2012-2013 CPS Scholarship Guide - Kelly High School

2012-2013 CPS Scholarship Guide - Kelly High School

2012-2013 CPS Scholarship Guide - Kelly High School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

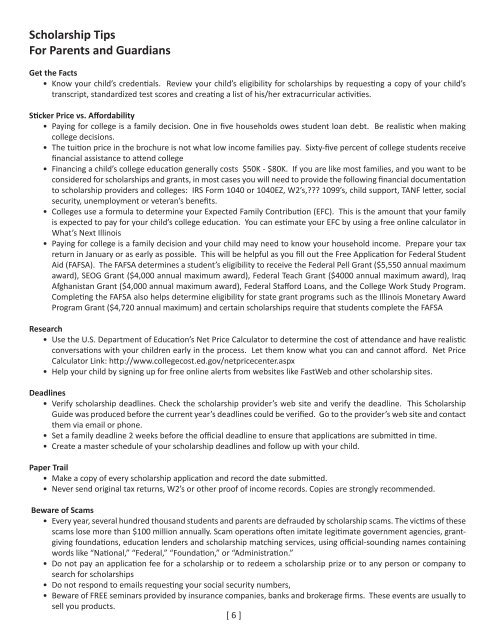

<strong>Scholarship</strong> Tips<br />

For Parents and Guardians<br />

Get the Facts<br />

• Know your child’s credentials. Review your child’s eligibility for scholarships by requesting a copy of your child’s<br />

transcript, standardized test scores and creating a list of his/her extracurricular activities.<br />

Sticker Price vs. Affordability<br />

• Paying for college is a family decision. One in five households owes student loan debt. Be realistic when making<br />

college decisions.<br />

• The tuition price in the brochure is not what low income families pay. Sixty-five percent of college students receive<br />

financial assistance to attend college<br />

• Financing a child’s college education generally costs $50K - $80K. If you are like most families, and you want to be<br />

considered for scholarships and grants, in most cases you will need to provide the following financial documentation<br />

to scholarship providers and colleges: IRS Form 1040 or 1040EZ, W2’s, 1099’s, child support, TANF letter, social<br />

security, unemployment or veteran’s benefits.<br />

• Colleges use a formula to determine your Expected Family Contribution (EFC). This is the amount that your family<br />

is expected to pay for your child’s college education. You can estimate your EFC by using a free online calculator in<br />

What’s Next Illinois<br />

• Paying for college is a family decision and your child may need to know your household income. Prepare your tax<br />

return in January or as early as possible. This will be helpful as you fill out the Free Application for Federal Student<br />

Aid (FAFSA). The FAFSA determines a student’s eligibility to receive the Federal Pell Grant ($5,550 annual maximum<br />

award), SEOG Grant ($4,000 annual maximum award), Federal Teach Grant ($4000 annual maximum award), Iraq<br />

Afghanistan Grant ($4,000 annual maximum award), Federal Stafford Loans, and the College Work Study Program.<br />

Completing the FAFSA also helps determine eligibility for state grant programs such as the Illinois Monetary Award<br />

Program Grant ($4,720 annual maximum) and certain scholarships require that students complete the FAFSA<br />

Research<br />

• Use the U.S. Department of Education’s Net Price Calculator to determine the cost of attendance and have realistic<br />

conversations with your children early in the process. Let them know what you can and cannot afford. Net Price<br />

Calculator Link: http://www.collegecost.ed.gov/netpricecenter.aspx<br />

• Help your child by signing up for free online alerts from websites like FastWeb and other scholarship sites.<br />

Deadlines<br />

• Verify scholarship deadlines. Check the scholarship provider’s web site and verify the deadline. This <strong>Scholarship</strong><br />

<strong>Guide</strong> was produced before the current year’s deadlines could be verified. Go to the provider’s web site and contact<br />

them via email or phone.<br />

• Set a family deadline 2 weeks before the official deadline to ensure that applications are submitted in time.<br />

• Create a master schedule of your scholarship deadlines and follow up with your child.<br />

Paper Trail<br />

• Make a copy of every scholarship application and record the date submitted.<br />

• Never send original tax returns, W2’s or other proof of income records. Copies are strongly recommended.<br />

Beware of Scams<br />

• Every year, several hundred thousand students and parents are defrauded by scholarship scams. The victims of these<br />

scams lose more than $100 million annually. Scam operations often imitate legitimate government agencies, grantgiving<br />

foundations, education lenders and scholarship matching services, using official-sounding names containing<br />

words like “National,” “Federal,” “Foundation,” or “Administration.”<br />

• Do not pay an application fee for a scholarship or to redeem a scholarship prize or to any person or company to<br />

search for scholarships<br />

• Do not respond to emails requesting your social security numbers,<br />

• Beware of FREE seminars provided by insurance companies, banks and brokerage firms. These events are usually to<br />

sell you products.<br />

[ 6 ]