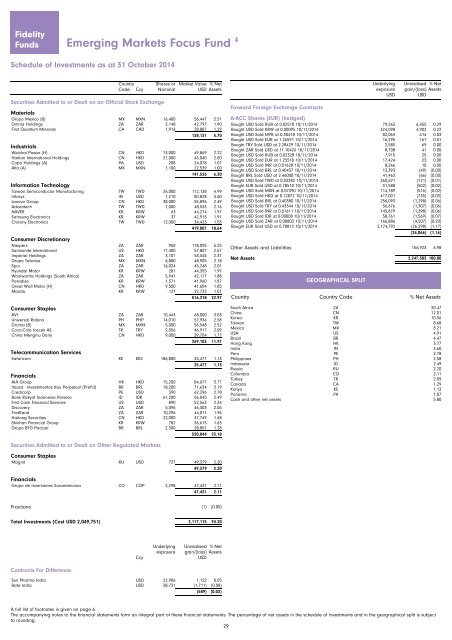

<strong>Fidelity</strong> <strong>Funds</strong> Emerging Markets Focus Fund 4 Schedule of Investments as at 31 October 2014 Country Code Ccy Shares or Nominal Market Value USD % Net Assets Securities Admitted to or Dealt on an Official Stock Exchange Securities Admitted to or Dealt on an Official Stock Exchange Materials Grupo Mexico (B) MX MXN 16,400 56,447 2.51 Omnia Holdings ZA ZAR 2,148 42,797 1.90 First Quantum Minerals CA CAD 1,916 28,887 1.29 128,131 5.70 Industrials Weichai Power (H) CN HKD 13,000 49,869 2.22 Haitian International Holdings CN HKD 21,000 45,040 2.00 Copa Holdings (A) PA USD 208 24,078 1.07 Alfa (A) MX MXN 7,100 22,539 1.00 141,526 6.30 Information Technology Taiwan Semiconductor Manufacturing TW TWD 26,000 112,138 4.99 Infosys IN USD 1,210 80,828 3.60 Lenovo Group CN HKD 38,000 55,896 2.49 Advantech TW TWD 7,000 48,533 2.16 NAVER KR KRW 63 44,274 1.97 Samsung Electronics KR KRW 37 42,915 1.91 Chicony Electronics TW TWD 12,000 34,423 1.53 419,007 18.64 Consumer Discretionary Naspers ZA ZAR 950 118,095 5.25 Samsonite International US HKD 17,400 57,807 2.57 Imperial Holdings ZA ZAR 3,101 53,345 2.37 Grupo Televisa MX MXN 6,800 48,905 2.18 Spur ZA ZAR 16,024 45,248 2.01 Hyundai Motor KR KRW 281 44,355 1.97 Woolworths Holdings (South Africa) ZA ZAR 5,941 42,177 1.88 Paradise KR KRW 1,371 41,960 1.87 Great Wall Motor (H) CN HKD 9,500 41,604 1.85 Mando KR KRW 121 22,722 1.01 516,218 22.97 Consumer Staples AVI ZA ZAR 10,443 68,000 3.03 Universal Robina PH PHP 14,010 57,934 2.58 Gruma (B) MX MXN 5,000 56,548 2.52 Coca-Cola Icecek AS TR TRY 2,056 46,917 2.09 China Mengniu Dairy CN HKD 9,000 39,704 1.77 269,103 11.97 Tele<strong>com</strong>munication Services Safari<strong>com</strong> KE KES 186,800 25,477 1.13 25,477 1.13 Financials AIA Group HK HKD 15,200 84,677 3.77 Itausa - Investimentos Itau Perpetual (Pref'd) BR BRL 18,200 71,634 3.19 Credicorp PE USD 390 62,396 2.78 Bank Rakyat Indonesia Persero ID IDR 61,200 56,045 2.49 First Cash Financial Services US USD 890 52,563 2.34 Discovery ZA ZAR 5,096 46,303 2.06 FirstRand ZA ZAR 10,296 44,011 1.96 Haitong Securities CN HKD 22,000 37,749 1.68 Shinhan Financial Group KR KRW 782 36,615 1.63 Grupo BTG Pactual BR BRL 2,300 28,851 1.28 520,844 23.18 Securities Admitted to or Dealt on Other Regulated Markets Securities Admitted to or Dealt on Other Regulated Markets Consumer Staples Magnit RU USD 737 49,379 2.20 49,379 2.20 Financials Grupo de Inversiones Suramericana CO COP 2,298 47,431 2.11 47,431 2.11 Underlying exposure USD Unrealised % Net gain/(loss) Assets USD Forward Foreign Exchange Contracts Forward Foreign Exchange Contracts A-ACC Shares (EUR) (hedged) Bought USD Sold RUB at 0.02510 10/11/2014 79,263 6,455 0.29 Bought USD Sold KRW at 0.00095 10/11/2014 324,098 4,902 0.22 Bought USD Sold MYR at 0.30418 10/11/2014 82,063 614 0.03 Bought USD Sold EUR at 1.26591 10/11/2014 16,295 161 0.01 Bought TRY Sold USD at 2.28429 10/11/2014 2,583 69 0.00 Bought ZAR Sold USD at 11.10426 10/11/2014 8,708 41 0.00 Bought USD Sold RUB at 0.02328 10/11/2014 7,915 25 0.00 Bought USD Sold EUR at 1.25518 10/11/2014 17,424 23 0.00 Bought USD Sold INR at 0.01628 10/11/2014 8,266 10 0.00 Bought USD Sold BRL at 0.40437 10/11/2014 13,393 (49) (0.00) Bought BRL Sold USD at 2.46000 10/11/2014 41,463 (66) (0.00) Bought USD Sold TWD at 0.03282 10/11/2014 260,621 (121) (0.01) Bought EUR Sold USD at 0.78510 10/11/2014 31,588 (502) (0.02) Bought USD Sold MXN at 0.07390 10/11/2014 114,789 (516) (0.02) Bought USD Sold HKD at 0.12872 10/11/2014 417,001 (735) (0.03) Bought USD Sold BRL at 0.40380 10/11/2014 256,093 (1,298) (0.06) Bought USD Sold TRY at 0.43344 10/11/2014 36,676 (1,307) (0.06) Bought USD Sold INR at 0.01611 10/11/2014 145,879 (1,398) (0.06) Bought USD Sold IDR at 0.00008 10/11/2014 58,761 (1,569) (0.07) Bought USD Sold ZAR at 0.08803 10/11/2014 166,886 (4,507) (0.20) Bought EUR Sold USD at 0.78812 10/11/2014 2,174,792 (26,298) (1.17) (26,066) (1.16) Other Assets and Liabilities 156,923 6.98 Net Assets 2,247,383 100.00 2 247 383 00 GEOGRAPHICAL SPLIT Country Country Code % Net Assets South Africa ZA 20.47 China CN 12.01 Korea KR 10.36 Taiwan TW 8.68 Mexico MX 8.21 USA US 4.91 Brazil BR 4.47 Hong Kong HK 3.77 India IN 3.60 Peru PE 2.78 Philippines PH 2.58 Indonesia ID 2.49 Russia RU 2.20 Colombia CO 2.11 Turkey TR 2.09 Canada CA 1.29 Kenya KE 1.13 Panama PA 1.07 Cash and other net assets 5.80 Fractions (1) (0.00) Total Investments (Cost USD 2,049,751) 2,117,115 94.20 1 2 117 115 00 Ccy Underlying exposure Unrealised % Net gain/(loss) Assets USD Contracts For Difference Contracts For Difference Sun Pharma India USD 22,906 1,122 0.05 Bata India USD 38,731 (1,711) (0.08) (589) (0.03) A full list of footnotes is given on page 6. The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements. The percentage of net assets in the schedule of investments and in the geographical split is subject to rounding. 29

- Page 1 and 2: Fidelity Funds Société d’invest

- Page 3 and 4: Fidelity Funds Contents Introductio

- Page 5 and 6: Fidelity Funds Directors and Superv

- Page 7 and 8: Fidelity Funds Investment Manager

- Page 9 and 10: Fidelity Funds America Fund Schedu

- Page 11 and 12: Fidelity Funds American Diversified

- Page 13 and 14: Fidelity Funds American Growth Fund

- Page 15 and 16: Fidelity Funds Asia Pacific Dividen

- Page 17 and 18: Fidelity Funds Asia Pacific Propert

- Page 19 and 20: Fidelity Funds Asian Equity Fund 1,

- Page 21 and 22: Fidelity Funds Asian Smaller Compan

- Page 23 and 24: Fidelity Funds Asian Special Situat

- Page 25 and 26: Fidelity Funds China Consumer Fund

- Page 27 and 28: Fidelity Funds China Focus Fund Sc

- Page 29: Fidelity Funds Emerging Asia Fund

- Page 33 and 34: Fidelity Funds Emerging Markets Fun

- Page 35 and 36: Fidelity Funds EURO STOXX 50 Fund 2

- Page 37 and 38: Fidelity Funds European Dividend Fu

- Page 39 and 40: Fidelity Funds European Dynamic Gro

- Page 41 and 42: Fidelity Funds European Growth Fund

- Page 43 and 44: Fidelity Funds European Smaller Com

- Page 45 and 46: Fidelity Funds European Smaller Com

- Page 47 and 48: Fidelity Funds France Fund Schedul

- Page 49 and 50: Fidelity Funds Global Consumer Indu

- Page 51 and 52: Fidelity Funds Global Dividend Fund

- Page 53 and 54: Fidelity Funds Global Equity Income

- Page 55 and 56: Fidelity Funds Global Focus Fund S

- Page 57 and 58: Fidelity Funds Global Industrials F

- Page 59 and 60: Fidelity Funds Global Property Fund

- Page 61 and 62: Fidelity Funds Global Real Asset Se

- Page 63 and 64: Fidelity Funds Global Telecommunica

- Page 65 and 66: Fidelity Funds Greater China Fund -

- Page 67 and 68: Fidelity Funds Greater China Fund I

- Page 69 and 70: Fidelity Funds India Focus Fund 7

- Page 71 and 72: Fidelity Funds International Fund

- Page 73 and 74: Fidelity Funds International Fund -

- Page 75 and 76: Fidelity Funds International Fund -

- Page 77 and 78: Fidelity Funds International Fund -

- Page 79 and 80: Fidelity Funds Japan Advantage Fund

- Page 81 and 82:

Fidelity Funds Japan Fund Schedule

- Page 83 and 84:

Fidelity Funds Japan Smaller Compan

- Page 85 and 86:

Fidelity Funds Latin America Fund

- Page 87 and 88:

Fidelity Funds Nordic Fund Schedul

- Page 89 and 90:

Fidelity Funds Pacific Fund - conti

- Page 91 and 92:

Fidelity Funds South East Asia Fund

- Page 93 and 94:

Fidelity Funds Switzerland Fund Sc

- Page 95 and 96:

Fidelity Funds Thailand Fund Sched

- Page 97 and 98:

Fidelity Funds World Fund Schedule

- Page 99 and 100:

Fidelity Funds Fidelity Patrimoine

- Page 101 and 102:

Fidelity Funds Fidelity Patrimoine

- Page 103 and 104:

Fidelity Funds Fidelity Patrimoine

- Page 105 and 106:

Fidelity Funds Fidelity Patrimoine

- Page 107 and 108:

Fidelity Funds Fidelity Patrimoine

- Page 109 and 110:

Fidelity Funds Fidelity Sélection

- Page 111 and 112:

Fidelity Funds Fidelity Sélection

- Page 113 and 114:

Fidelity Funds Fidelity Sélection

- Page 115 and 116:

Fidelity Funds Fidelity Sélection

- Page 117 and 118:

Fidelity Funds Fidelity Sélection

- Page 119 and 120:

Fidelity Funds FPS Global Growth Fu

- Page 121 and 122:

Fidelity Funds FPS Global Growth Fu

- Page 123 and 124:

Fidelity Funds FPS Global Growth Fu

- Page 125 and 126:

Fidelity Funds FPS Growth Fund 4 S

- Page 127 and 128:

Fidelity Funds FPS Growth Fund 4 -

- Page 129 and 130:

Fidelity Funds FPS Growth Fund 4 -

- Page 131 and 132:

Fidelity Funds FPS Moderate Growth

- Page 133 and 134:

Fidelity Funds FPS Moderate Growth

- Page 135 and 136:

Fidelity Funds FPS Moderate Growth

- Page 137 and 138:

Fidelity Funds Euro Balanced Fund

- Page 139 and 140:

Fidelity Funds Global Multi Asset I

- Page 141 and 142:

Fidelity Funds Global Multi Asset I

- Page 143 and 144:

Fidelity Funds Global Multi Asset I

- Page 145 and 146:

Fidelity Funds Global Multi Asset I

- Page 147 and 148:

Fidelity Funds Global Multi Asset I

- Page 149 and 150:

Fidelity Funds Global Multi Asset I

- Page 151 and 152:

Fidelity Funds Global Multi Asset I

- Page 153 and 154:

Fidelity Funds Growth & Income Fund

- Page 155 and 156:

Fidelity Funds Growth & Income Fund

- Page 157 and 158:

Fidelity Funds Growth & Income Fund

- Page 159 and 160:

Fidelity Funds Growth & Income Fund

- Page 161 and 162:

Fidelity Funds Multi Asset Strategi

- Page 163 and 164:

Fidelity Funds Multi Asset Strategi

- Page 165 and 166:

Fidelity Funds Multi Asset Strategi

- Page 167 and 168:

Fidelity Funds Multi Asset Strategi

- Page 169 and 170:

Fidelity Funds Multi Asset Strategi

- Page 171 and 172:

Fidelity Funds Multi Asset Strategi

- Page 173 and 174:

Fidelity Funds Multi Asset Strategi

- Page 175 and 176:

Fidelity Funds Multi Asset Strategi

- Page 177 and 178:

Fidelity Funds Asian Bond Fund - co

- Page 179 and 180:

Fidelity Funds Asian High Yield Fun

- Page 181 and 182:

Fidelity Funds China RMB Bond Fund

- Page 183 and 184:

Fidelity Funds Core Euro Bond Fund

- Page 185 and 186:

Fidelity Funds Emerging Market Corp

- Page 187 and 188:

Fidelity Funds Emerging Market Debt

- Page 189 and 190:

Fidelity Funds Emerging Market Loca

- Page 191 and 192:

Fidelity Funds Emerging Markets Inf

- Page 193 and 194:

Fidelity Funds Euro Bond Fund - con

- Page 195 and 196:

Fidelity Funds Euro Corporate Bond

- Page 197 and 198:

Fidelity Funds European High Yield

- Page 199 and 200:

Fidelity Funds European High Yield

- Page 201 and 202:

Fidelity Funds Global Corporate Bon

- Page 203 and 204:

Fidelity Funds Global Corporate Bon

- Page 205 and 206:

Fidelity Funds Global High Yield Fu

- Page 207 and 208:

Fidelity Funds Global High Yield Fu

- Page 209 and 210:

Fidelity Funds Global Income Fund -

- Page 211 and 212:

Fidelity Funds Global Income Fund -

- Page 213 and 214:

Fidelity Funds Global Inflation-lin

- Page 215 and 216:

Fidelity Funds Global Strategic Bon

- Page 217 and 218:

Fidelity Funds Global Strategic Bon

- Page 219 and 220:

Fidelity Funds Global Strategic Bon

- Page 221 and 222:

Fidelity Funds Global Strategic Bon

- Page 223 and 224:

Fidelity Funds Global Strategic Bon

- Page 225 and 226:

Fidelity Funds International Bond F

- Page 227 and 228:

Fidelity Funds Sterling Bond Fund

- Page 229 and 230:

Fidelity Funds US Dollar Bond Fund

- Page 231 and 232:

Fidelity Funds US High Yield Fund

- Page 233 and 234:

Fidelity Funds US High Yield Fund -

- Page 235 and 236:

Fidelity Funds Fixed Term 2018 Fund

- Page 237 and 238:

Fidelity Funds Euro Cash Fund Sche

- Page 239 and 240:

Fidelity Funds MoneyBuilder Europe

- Page 241 and 242:

Fidelity Funds MoneyBuilder Europe

- Page 243 and 244:

Fidelity Funds MoneyBuilder Europea

- Page 245 and 246:

Fidelity Funds MoneyBuilder Europea

- Page 247 and 248:

Fidelity Funds MoneyBuilder Global

- Page 249 and 250:

Fidelity Funds MoneyBuilder Global

- Page 251 and 252:

Fidelity Funds MoneyBuilder Global

- Page 253 and 254:

Fidelity Funds MoneyBuilder Global

- Page 255 and 256:

Fidelity Funds Fidelity Target 2020

- Page 257 and 258:

Fidelity Funds Fidelity Target 2020

- Page 259 and 260:

Fidelity Funds Fidelity Target 2020

- Page 261 and 262:

Fidelity Funds Fidelity Target 2020

- Page 263 and 264:

Fidelity Funds Fidelity Target 2020

- Page 265 and 266:

Fidelity Funds Fidelity Target 2020

- Page 267 and 268:

Fidelity Funds Fidelity Target 2015

- Page 269 and 270:

Fidelity Funds Fidelity Target 2015

- Page 271 and 272:

Fidelity Funds Fidelity Target 2015

- Page 273 and 274:

Fidelity Funds Fidelity Target 2020

- Page 275 and 276:

Fidelity Funds Fidelity Target 2020

- Page 277 and 278:

Fidelity Funds Fidelity Target 2020

- Page 279 and 280:

Fidelity Funds Fidelity Target 2020

- Page 281 and 282:

Fidelity Funds Fidelity Target 2025

- Page 283 and 284:

Fidelity Funds Fidelity Target 2025

- Page 285 and 286:

Fidelity Funds Fidelity Target 2025

- Page 287 and 288:

Fidelity Funds Fidelity Target 2025

- Page 289 and 290:

Fidelity Funds Fidelity Target 2025

- Page 291 and 292:

Fidelity Funds Fidelity Target 2030

- Page 293 and 294:

Fidelity Funds Fidelity Target 2030

- Page 295 and 296:

Fidelity Funds Fidelity Target 2030

- Page 297 and 298:

Fidelity Funds Fidelity Target 2030

- Page 299 and 300:

Fidelity Funds Fidelity Target 2035

- Page 301 and 302:

Fidelity Funds Fidelity Target 2035

- Page 303 and 304:

Fidelity Funds Fidelity Target 2035

- Page 305 and 306:

Fidelity Funds Fidelity Target 2040

- Page 307 and 308:

Fidelity Funds Fidelity Target 2040

- Page 309 and 310:

Fidelity Funds Fidelity Target 2040

- Page 311 and 312:

Fidelity Funds Fidelity Target 2045

- Page 313 and 314:

Fidelity Funds Fidelity Target 2045

- Page 315 and 316:

Fidelity Funds Fidelity Target 2045

- Page 317 and 318:

Fidelity Funds Fidelity Target 2050

- Page 319 and 320:

Fidelity Funds Fidelity Target 2050

- Page 321 and 322:

Fidelity Funds FAWF Asian Special S

- Page 323 and 324:

Fidelity Funds FAWF Diversified Sto

- Page 325 and 326:

Fidelity Funds FAWF Emerging Market

- Page 327 and 328:

Fidelity Funds FAWF Equity Income F

- Page 329 and 330:

Fidelity Funds FAWF International F

- Page 331 and 332:

Fidelity Funds FAWF International F

- Page 333 and 334:

Fidelity Funds FAWF International F

- Page 335 and 336:

Fidelity Funds FAWF International F

- Page 337 and 338:

Fidelity Funds FAWF Pacific Fund 1,

- Page 339 and 340:

Fidelity Funds FAWF Limited Term Bo

- Page 341 and 342:

Fidelity Funds FAWF Limited Term Bo

- Page 343 and 344:

Fidelity Funds FAWF US Dollar Bond

- Page 345 and 346:

Fidelity Funds FAWF US High Income

- Page 347 and 348:

Fidelity Funds FAWF US High Income

- Page 349 and 350:

Fidelity Funds Institutional Americ

- Page 351 and 352:

Fidelity Funds Institutional Asia P

- Page 353 and 354:

Fidelity Funds Institutional Euro B

- Page 355 and 356:

Fidelity Funds Institutional Europe

- Page 357 and 358:

Fidelity Funds Institutional Global

- Page 359 and 360:

Fidelity Funds Institutional Global

- Page 361 and 362:

Fidelity Funds Institutional Japan

- Page 363 and 364:

Fidelity Funds Institutional Europe

- Page 365 and 366:

This page has been left blank inten

- Page 367 and 368:

Asia Pacific Dividend Fund Asia Pac

- Page 369 and 370:

Emerging Markets Fund Euro Blue Chi

- Page 371 and 372:

Global Consumer Industries Fund Glo

- Page 373 and 374:

Greater China Fund Greater China Fu

- Page 375 and 376:

Malaysia Fund Nordic Fund Pacific F

- Page 377 and 378:

Balanced Funds: FPS Global Growth F

- Page 379 and 380:

Emerging Market Debt Fund Emerging

- Page 381 and 382:

International Bond Fund Sterling Bo

- Page 383 and 384:

Reserved Equity Funds: Fidelity Tar

- Page 385 and 386:

Reserved Bond Funds: Institutional

- Page 387 and 388:

Institutional Global Sector Fund 4,

- Page 389 and 390:

Fidelity Funds Statement of Net Ass

- Page 391 and 392:

Fidelity Funds Statement of Net Ass

- Page 393 and 394:

Fidelity Funds Statement of Net Ass

- Page 395 and 396:

Fidelity Funds Statement of Net Ass

- Page 397 and 398:

Fidelity Funds Statement of Net Ass

- Page 399 and 400:

Fidelity Funds Statement of Net Ass

- Page 401 and 402:

Fidelity Funds Statement of Net Ass

- Page 403 and 404:

Fidelity Funds Statement of Net Ass

- Page 405 and 406:

Fidelity Funds Statement of Net Ass

- Page 407 and 408:

1 Fidelity Funds Notes to the Finan

- Page 409 and 410:

Fidelity Funds Notes to the Financi

- Page 411 and 412:

Fidelity Funds Notes to the Financi

- Page 413 and 414:

Fidelity Funds Notes to the Financi

- Page 415 and 416:

Fidelity Funds Notes to the Financi

- Page 417 and 418:

Fidelity Funds Notes to the Financi

- Page 419 and 420:

Fidelity Funds Notes to the Financi

- Page 421:

Fidelity, Fidelity Worldwide Invest