Fidelity Funds - Chartbook.fid-intl.com

Fidelity Funds - Chartbook.fid-intl.com

Fidelity Funds - Chartbook.fid-intl.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Fidelity</strong><br />

<strong>Funds</strong><br />

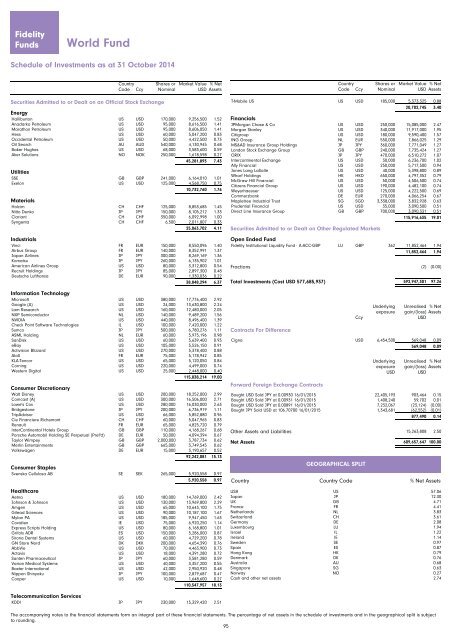

World Fund <br />

Schedule of Investments as at 31 October 2014 <br />

Country<br />

Code Ccy<br />

Shares or<br />

Nominal<br />

Market Value<br />

USD % Net<br />

Assets<br />

Securities Admitted to or Dealt on an Official Stock Exchange<br />

Securities Admitted to or Dealt on an Official Stock Exchange<br />

Energy<br />

Halliburton US USD 170,000 9,256,500 1.52<br />

Anadarko Petroleum US USD 95,000 8,616,500 1.41<br />

Marathon Petroleum US USD 95,000 8,606,050 1.41<br />

Hess US USD 60,000 5,047,200 0.83<br />

Occidental Petroleum US USD 50,000 4,422,500 0.73<br />

Oil Search AU AUD 540,000 4,130,945 0.68<br />

Baker Hughes US USD 68,000 3,583,600 0.59<br />

Aker Solutions NO NOK 250,000 1,618,598 0.27<br />

45,281,893 7.43<br />

Utilities<br />

SSE GB GBP 241,000 6,164,010 1.01<br />

Exelon US USD 125,000 4,568,750 0.75<br />

10,732,760 1.76<br />

Materials<br />

Holcim CH CHF 125,000 8,853,685 1.45<br />

Nitto Denko JP JPY 150,000 8,105,212 1.33<br />

Clariant CH CHF 350,000 6,092,998 1.00<br />

Syngenta CH CHF 6,500 2,011,807 0.33<br />

25,063,702 4.11<br />

Industrials<br />

Vinci FR EUR 150,000 8,550,096 1.40<br />

Airbus Group FR EUR 140,000 8,352,991 1.37<br />

Japan Airlines JP JPY 300,000 8,269,169 1.36<br />

Komatsu JP JPY 260,000 6,135,902 1.01<br />

American Airlines Group US USD 80,000 3,312,800 0.54<br />

Recruit Holdings JP JPY 85,000 2,897,300 0.48<br />

Deutsche Lufthansa DE EUR 90,000 1,330,036 0.22<br />

38,848,294 6.37<br />

Information Technology<br />

Microsoft US USD 380,000 17,776,400 2.92<br />

Google (A) US USD 24,000 13,630,800 2.24<br />

Lam Research US USD 160,000 12,480,000 2.05<br />

NXP Semiconductor NL USD 140,000 9,489,200 1.56<br />

NVIDIA US USD 440,000 8,496,400 1.39<br />

Check Point Software Technologies IL USD 100,000 7,420,000 1.22<br />

Sumco JP JPY 500,000 6,780,276 1.11<br />

ASML Holding NL EUR 60,000 5,975,196 0.98<br />

SanDisk US USD 60,000 5,639,400 0.93<br />

eBay US USD 105,000 5,526,150 0.91<br />

Activision Blizzard US USD 270,000 5,378,400 0.88<br />

AtoS FR EUR 75,000 5,178,942 0.85<br />

KLA-Tencor US USD 65,000 5,120,050 0.84<br />

Corning US USD 220,000 4,499,000 0.74<br />

Western Digital US USD 25,000 2,448,000 0.40<br />

115,838,214 19.00<br />

Consumer Discretionary<br />

Walt Disney US USD 200,000 18,252,000 2.99<br />

Comcast (A) US USD 300,000 16,506,000 2.71<br />

Lowe's Cos US USD 280,000 16,030,000 2.63<br />

Bridgestone JP JPY 200,000 6,736,919 1.11<br />

TripAdvisor US USD 66,000 5,852,880 0.96<br />

Cie Financiere Richemont CH CHF 60,000 5,047,965 0.83<br />

Renault FR EUR 65,000 4,825,720 0.79<br />

InterContinental Hotels Group GB GBP 110,000 4,168,267 0.68<br />

Porsche Automobil Holding SE Perpetual (Pref'd) DE EUR 50,000 4,094,394 0.67<br />

Taylor Wimpey GB GBP 2,000,000 3,787,734 0.62<br />

Merlin Entertainments GB GBP 665,000 3,749,545 0.62<br />

Volkswagen DE EUR 15,000 3,190,657 0.52<br />

92,242,081 15.13<br />

Consumer Staples<br />

Svenska Cellulosa AB SE SEK 265,000 5,920,558 0.97<br />

5,920,558 0.97<br />

Healthcare<br />

Aetna US USD 180,000 14,769,000 2.42<br />

Johnson & Johnson US USD 130,000 13,969,800 2.29<br />

Amgen US USD 65,000 10,643,100 1.75<br />

Gilead Sciences US USD 90,000 10,187,100 1.67<br />

Mylan PA US USD 185,000 9,947,450 1.63<br />

Covidien IE USD 75,000 6,920,250 1.14<br />

Express Scripts Holding US USD 80,000 6,168,800 1.01<br />

Grifols ADR ES USD 150,000 5,286,000 0.87<br />

Sirona Dental Systems US USD 60,000 4,729,200 0.78<br />

GN Store Nord DK DKK 200,000 4,654,390 0.76<br />

AbbVie US USD 70,000 4,463,900 0.73<br />

Actavis US USD 18,000 4,391,280 0.72<br />

Santen Pharmaceutical JP JPY 60,000 3,581,280 0.59<br />

Varian Medical Systems US USD 40,000 3,357,200 0.55<br />

Baxter International US USD 42,000 2,950,920 0.48<br />

Nippon Shinyaku JP JPY 100,000 2,879,687 0.47<br />

Cooper US USD 10,000 1,648,600 0.27<br />

110,547,957 18.13<br />

Tele<strong>com</strong>munication Services<br />

KDDI JP JPY 230,000 15,329,420 2.51<br />

Country<br />

Code Ccy<br />

Shares or<br />

Nominal<br />

Market Value % Net<br />

USD Assets<br />

T-Mobile US US USD 185,000 5,373,325 0.88<br />

20,702,745 3.40<br />

Financials<br />

JPMorgan Chase & Co US USD 250,000 15,085,000 2.47<br />

Morgan Stanley US USD 340,000 11,917,000 1.95<br />

Citigroup US USD 180,000 9,590,400 1.57<br />

ING Groep NL EUR 550,000 7,866,025 1.29<br />

MS&AD Insurance Group Holdings JP JPY 360,000 7,771,049 1.27<br />

London Stock Exchange Group GB GBP 240,000 7,735,424 1.27<br />

ORIX JP JPY 470,000 6,510,272 1.07<br />

Intercontinental Exchange US USD 30,000 6,236,700 1.02<br />

Ally Financial US USD 250,000 5,717,500 0.94<br />

Jones Lang LaSalle US USD 40,000 5,398,800 0.89<br />

Wharf Holdings HK HKD 650,000 4,797,352 0.79<br />

McGraw Hill Financial US USD 50,000 4,506,500 0.74<br />

Citizens Financial Group US USD 190,000 4,482,100 0.74<br />

Weyerhaeuser US USD 125,000 4,222,500 0.69<br />

Commerzbank DE EUR 270,000 4,066,254 0.67<br />

Mapletree Industrial Trust SG SGD 3,338,000 3,832,928 0.63<br />

Prudential Financial US USD 35,000 3,090,500 0.51<br />

Direct Line Insurance Group GB GBP 700,000 3,090,331 0.51<br />

115,916,635 19.01<br />

Securities Admitted to or Dealt on Other Regulated Markets<br />

Securities Admitted to or Dealt on Other Regulated Markets<br />

Open Ended Fund<br />

<strong>Fidelity</strong> Institutional Liquidity Fund - A-ACC-GBP LU GBP 362 11,852,464 1.94<br />

11,852,464 1.94<br />

Fractions (2) (0.00)<br />

Total Investments (Cost USD 577,685,937) 592,947,301 97.26<br />

1<br />

592 947 301 00<br />

Ccy<br />

Underlying<br />

exposure<br />

Unrealised % Net<br />

gain/(loss) Assets<br />

USD<br />

Contracts For Difference<br />

Contracts For Difference<br />

Cigna USD 6,454,500 569,048 0.09<br />

569,048 0.09<br />

Underlying<br />

exposure<br />

USD<br />

Unrealised % Net<br />

gain/(loss) Assets<br />

USD<br />

Forward Foreign Exchange Contracts<br />

Forward Foreign Exchange Contracts<br />

Bought USD Sold JPY at 0.00930 16/01/2015 22,405,193 903,464 0.15<br />

Bought USD Sold JPY at 0.00931 16/01/2015 1,408,240 59,702 0.01<br />

Bought USD Sold JPY at 0.00891 16/01/2015 7,232,067 (23,124) (0.00)<br />

Bought JPY Sold USD at 106.70700 16/01/2015 1,343,681 (62,552) (0.01)<br />

877,490 0.14<br />

Other Assets and Liabilities 15,263,808 2.50<br />

Net Assets 609,657,647 100.00<br />

609 657 647 00<br />

GEOGRAPHICAL SPLIT<br />

Country Country Code % Net Assets<br />

USA US 57.06<br />

Japan JP 12.30<br />

UK GB 4.71<br />

France FR 4.41<br />

Netherlands NL 3.83<br />

Switzerland CH 3.61<br />

Germany DE 2.08<br />

Luxembourg LU 1.94<br />

Israel IL 1.22<br />

Ireland IE 1.14<br />

Sweden SE 0.97<br />

Spain ES 0.87<br />

Hong Kong HK 0.79<br />

Denmark DK 0.76<br />

Australia AU 0.68<br />

Singapore SG 0.63<br />

Norway NO 0.27<br />

Cash and other net assets 2.74<br />

The ac<strong>com</strong>panying notes to the financial statements form an integral part of these financial statements. The percentage of net assets in the schedule of investments and in the geographical split is subject<br />

to rounding.<br />

95